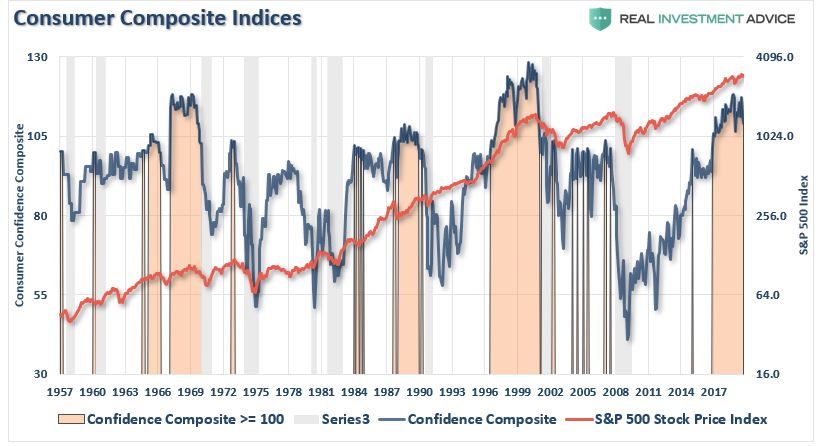

As I have discussed many times previously, the stock market rise has NOT lifted all boats equally. More importantly, the surge in confidence is a coincident indicator and more suggestive, historically, of market peaks as opposed to further advances.

As David Rosenberg, the chief economist at Gluskin Sheff previously wrote:

As David Rosenberg, the chief economist at Gluskin Sheff previously wrote:‘For an investment community that typically lives in the moment and extrapolates the most recent experience into the future, it would only fall on deaf ears to suggest that peak confidence like this and peak market pricing tend to coincide with each other.”

However, that confidence may be short-lived as “CEO Confidence” is near historic lows. As we covered in our previous analysis, this divergence should not be dismissed. A quick look at history shows this historical relationship between these two measures of confidence. The divergence is seen every time prior to the onset of a recession.

Notice that CEO confidence leads consumer confidence by a wide margin. This lures bullish investors, and the media, into believing that CEO’s really don’t know what they are doing. Unfortunately, consumer confidence tends to crash as it catches up