VIX Futures Hit New Record Short: Is A Historic Volatility Squeeze Coming?

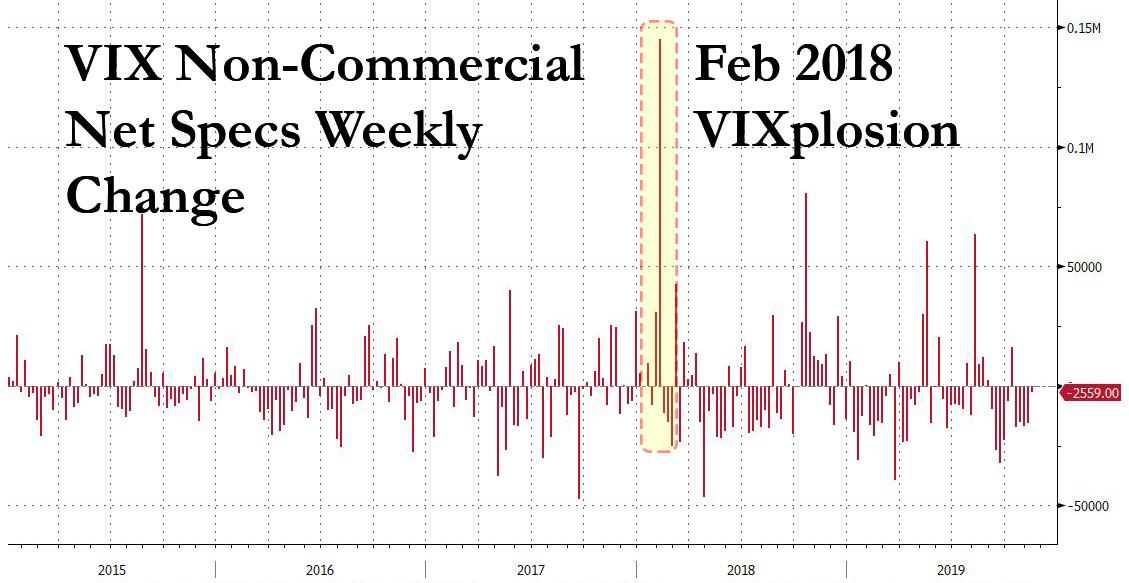

SO FOR ALL THOSE WHO HOPE TO MITIGATE THE IMPORTANCE OF A RECORD VIX NET SHORT IN FUTURES, NOT ONLY DO WE DISAGREE THAT THIS POSITION IS “PERFECTLY” HEDGE WITH COMMERCIAL LONGS, BUT SINCE NON-COMMERCIAL ACTORS ARE MORE LIKELY TO REVERSE POSITIONS, CATCHING COMMERCIAL LONGS OFFSIDE AND UNWILLING TO PART WITH THEIR LONGS, IT IS OUR BELIEF THAT THE POTENTIAL FOR A HISTORIC VIX SHORT SQUEEZE IS NOW FAR GREATER THAN IT WAS DURING THE FEB 2018 VIXPLOSION WHICH ENDED UP WIPING OUT ALL THOSE WHO WERE LONG INVERSE VIX ETNS. WE, FOR ONE, CAN’T WAIT TO FIND OUT JUST WHAT “COLLECTING PENNIES IN FRONT OF A STEAMROLLER” TRADE WILL BE WIPED OUT DURING THE NEXT EPIC VIX SQUEEZE.

ISEE INDEX

Investors often buy call and put options to express their actual market view of a particular stock, and because of that, opening such long transactions are thought to best represent market sentiment. Market maker and firm trades, which are excluded, are not considered representative of true market sentiment due to their specialized nature. As such, the ISEE calculation method allows for a more accurate measure of true investor sentiment than traditional put/call ratios.

Because of this distinctive calculation methodology, ISEE has been referenced by The Wall Street Journal, Barron’s and other leading publications as a useful investment tool. Investors and investment professionals can use this unique put/call value to determine how other investors view stock prices, as well as to supplement and validate their own market views.