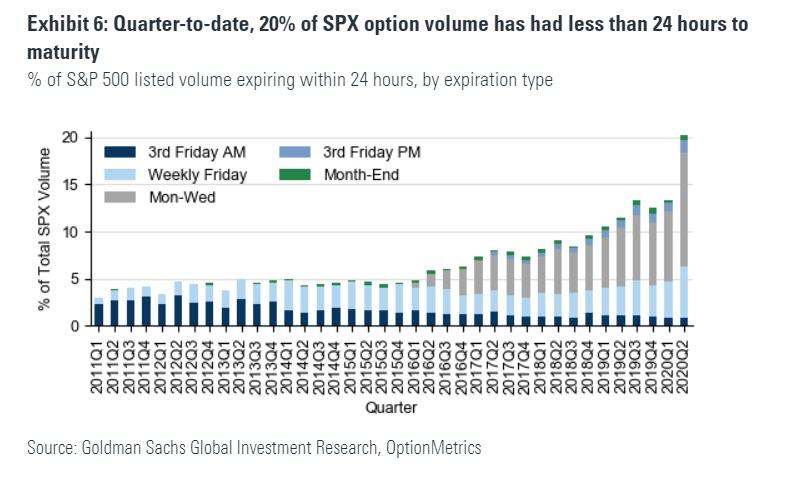

The biggest wildcard, according to Goldman, is the concentration in ultra short-term momentum chasing. As a result of the aggressive momentum-chasing, soon-to-expire option volume has exploded: over the course of Q2 2020, there has been an acceleration of final day trading of SPX options that expire every Monday, Wednesday, and Friday. Most such expirations had over $100bln notional trade on their final day, “making them a potentially large, but hard-to-track, source of gamma.”

* * *

The bottom line is that while we are facing a near record $1.8 trillion in option expiration in two days, it is not immediately clear if this alone will have a material move on the market in the immediately preceding period, and also whether this impact would be bullish or bearish.

One thing we do know for certain, however, is that pension selling will be substantial, as a result of the outperformance of stocks over bonds this quarter. Indeed, according to Goldman, as of the close on Tuesday, the desk’s theoretical model estimates a net $76bn of equities to sell, the third largest estimate on record, only behind Mar 2020 and Dec 2018, both of which happened to be extremely volatile periods.