Maybe good for witches brew too…Nah, she too busy tuning up her broom for the end of the month parade…

I had no idea Maya Brux was 22 years old…

He seemed so much wiser…

Lunar Year

effects Stocks also 365 into 13 months =28 days in a natural month ..same as a womens monthly cycle!

13 is a Fibonacci number ..WD Gann was a great practicioner of Fibonacci numbers ..one time in a challange he made 96 profitable trades of 100 consecutive trades…to prove his method.He used 8ths and multiples or divisions of 8ths frequently .8 being a Fibonacci number he used 1/8ths as natural turning points ..12 1/2 % 25% ,37 1/2 % 50 % etc . Schools won’t teach this,teachers don’t like difficult math for students they’d rather dumb them down.use the decimal system …just move the decimal point ….

and feel good about yur self …..hehe….

This is what happins when the Word Processors run everything …just find the words that make you feel good ….that sounds good do that ! Elect the Word Processors they make you feel good ….

They run the TV,the Marketing Degrees are everywhere …..Don’t get me started !

The Fed has a 10 foot seawall, and they are going to get hit with a 50 foot tsunami.”

You Can See This Collapse Coming A Mile Away-James Rickards

By Greg Hunter On October 12, 2014 In Market Analysis 4 Comments

Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Best-selling author and financial expert James Rickards contends a big financial crash is locked in. Rickards says, “Everyone is waiting for some blunder down the road, and the point I try to make is the blunders have already been made. The blunders have already been built into the system. You can see this collapse coming a mile away. . . . Using science, we can’t say very much about the timing, but we can say a lot about the magnitude. This will be the greatest financial collapse in history. I am quite sure about that, but I am not sure about the timing. . . . People think I can call them up at 3 o’clock in the afternoon and tell them tomorrow’s that day, sell your stocks and buy some gold. I can’t do that. I don’t know what day it will be. If we get to that point, it would be too late to act. So, the time to act is now.” Rickards goes on to say, “On top of the threats from Ebola, the Islamic State, the normal currency wars and the normal depression the world is in, there is financial war going on right now. We put sanctions on Russia. Do you think Russia is going to sit there and take it? Russia is responding asymmetrically through cyber warfare.”

Rickards says in the coming crash, it is going to be very difficult to turn your assets into spendable cash. Rickards explains, “People think everything is money. People think your stocks are money because you can sell them and get the cash in your account in a couple of days. People think your money market funds are money because you can call your broker and get the cash in your bank account tomorrow. You think your house is money because you can take a second mortgage or sell your house. What you find out in a panic is all those things are not money. You are locked in, locked down and the only thing that is money is money. That would be cash, if you happen to have it or gold or silver in physical form, not paper gold. So, people don’t understand what money really is until everyone wants their money back. That’s when you find out only a small number of things are actually money.”

On the Islamic State or caliphate, Rickards says, “There is nothing new about this. Islam has been establishing caliphates since the seventh century A.D. This is just the latest in a long string; it’s part of their plan for global domination. Their theology is you convert to Islam . . . or they behead you. They kill you. What they are doing is according to their scripts. None of it comes as a surprise. What is a surprise is how unprepared the United States was for the emergence of something like the Islamic State and the weakness of our response.” Can things like beheadings in America take down the markets? Rickards says, “That’s kind of street violence, and that by itself will terrorize people, but that won’t take down the markets. What would take down the markets is some type of bomb or radiological device and other kinds of asymmetric warfare on a large scale. That’s probably coming. The other thing is disruption to the flow of oil. The United States does not get its oil from the Middle East . . . but it’s a world market and a world price. . . . If the Islamic State spreads and disrupts the flow of oil . . . that would have an enormous impact upon markets. You’ve seen the price of oil drop like a stone lately because the world is in depression and there are deflationary fears, but that could turn around on a geopolitical vector.”

When asked if a crash was a mathematical certainty, Rickards said, “It is a mathematical certainty, but I can take it further . . . what you don’t hear is this will be exponentially larger than any financial panic in the past. . . . The next time, the Fed is going to be in trouble. They are already insolvent on a mark-to-market basis. Each bailout gets much bigger than the one before. The Fed has a 10 foot seawall, and they are going to get hit with a 50 foot tsunami.”

The Fed, ECB, BoJ, PBOC will re-open the spigots and print (defending their actions on the back of global growth slowing – a new mandate it would appear) – and up goes gold.

From Zero Hedge

On QE99, Gold, & Global Growth Concerns – The Chart That Explains Marc Faber’s Fears

AND UP GOES GOLD….

With all that hot money having flooded into stocks, art, and real estate; this week’s record high inflows into bonds suggest commission-takers’ worst nightmare “great rotation” is about to happen… or The Fed, ECB, BoJ, PBOC will re-open the spigots and print (defending their actions on the back of global growth slowing – a new mandate it would appear) – and up goes gold.

While The IMF recognizes the gaping chasm between collapsing global growth expectations and market exuberance, they remain confident that US growth will save the world. This, Marc Faber explains to a wise Bloomberg TV panel, is why stocks around the world (and now in the US) are starting to weaken, “the recognition that global growth is not accelerating,” as the narrative would like us all to believe, “but is slowing.” Central Bank money-printing has enabled deficit-heavy fiscal policy and, Faber simplifies, “the larger the government, the less growth there will be from a less dynamic economy.” Policy-makers have only one tool – money-printing, and QE99 is coming.

In true Keynesian hockey-stick style, each time a current year’s growth expectations slide, the following year’s expectations are ratcheted higher… and if stocks weaken into that ‘ratcheting’ then the central banks unleash more QE… As the following chart shows, the gap between the ‘efficient’ market and fundamental reality has never been wider and – as Faber implies – policy makers simply cannot allow that gap to be filled (and all that created wealth to once again evaporate)… with QE4EVA coming to an end, the market is forcing “someone”‘s invisible hand to act – demanding moar money-printing or the Keynesians will once again be proved entirely wrong.

Richard640 @ 16:20

Those (My) charts are Renko charts a Japanese style that has features of point &figure charts and as such they don’t have much of a time line ,but thet do eliminate daily jiggles of daily fluctuations and are used to keep you on tract or on trend .The so called time is created by new tops or bottoms or (change of direction) so the time line really is the recorded point trend continued up or down or when direction was changed .It is not a daily data point .If you do a little study on point & figure it will become more clear how a Renko chart records.Also since RSI and other momentun indicaters need to be of shorter duration and not the normal .I also discovered that a moving average of 8 works mysteriously well while other don’t work at all ! It seems the Fibonacci numbers work well like 3-5-8 which seems to make sence because they represent natural turning points of a natural sort rather than a daily average which Renko does not record at all. Fibonacci was very perceptive Italian mathmatician.! On almost all my charts of any sort I use Fibonacci numbers for moving averages ,momentum indicaters etc.They are natural turning points in the natural world.In the plant world they show where growth stops and starts a new like branches on a tree. Why not work with Mother Nature ? I also noticed that the Stock Market moves in 8ths ,not the decimal system the schools teach.Music is the same ,Octaves ,No ? the’re 8ths No? try teaching Music in decimals haha.. Schools like to teach the easy way ,not the right way…!

I march to the tune of a different drummer !

Currencies

Some of the currencies seem to be finding good support here. The Canadian $ seems like it wants to go higher.

rno

Maya

The hospital worker and Ebola. Hope this time the worker gets the antibodies Duncan didn’t get. Anywho there are many unseen ways you can get sick despite the hazmat suit and biggest way is respiratory or the eyes. If a virus is small a unseen crack or micro hole in gloves. Hands can have abrasions unseen from over washing hands. Another risk is taking off the hazmat getup. To be safe anyone who’s wearing goggles should take off gloves wash hands, put on more gloves before taking them off with something that contagious. Also I noticed some nurses will still take off one glove then use their bare hand to take off other. There’s a way to do it neither hand is exposed don’t want to get into. Another is cover for shoes taking them off without contaminating hands or shoes but your shoes still walking on ground where others walked out. Lots if things to consider.

The 33rd Parallel

When JFK flew into Dallas what happened there changed the country.

This fella Duncan flew into Dallas and what happen there is going to change the country.

Baghdad is also located on the 33rd parallel.

Nemo, when you next post on Oasis, could you please translate the conclusion of

today’s posting at 15:08, where the author wondered if day trading was for me?

a/d

Ororeef posted a chart of the a/d line – it is something I have also been watching. My version below and also an a/d oscillator which has turned ugly but showed signs many weeks ago of trouble which gave a hint of what was to come.

Tonight I am looking at these charts and listening to Fred Neil – he was my beacon. He came up with a good sum and retired to the beach. I always decided should I have that opportunity I would take it. My good sum however came over saving several lesser sums. Still it worked.

aurum

I thought about a link to the Karen Dalton version and I love her work too – so take your pick.

http://www.theguardian.com/music/2007/mar/23/folk

silverngold @12:02 – Pulling out the US Flags

that are placed next to veterans headstones was way over the top. Who is giving these orders and why are people blindly following them?

Richard

I certainly don’t disagree with the possible vaporization scenario, but another part of me feels that If TPTB have completely manipulated these so called “markets” this long, why wouldn’t they continue to do so until after the mid-term elections occur, and then let the chips fall where they may.

This guy is good!

DAY TRADING

Day Trading kan vara mycket lönsamt om man har den disciplin och dedikation som krävs för att bli en framgångsrik Day Trader. Om du vill börja med day trading för att du tror att det är ett enkelt sätt att tjäna pengar så bör du överväga att göra något annat. Day trading kräver att du håller dig mycket insatt i de finansiella instrument du handlar i, att du har disciplinen att bara handla när bra affärer uppstår och att du är beredd att spendera den tid som krävs på din handel. Verkligheten är långt ifrån den romantiserade bilden av en handlare som tjänar stora pengar med minimal insats.

Är Day trading rätt för mig?

Den enda som kan svara på denna fråga är du. Day trading är verkligen inte för alla. Det krävs som sagt disciplin och stor hängivenhet för att lyckas. Du måste kunna motivera dig att jobba hela dagarna trots att du inte längre har någon chef eller medarbetar som håller dig motiverad. Ett brinnande intresse för aktier och andra finansiella instrument är också ett plus. Att vara en Day trader kan också vara mycket stressande och mentalt påfrestande så man måste vara en stabil person som hanterare stress bra för att bli riktigt framgångsrik. Om detta låter som dig så kanske day trading är rätt för dig.

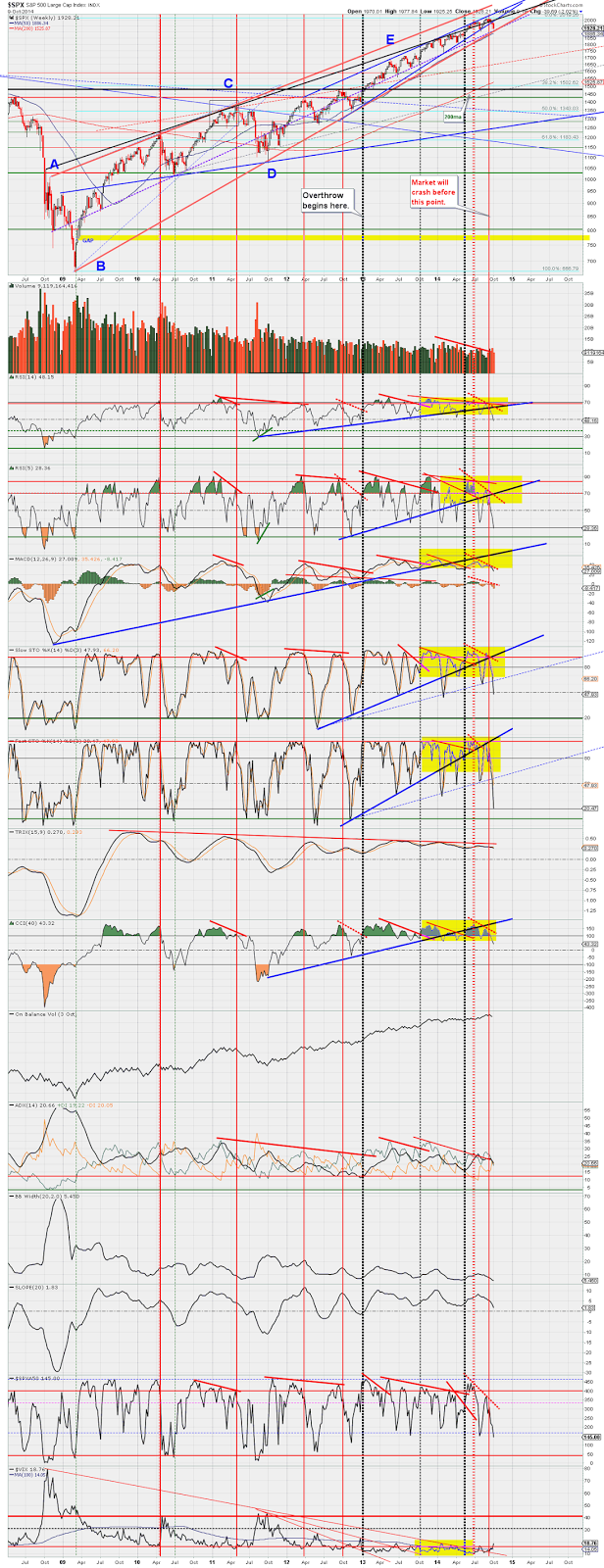

P.S.Prechter makes millions talking shit, and I generate possibly the most prophetic chart anyone has produced in years and get … bubkus.

Click SPX weekly to get his jumbo, viewable chart

SPX Weekly – Sorry that note on the chart that I wrote well over a year and a half ago about the market crashing before this point did not say at this point. TA is amazing, I have always had faith price would get it right, and I knew this point was absolutely as far as they could manage the run before price took over. Funny, Prechter makes millions talking shit, and I generate possibly the most prophetic chart anyone has produced in years and get … bubkus.

today the WSJ Sunday published an illustration

In my paper it showed three angry bears surrounding Goldilocks with the headline of “it’s getting scary, bears stalk the ‘Goldilocks’ market.”

I COMMAND U ALL TO READ THIS! The herd is not going to sit through another 2008. They will exit and possibly all at once=Vaporized will be the headline.

This is a perfect technical setup of disastrous proportions. If support fails here, the CME/PPT will have more than its hands full trying to manage the carnage that will come. I’ve often said, the herd is not going to sit this through another 2008. They will exit and possibly all at once. Vaporized will be the headline. If you think they have issues managing the ebola fears, just wait for their darling DOW to falter.

RUT Weekly – The consequences of the INDU setup above can be seen on the RUT. Meet upper LT resistance at improbable levels, rising channel failure, backtest at double top with horrible negative divergences and let go. RUT taking out key support yesterday setting a lower low was really not good. 1025 and 980 are RUT key support points and should be the targets from here.

http://shankystechblog.blogspot.com

Thank u for your cooperation!

Dallas Hospital Worker Tests Positive For Ebola In First Person-To-Person Transmission On US Soil

“…the worker was wearing full protective gear when treating Duncan, suggesting – yet again – that there is a transmission mechanism which is not accounted for under conventional protocol.”

World financial markets are like a pie crust stretched across the roof of a volcano

THE TELEGRAPH=Global stock selloff is ‘more than a dip’ as European markets ‘step off the cliff’ =BAD NEWS IS BAD NEWS= and the dovish signals from CBs SEEN as a sign of weakness rather than a reason to ramp up equities

FTSE 100 correction ‘more than a dip’ as Europe stares into abyss

Global stock selloff is ‘more than a dip’ as European markets ‘step off the cliff’ says Alastair McCaig, market Analyst from spread betting firm IG

Global markets are at their lowest levels for more than a year

By John Ficenec, Denise Roland and James Titcomb, in the City

12:04PM BST 10 Oct 20142

Bad economic data is now being viewed as bad and the dovish signals from central banks are now being taken as a sign of weakness rather than a reason to ramp up equities,” said Mr Sudaria.

The Global stock market selloff accelerated on Friday with the FTSE 100 index falling 91.56 points, or 1.4pc, to 6,340.2, it’s lowest level in a year and 7.81pc below highs of 6,878 on May 14.

Gold, a shelter for investors in times of uncertainty, has surged during the past week by as much as 2.64pc, to $1,222.95 per ounce, as the Federal Reserve minutes hinted at delaying interest rate rises till later next year.

Meanwhile, the CBOE Volatility Index, a measure of investor anxiety known as the Vix or “fear index”, leapt more than 24pc.

Related Articles

• Eurozone on cusp of triple-dip recession as German exports drop 09 Oct 2014

• Market correction could become a crash 02 Oct 2014

“The FTSE 100 has broken through the support on its recent trading range and US traders have moved from the ‘buy the dip’ and ‘risk on’ commentary we heard earlier in the year, this is becoming more than just a dip,” said Alastair McCaig, market analyst from IG.

“Going into the weekend with so much uncertainty in the air will only further fuel traders compulsion to get out of risky assets and it would take a miracle for the bulls to salvage anything today,” added Jonathan Sudaria, from Capital Spreads.

The Dow Jones Industrial Average slumped by 334.97 points, or 1.97pc, to close at 16,659.25 last night as Wall Street feared the US economy would be dragged down by weakness in Europe and the rest of the world.. The price of Brent crude also collapsed to its lowest level in five years at $89.42 per barrel.

“European markets looks like they are staring over the edge and into the abyss, or may have even stepped off the cliff,” added Mr McCaig as Ebola screening at UK airports and the discovery of new cases raised fears the deadly virus may have spread to the continent.

“European equities have plunged on the open as storm clouds gather over the global economy. Bad economic data is now being viewed as bad and the dovish signals from central banks are now being taken as a sign of weakness rather than a reason to ramp up equities,” said Mr Sudaria.

In Germany the benchmark DAX index collapsed by 196 points, or 2.16pc, to 8809.83, bringing the falls for the week to more than 4pc.

Investors were concerned about the slowdown in the German economy as exports in August reported their biggest fall since January 2009 when the global economy was rocked following the collapse of Lehman Brothers. The CAC 40 index of leading shares in France was also 63.9 points, or 1.5pc lower, at 4,076.27 by midday.

In London it was travel stocks which led the market lower on ebola fears, with TUI Travel down 7.34pc to 330.7p and Carnival the cruise ship operator falling 3.3pc to £21.93. Oil related stocks were also feeling the pain as African oil explorer Tullow Oil fell 5.6pc to 539p, and Weir the Scottish based manufacturer of industrial pumps used in the oil industry, was down 3.2pc to £22.26.