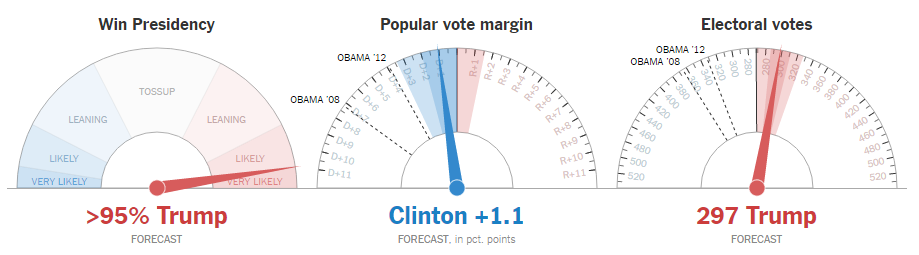

With key swing states Florida and Ohio falling to Trump the New York Times is gauging the probability of a Trump win at more than 95% (a virtual certainty that he will be the next US President at this point):

Equity futures have slumped around 4% while gold futures have soared more than 3%:

Given what markets were already looking forward to in terms of a December rate hike and Hillary’s economic proposals, a Trump win is especially bullish for gold and here’s why:

- A Fed rate hike cycle is pushed out even further and there is a better than 50% that there will not be a December rate hike.

- Trump’s economic policy proposals are likely to shave a considerable amount off GDP growth due to trade protectionism, this will result in more accommodative monetary policy for longer.

- Trade protectionism and weaker growth are dollar negatives.

- Trump is a wild card and much more of a destabilizing President than a President Hillary Clinton would be, gold does better in a chaotic backdrop as a flight to safety asset.

- Foreign central banks are more likely to be accommodative in their monetary policy stance to counteract what they deem to be a chaotic environment in the US.

Gold investors have just been rewarded for their perseverance and with the yellow metal surpassing $1320 in overnight futures trading the key $1310 level becomes support once again.