It’s already 315 bps off the high

Stated differently, the combined market cap of the NASDAQ “Big 5” has soared from $1.9 trillion to nearly $3 trillion since early 2015, or by 55%. That compares to just a 4.5% gain in the aggregate market cap of the the other 495 S&P 500 stocks during that period.

That’s a radical narrowing of the market if there ever was one. It’s also evidence that they eye of a financial hurricane now sits dead atop the canyons of Wall Street.

When the market narrows to a handful of momo names, its all over but the shouting. Like the case of the Nifty Fifty back in the early 1970s, a crash is just around the corner.

In short, these five giant companies essentially account for the last spasm of a monumental financial bubble that has been building for nearly three decades.

Get out while you still can!

In short, so much for the newly discovered “fundamentals.”

What this really means is that the robo-machines and day traders are playing chicken with the Imperial City. There is no basis whatsoever for the massive post-election re-rating of the stock market except for the fabled Trump Stimulus.

And that is now deader than a doornail. In fact, the reality is even worse than the certainty that no “hand-off” of the stimulus baton to fiscal policy is going to occur.

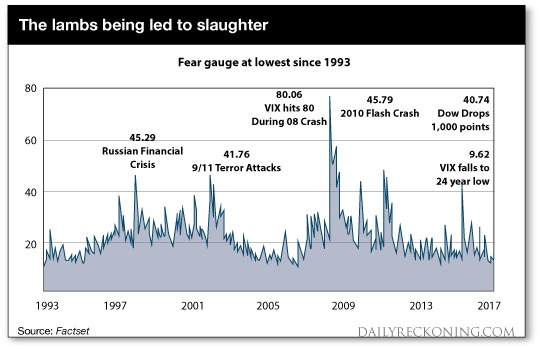

But for some reason, market volatility is at a 24-year low. That’s despite the unprecedented convergence of political, fiscal and monetary policy risks — to say nothing of foreign policy hot spots from Ukraine to Syria and the Korean peninsula.

Stated differently, the casino is completely unhinged. And the market moved hardly four S&P points — in the wrong direction — after the Comey firing.

5 year chart vs current chart

5 year chart vs current chart

click click

click click