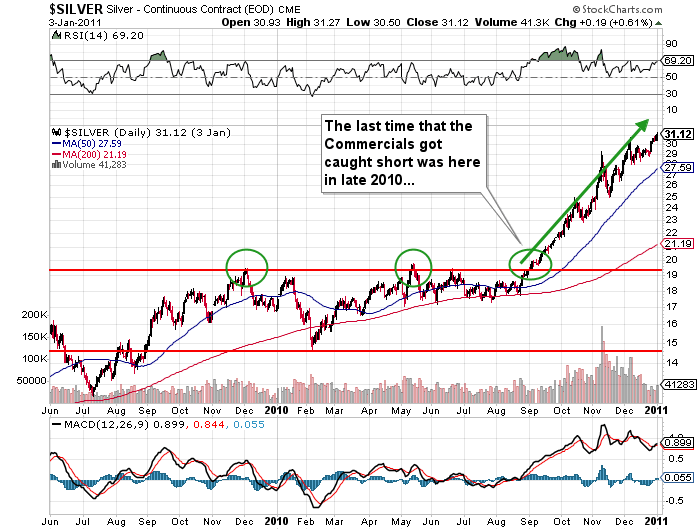

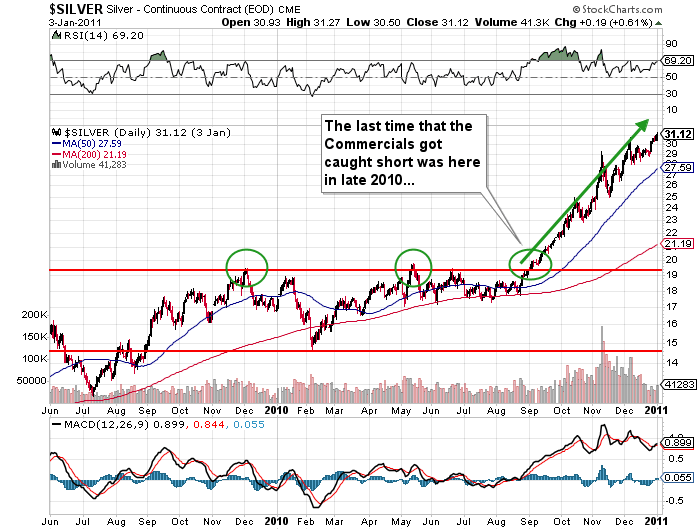

The last time the Commercial Cretins were caught short into a monster move was back in September 2010after two attempted breakouts above $19.25 were soundly rejected by way of blatant interventions. As gold was answering the class quiz with answer after answer of incredible accuracy, silver was stumbling along in a miasma of pitifully-wrong responses until late in the game when it finally caught a breeze and with sails full, went on a screaming, uninterrupted, three-month ride to over $31.00 (making me and a few others extremely happy including, in order of priority, my significant other, my bank manager, and my dog). It was a wondrous event watching open interest DECLINE into a rising silver market and it is one that I am fully-expecting here in 2017.

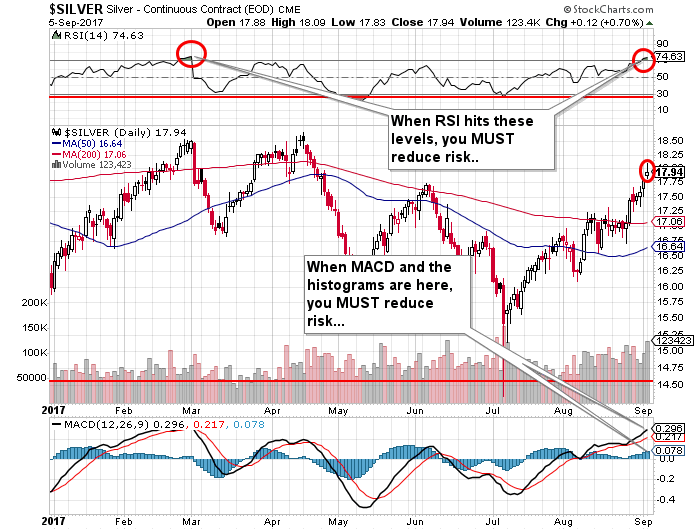

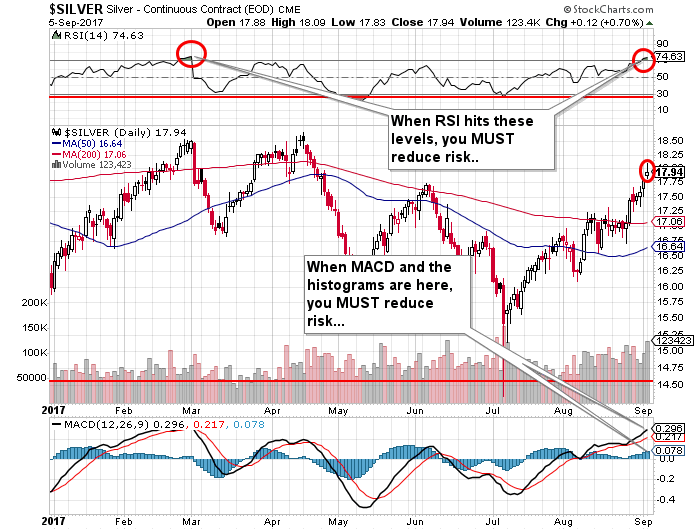

However, as great as the silver market looks today, the RSI and MACD are overbought in an historically-bearish configuration with the Histograms to a lesser degree. This, my friends, is where it gets REALLY tough because there have been moves that I have witnessed over the past forty years covering commodity and stock markets where prices moved sharply higher dragging the RSI, MACD, and Histograms into overbought territory and rather than correcting, they stayed elevated for weeks at a time. This, of course, was before the central bank trading desks were permitted to team up with the “private sector” (JP Morgan) and randomly intervene to ensure that the preferred and desired outcome was indeed effected. So the big question I am asking myself as I wander around the trading den with a handful of darts and an old driving range club-in-hand, “What is the signal – the omen – that they have removed the heel of the hobnailed boot from silver’s Achilles-Tendon-like throat?”. What, EXACTLY, makes it “different this time”?

I went long the Global X Silver Miners ETF by way of the October $35 calls back when the stock was in the $33 range so now that it has advanced to $35.87, the calls I bought for $1.00 are now $1.80 and if we get a pop tomorrow to $2.00, I will be forced to take at least half of them down at a double because after all, the proper trade is to be long the PHYSICAL, rather than the paper, so while I opted for the added elasticity of upside leverage afforded by not only the miners versus the physical and heaped even more leverage on it by buying the calls versus the ETF, I have an 80% move under my belt versus an approximate 10% move in the physical. The reason I did that, I suspect, goes back to my youth when I use to sell papers at 6:00 a.m. at Woodbine Racetrack in NW Toronto to the throng of “track people” (as opposed to “horsey people”) during which time I ran into a trainer (who shall remain nameless) who would give me a $5 tip if I hid a copy of “The Racing Forum” for him before I went “sold out”. Now, back in the 60’s, a $5 tip was like $50 today (a topic for another day) so I learned really fast to look after the “tippers”. Well, this gentleman would wave me over to the paddock fence every afternoon and ask me the same question: “How much did you get tipped today?” and I would tell him. “OK give me 50 percent of your tips.” and I would hand over a few dollars and he would disappear for a minute and come back with The Racing Forum and explain to me, in layman’s terms, not only how to bet on horses but more importantly, how to manage risk. At the end of the fifth race it was mid-afternoon and I knew that I had to ride my bike all the way back up Derry Road to Airport Road and then had straight north along the truck-infested, double-lane road until the big red-and-white checkered water tower came into sight. Before I left, though, Mr. Big would come over to the bike rack and hand me two things: 1. a copy of The Racing Forum where he made his notes and 2. an envelope with between forty and fifty dollars. And while the doubling or tripling of my tip money was great, those notes in red ink complete with underlines and circles and arrows were better than four years at the Wharton School. Trust me, they were. I would happily return the tip money today for even one of those sessions explaining to a 12-year-old why a soggy track is the best time to bet on a filly with “soft hooves”. But then again, I digress…

The reason I digress is that right now we have the absolute PERFECT STORM lying right in front of us as investors. In what I deem as “normal times”, the rules I learned as a young board-marker in St. Louis while in school worked magically-well and if you were disciplined and diligent. To wit, if you deflected away from the toxicity of the “greed overdose”, you could sport a win-loss ratio that could feed a family and provide a decent-enough lifestyle for all around you. That was BEFORE the interventions began. After the Crash of ’87, Ronald Reagan and Company decided that stock market crashes were un-American and it was in the year 1988 that I watched literally ALL stock market losses reversed in the face of sub-par economic numbers followed by the “whisper” of “behavioural finance” modelling and the rise to prominence of “The Working Group on Capital Markets”. Our “perfect storm” has incubated within the insidious wombs of the world’s Central Banking community whose systematic practices of denial and deceit have created a new generation of robotic “traders” that care not about the sanctity of money nor the importance of free market thinking and economic principles.

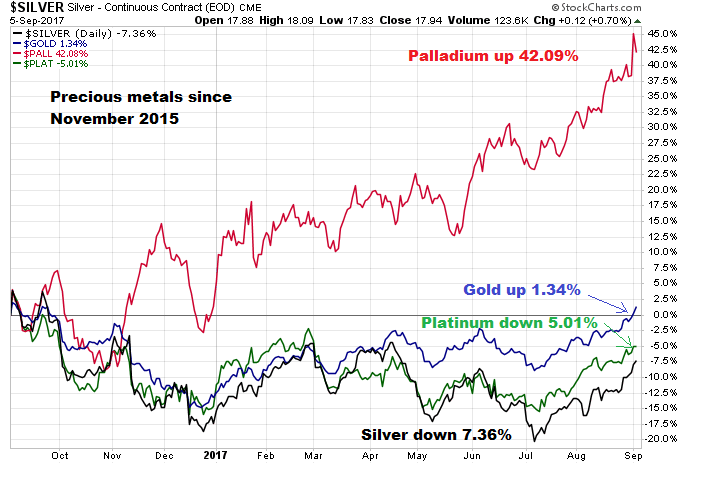

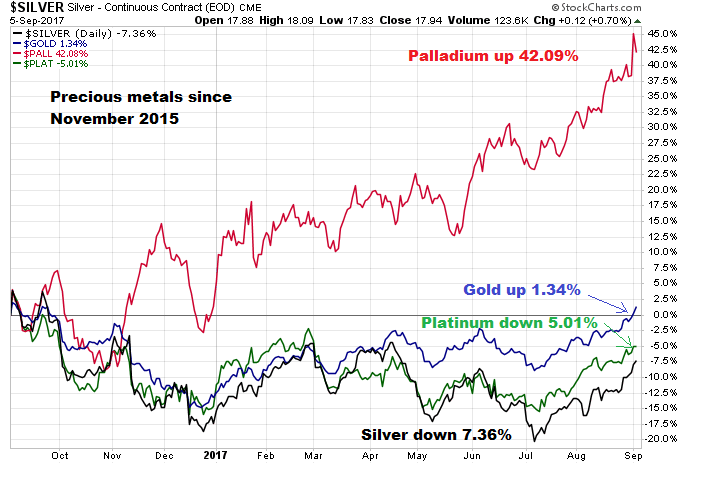

To my earlier point, the Silver Secretariat should be flying miles ahead of the Golden Sham (referencing of course the 1973 Triple Crown Belmont Stakes) but the problem remains that gold continues to outperform silver at every turn resulting in a GTSR of 74.88 versus the sub-70 we had in the 2009-2011 advance. Notwithstanding that there seems to be a lead anvil attached to silver any time we get an advance in precious metals, it has been the worst performer of the Big Four (platinum, palladium, gold and silver) as shown in the chart below.

In summary, recent moves in copper, zinc, Bitcoin, and gold are ample evidence that the regime of King Paper is rapidly coming to an end as fiat of all denominations and sovereign jurisdictions is being jettisoned in favour of “assets” whose price cannot be “managed” by a government agency through edict. For this reason, logic dictates that I own silver. Just -as a 3-year-old filly coming down in class (running against easier competition) that loves to run on turf is favoured on a rainy day on the turf track, an asset deemed “the poor man’s gold” seems like the perfect place to dump one’s depreciating dollars and yen and euros on the basis of where it trades TODAY relative to the other three of the Big Four. So, I am holding my silver positions and in light of the current overbought status, I will be adding to physical silver in the $17.50 range basis December (IF it corrects) and will revisit JNUG on a similar pullback. RSI readings under 30 are optimum but with seasonality in play, we may only get to 50. It is difficult to do but we all must remember that with stock valuations now (based on CAPE) higher than any time other than 2007 and 2001; with bonds in a bubble; with cryptocurrencies in nosebleed zones, and with silver depressed, the big investment pools have few places to go other than “value plays”. Silver is, in my opinion, just that and will have a major move before the month is out.

One final remark on the topic of the penny explorco’s – Stakeholder Gold Corp. had a pretty nice move today and from what I gather, a drill program for Goldstorm is in the wind for October with further “corporate developments” about to unfold. Stakeholder has a serious land position located SSE of and tied on to Seabridge Gold’s Snowstorm property in northern Nevada in an area seen as a convergence zone of the Carlin, Nevada Rift, and Getchell trends where lies in excess of 300 million ounces of gold. Stay tuned…

MJB

“Every stock market bull out there whether in New York or London or Mumbai or Beijing is in a drunken myopia of elevated expectations and deviated denial scrambling and scratching and pleading for assurances that “it is truly different this time”.”