Posted by Maddog

@ 15:27 on April 16, 2018

Shares have been horrible all day.

Sat on all day……No way would the Rig let a 2nd day look good, that only happens EVERY day in the SM.

More depressing action in the Bond mkt…clear break out sold right back down, despite the SM going bonkers.

Posted by Mr.Copper

@ 15:26 on April 16, 2018

Re “after previous instances when the combined front-month gamma-weighted SOIR of the aforementioned ETFs went north of 5.0, the stock market tended to rocket higher, while the VIX plummeted.”

I’m thinking if the main trend is down for the SnP or SPY, then this 10 day rally should peter out. The info in that post is saying the correction that started 1/24 is over. What do you think?? Long or short SPY?

Posted by Buygold

@ 15:10 on April 16, 2018

but nowhere as good as I’d hoped with the USD down like it is.

Shares have been horrible all day.

Posted by macroman3

@ 14:31 on April 16, 2018

Posted by macroman3

@ 14:28 on April 16, 2018

Posted by Richard640

@ 14:09 on April 16, 2018

MY only hesitation is op-ex and the slv’s april 20 120,000 calls in just 3 strikes-it’s a long shot but maybe those call writers will be squeezed

Posted by Equisetum

@ 14:07 on April 16, 2018

Posted by ipso facto

@ 13:51 on April 16, 2018

Toronto, ON / April 16, 2018 / Victoria Gold Corp. (TSX.V-VIT) “Victoria” or the “Company” is pleased to announce that it has finalized and executed definitive transaction agreements with Orion Mine Finance (“Orion”), Osisko Gold Royalties Ltd (“Osisko”) and Caterpillar Financial Services Limited (“Cat Financial”) with respect to the previously announced construction financing package totalling approximately C$505 million in aggregate (the “Financing”) that will fully fund the development of the Eagle Gold project through to commercial production.

cont. https://www.vitgoldcorp.com/news/2018/victoria-gold-announces-execution-of-definitive-documentation-for-the-eagle-financing-package-and-closing-of-equity-and-royalty/

Posted by ipso facto

@ 13:48 on April 16, 2018

“Reflect on what happens when a terrible winter blizzard strikes. You hear the weather warning but probably fail to act on it. The sky darkens. Then the storm hits with full fury, and the air is a howling whiteness. One by one, your links to the machine age break down. Electricity flickers out, cutting off the TV. Batteries fade, cutting off the radio. Phones go dead. Roads become impassible, and cars get stuck. Food supplies dwindle. Day to day vestiges of modern civilization – bank machines, mutual funds, mass retailers, computers, satellites, airplanes, governments – all recede into irrelevance.

Picture yourself and your loved ones in the midst of a howling blizzard that lasts several years. Think about what you would need, who could help you, and why your fate might matter to anybody other than yourself. That is how to plan for a saecular winter. Don’t think you can escape the Fourth Turning. History warns that a Crisis will reshape the basic social and economic environment that you now take for granted.” –

Strauss & Howe – The Fourth Turning

https://www.theburningplatform.com/2018/04/16/winter-is-coming-2/

Posted by Ororeef

@ 13:45 on April 16, 2018

is investing in what THEY understand………POT & BIT COINS ,,,smoke & Mirrors

Posted by Maddog

@ 12:31 on April 16, 2018

PM Shares had a good day and closes Fri….no follow thru allowed tdy….That’s scum law.

Gold just slipped from 1350 + to 1346, then just popped back to 1349.25 …Nem was down 44 and is still down 31…they have been sitting on it all day.

GG has been down all day…..No way is Hui going to run tdy, absent any new news.

Posted by Richard640

@ 12:17 on April 16, 2018

Posted by ipso facto

@ 11:39 on April 16, 2018

Posted by ipso facto

@ 11:28 on April 16, 2018

Posted by ipso facto

@ 11:15 on April 16, 2018

LOL Sorry! Here’s a hanky. 🙂

Posted by ipso facto

@ 11:13 on April 16, 2018

Fortuna reports production of 2.4 million ounces of silver and 15,041 ounces of gold for the first quarter of 2018

https://ceo.ca/@nasdaq/fortuna-reports-production-of-24-million-ounces-of

I wish all my shares had charts like this: (now getting overbought)

http://schrts.co/URzAeU

Posted by Maddog

@ 11:09 on April 16, 2018

There’s no snowflakes here who will go crying to the safe room if someone has a differing opinion!

That’s only because u hard arsed bastards close it down…..Sob !!!!

Posted by Buygold

@ 11:04 on April 16, 2018

are calling B.S. on this little metals rally.

Probably safe to say the USD is going to strengthen and the metals fall.

Posted by Richard640

@ 10:56 on April 16, 2018

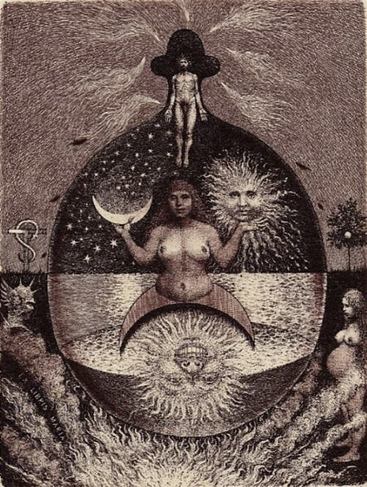

“The alchemist saw the union of opposites under the symbol of the tree, and it is therefore not surprising that the unconscious of present-day man, who no longer feels at home in his world and can base his existence neither on the past that is no more nor on the future that is yet to be, should hark back to the symbol of the cosmic tree rooted in this world and growing up to heaven – the tree that is also man. In the history of symbols this tree is described as the way of life itself, a growing into that which eternally is and does not change; which springs from the union of opposites and, by its eternal presence, also makes that union possible.

******************************

ANCESTRAL ALCHEMY

Marriage of the Sun & the Moon: Primordial Parents

“When you make the two into one, and when you make the inner like the outer and the outer like the inner, and the upper like the lower, and when you make male and female into a single one, so that the male will not be male nor the female be female, when you make eyes in place of an eye, a hand in place of a hand, a foot in place of a foot, an image in place of an image, then you will enter the Kingdom.” (Gospel of Thomas, 22)

Posted by Richard640

@ 10:42 on April 16, 2018

In conclusion, there’s an abundance of near-the-money put open interest on the SPY, QQQ, and IWM — more than we’ve seen in over a year. As Schaeffer’s Senior V.P. of Research Todd Salamone noted on Monday, heavy SPY put open interest could translate into an options-related floor for stocks in the near term. What’s more, after previous instances when the combined front-month gamma-weighted SOIR of the aforementioned ETFs went north of 5.0, the stock market tended to rocket higher, while the VIX plummeted.

Posted by ipso facto

@ 10:41 on April 16, 2018

Posted by Richard640

@ 10:38 on April 16, 2018

VIX Speculators Have Never Been ‘Longer’

Shortly after the collapse of the ‘short-vol’ trade in February, VIX speculators were ripped into an unprecedented long position (i.e. betting on higher vol) and while VIX has fallen from its peak chaos levels, speculators have added to their ‘rising risk’ bets.

It appears ‘Buy the dip’ has reached the volatility markets…

As Bloomberg notes, hedge funds have increased their wagers for turbulence in the equity market for a fourth straight week, taking the number of net-long positions on Cboe Volatility Index futures to a fresh record.

After being short the contracts for almost two years, large speculators reversed their bets in February amid a surge in the VIX, data from the Commodity Futures Trading Commission show.

The VIX term structure has ‘normalized’ in the last week, as stocks bounced and spot VIX dropped back below 17.5…

Posted by ipso facto

@ 10:29 on April 16, 2018

Ditto that.

There’s no snowflakes here who will go crying to the safe room if someone has a differing opinion! 🙂

Posted by Buygold

@ 10:23 on April 16, 2018

Our opinions are what they are, we believe strongly here in the right to free speech.

Most of the stuff posted here and elsewhere on the net is opinion.

I welcome your thoughts and the thoughts of others.

Posted by Richard640

@ 10:21 on April 16, 2018

This could be setting up one of my best buying risk/reward situations–like the day gold was up or down a buck all day and JNUG briefly printed DOWN 12%…I won’t wait for that –with gold up 3 or 4 and the $ down .375, I’ll probably bites if JNUG’d down 3 to 5 percent..I wait and watch–

&&&&&&&&&&&&&&&&&&&&&&&&

a reminder=this friday the SLV april 20th 15.50–16 & 16.50 calls PER-spire–there are an incredible 110,000 calls of open interest–maybe much more by thursday–efforts will be made to shut them out…or we could get the “mother of all short squeezes”

https://finance.yahoo.com/quote/SLV/options?p=SLV