Then it sold down and closed at 53.15, up 20 cents…in bear markets, rallies get sold

R640

I noticed JPM guided down on revenues, course stock was up in the after hours

Good luck – tough to beat the banksters – just ask gold holders

Richard640

I don’t disagree with any of your points. As an old option trader from the CBOE floor, it’s something I did all the time. Most of the time, those premiums withered on the vine and died. Occasionally it paid off. Most bang for the buck though. Hope it pays off for you!

Yeeee-Haaaaaw-! How Systems Collapse–Charles Hughes

In our complex socio-economic system, the buffers are largely invisible. As a general rule, “money” is our all-purpose buffer: if something becomes scarce and threatens the system, we print/ borrow into existence more “money” which is distributed to buy whatever is needed.

But “money” is an illusory buffer. If the well has run dry, no amount of money will restore ground water. If the fisheries have collapsed due to overfishing, no amount of “money” issued by the Federal Reserve will restore the fisheries. In other words, the natural world provides hard limits that money can only fix if buffers are available for purchase.

“Money” is itself a system, a system with financial buffers, buffers that have been consumed by the speculative excesses of the private sector and the financial repression of central banks. These buffers are largely invisible; few know what’s going on in global liquidity markets, for example. Yet when liquidity dries up, for whatever reason, markets go bidless and asset prices go into freefall.

Flooding the financial system with “free money” only restores the illusion of stability. As noted in my diagram, restoring and maintaining an apparent stability thins buffers to the point of dangerous fragility.

When buffers are paper-thin, a crisis that would have been overcome with ease in the past triggers the collapse of the entire system. Everyone who based their faith in the system on its surface stability is stunned by the rapidity of the collapse, for how could such a vast, apparently robust system implode with so little warning?

The financial system’s buffers have been thinning for 10 long years, but nobody seems to notice or care. The quality of risk, debt, borrowers and speculative gambles have all declined, but faith in the “Fed put”–that the Federal Reserve can fix anything and everything by printing “money”– is quasi-religious: few doubt the limitless power of the Fed’s “money”-printing machinery to quickly overcome any crisis.

This is how systems collapse: faith in the visible surface of abundance reigns supreme, and the fragility of the buffers goes unnoticed.

https://www.zerohedge.com/news/2018-05-29/how-systems-collapse

Goody!

George Soros

“The EU is in an existential crisis. Everything that could go wrong has gone wrong,” he said.

To escape the crisis, “it needs to reinvent itself.”

“The United States, for its part, has exacerbated the EU’s problems. By unilaterally withdrawing from the 2015 Iran nuclear deal, President Donald Trump has effectively destroyed the transatlantic alliance. This has put additional pressure on an already beleaguered Europe. It is no longer a figure of speech to say that Europe is in existential danger; it is the harsh reality.”

There is and always has been:

An insane desire by the powerfull, wealthy, politically connected, and Hollywood types to speak out. They are not needed but, knowing that …they then have an overwhelming desire to prove their own virtual importance. To just simply Shut Up is not good enough for them, They are important, making good money and must struggle against their latest pack of celebrity competitors, Neer do wells that must make their very own most important voices heard. To much trouble to maybe just go fishing, or somehow help the Homeless: It’s just, “I am Famous…I am wealthy…you must hear my latest Bullshit”. More then a bit tired of it on my end.

The European end game—[The Macro Tourist]

I know we have all become somewhat immune to these sorts of balance sheet expansions. Nowadays a couple of trillion seems like no big deal, but we should be shaking our head in disbelief. Instead of screaming from the rafters about the bat-shit-craziness of the situation, we have become six-martinis-numb and just smile at the inanity of it all.

Well, here is something to think about. See that balance sheet reduction from 2012-14? That move was the primary immediate cause of the Euro crisis. That frightening market decline forced Draghi to ramp asset purchases back up, and even break the financial blood-brain barrier by lowering rates below zero. So anyone who thinks that this balance sheet expansion isn’t permanent is living in another world. Europe needs constant balance sheet expansion to avoid falling into a deflationary spiral.

The idea that Mario Draghi will retire and be replaced by a hard-money German who restores monetary responsibility is laughable. Doing so would usher in an economic depression worse than the 1930s Great Depression. Think about the economic pain Greece experienced during the past Euro-crisis (for some colour – check out this post – High Debt Levels Rant), and then apply it to almost all of Europe. The rioting would fill the streets and countries would exit the European Union faster than Amy Schumer’s movies leave the theatres.–

deer79–P.S.–Buffett alone cannot stop a crash–nor could J.P. Morgan in 1907…

complacency is off the charts…a guy was just on CNBC saying to buy the banks….the potential to panic is immense…but I am not at all calling for a 2008 scenario…a few days like today are not at all predictable of anything so for…

Maddog–Deer79–the bottom line is that I have only $800 in the trade…

Looking across the entire spectrum of possible option trades, this was the cheapest one I could find…that had an end of the rainbow chance of making $250K if 2008 repeated…in 2008, when WFC was $36, did any of the CNBC Fast Money boys evision a 12 buck price tag…or a one buck price tag on City? For $800, I think of this trade as a fire insurance policy…how often does the house burn down? Not often…but when it does yer glad it’s insured…I could load up with 200 October 2018 JNUG calls for $20 to 25K–OR 10-12 K OF SLV CALLS…but I have little confidence in PMs anymore…to risk that kind of exposure…and in 2008 when stocks crashed so did PMs…

Ororeef

People are mad all over and calling for Boycott then that nobody wants to watch Shepard Smith calls her a racist they’re not to happy about either. They’re calling for The View to be canceled.

ABC watchers are going down might watch to short it.

Here’s a post to boycott and complain with their number to abc customer service.

18002300229.

Richard640

I LOVE your idea of buying cheap OTM puts on banks. What I may be a little wary of though, is that Buffett helped bail out the banking industry in 2008 (bought $5 billion of preferred in Goldman Sachs and another $5 billion with a strike price of $115- that’s a roughly $560 billion gain on paper as of today’s close). If there is another financial frenzy a la 2008, I would think the government would have Buffett’s back and do almost anything to protect his holdings- almost a 10% stake in WFC. God knows we need to wring the financial inefficiencies out of the towel – so to speak, and get closer back to a ground zero, but who knows when/if that will ever happen…….

Why don’t the scum just announce the closeing prices before the open.

That way everyone could spend all day in the bar, drinking their profits.

Roseanne should SUE

because her Civil Rights were violated under equal protection clause .Freedom of Speech violations,and discrimination against whites for political views ..a constitutional RIGHT…

Get the right judge TO HEAR THE CASE ! AND DONT LET THEM rig IT LIKE the Obama and the Clintonistas…communist pimps…

Their Licence should be suspended pending a ruling …..ABC acted with malice against her political views ,she is due Reparations for damages to her reputation and political views.

Re The Italians Crashing Euro, Is Very Good For Europeon Countries.

Tourists will flock there. Their domestic producers will SELL more goods to foreign nations, and IMPORT more money and profits. Imported consumer products, will cost a lot more and discourage the purchasing of imported stuff. Less exporting of money. Keeping the money home.

The only thing Wells Fargo deserves

is a NAKED SHORT …and then another one to cover the first one …etc until its down below zero …

Buygold

scum ain’t waiting till tomorrow, they have the SM flying today…meanwhile NEM makes new lows.

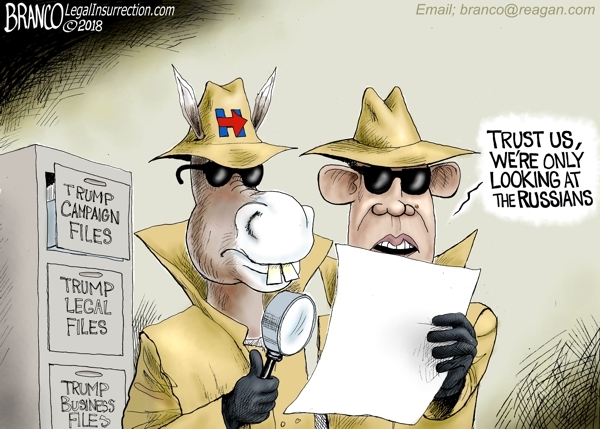

Obama spied on the French too ! That other Freedom loving country ! He might as well spied on the Statue of LIBERTY !

The CIA claimed to justify the spying in order to “prepare key U.S. policymakers for the post-election political landscape” — information that could have just as easily been gleaned from open-source intelligence (OSINT) on French political candidates and their campaign materials and websites.

R640

Smart trade….WFC should be cents for dollars yesterday.

One of my penny stock miners is up over 160% today

Another in the same state ( both domestic – USA ) is down about 25% . I will not name either one – both have been big losers for me .

I only hang on to them because if gold finally does the moon shot , I will recover more of the loss .

Maddog Ten Year Rate Crashing 2.76% Trump Effect Wearing Off.

Roger that. Dow now down 474 points now. USD index almost at 95. There is no way in hell to jack up exports with the alleged US Dollar up in the graveyard in the sky like that.

When the US real estate economy collapsed, in 2008, and credit limits were lowered, Joe Sixpack had no money to continue paying down loans. Everything was so bad in 2009 that things had to get better. And they did.

With everything getting so greater after Trump getting elected, I assumed soon after that it was a psychological placebo effect, and a new economic slowdown was a no brainer.

I’m sure TPTB know what I know, and it would explain all the love fest cheerleading via Trump, about how great the economy has been doing. They are using psychology, words, to maintain confidence with the masses.

The next thing ya know, they’ll be telling us on TV, thru Trump, that all we have to fear, is fear itself.

Maddog–I’m looking to buy the WFC [Wells Fargo] October 19th 2018 $30 put–200 of em at 4 bucks a copy [.04]

In 2008–the unimaginable happened– WFC dropped from about 36 to 12–or a loss of 66%–it is now $52–a similar drop would be about $17…even if it dropped to 40 or 45 I could still have a salvageable trade—in 2008 City Bank went from about what? 65… to a buck…oops! just got filled-[Yeeeee-Haaaaaw-!]

FilledBuy to Open200WFC Oct 19 2018 30.0 PutLimit0.04—-15:11:21 05/29/18

Maddog

Agree. Doing OK against some other currencies but certainly not “flying” as it probably should be.

Money appears to be flying into US dollars and bonds.

We’ll have to see if Italy turns into something bigger than a one day wonder. Wouldn’t surprise me if the DOW opened up 300 pts. tomorrow.

Mr Copper

Yup Dow down 400 etc…but PM’s being sat on so Gold is unch and PM shares mostly down….days like tdy PM world should be flying.

The Rig means no hiding place/relief valve…one day it will all just blow.

Last hour might be interesting

We’ll have to see if the banksters can bring the SM back and slam the metals as usual.

If not, tomorrow might even be more interesting