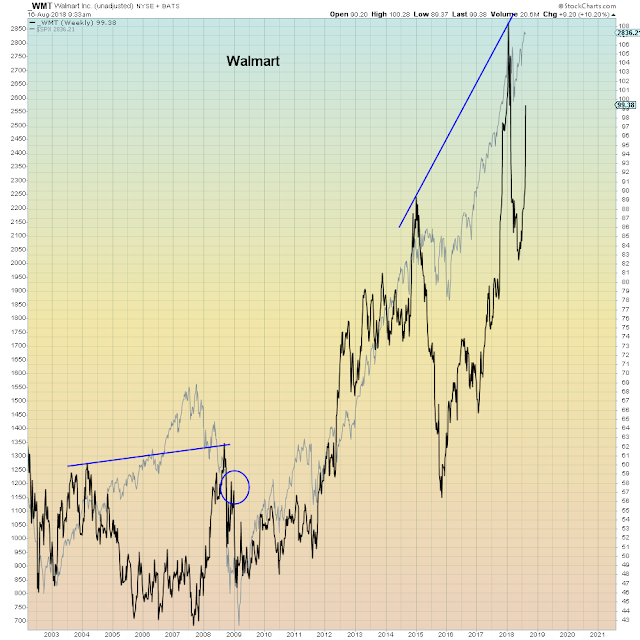

Speaking of denial, the casino is bid today compliments of Walmart’s “best quarter in a decade”. Which highlights the chasmic divergence between stock market denialists and bond market realists at this pivotal juncture.

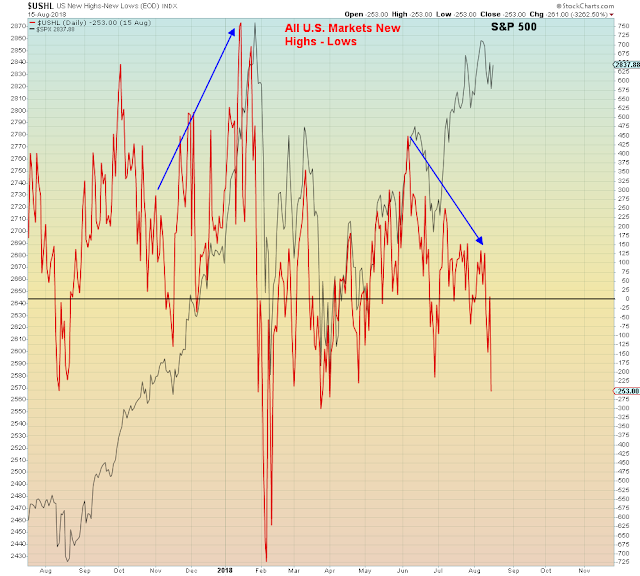

First, the realists:

“Core consumer prices ran at the hottest yearly rate since September 2008. Rather than viewing July’s consumer price data as a warning sign, some economists expect the data point to mark the peak in the inflation cycle. That’s in part because many of the drivers in July’s price surge were one-off boosters that are likely to diminish in the coming months.”

Now, the denialists:

Bear in mind that revenue growth is not adjusted for inflation:

What is being sold as decade high revenue growth is actually an entire decade of ZERO real revenue growth.