Critically, as Jim Grant noted recently, the spread between the 10-year and three-month yields is an important indicator, James Bianco, president and eponym of Bianco Research LLC notes today. On six occasions over the past 50 years when the three-month yield exceeded that of the 10-year, economic recession invariably followed, commencing an average of 311 days after the initial signal.

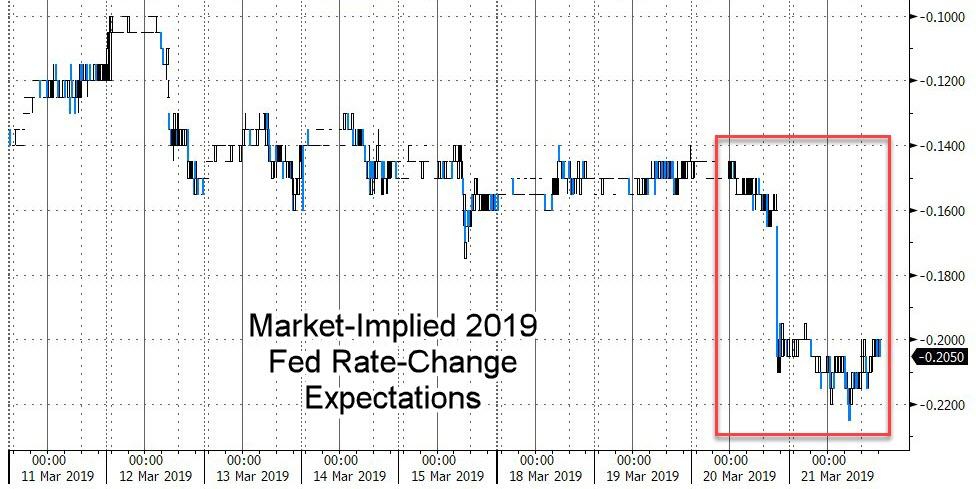

Bianco concludes that the market, like Trump, believes that the current Funds rate isn’t low enough:

While Powell stressed over and over that the Fed is at “neutral,” . . . the market is saying the rate hike cycle ended last December and the economy will weaken enough for the Fed to see a reason to cut in less than a year.

Equity markets remain ignorant of this risk, seemingly banking it all on The Powell Put. We give the last word to DoubleLine’s Jeff Gundlach as a word of caution on the massive decoupling between bonds and stocks…

“Just because things seem invincible doesn’t mean they are invincible. There is kryptonite everywhere. Yesterday’s move created more uncertainty.”