At a time when the US economy is supposedly running at 3+%, unemployment is supposedly around 4%, and the stock market is a mere 5% off its all time highs… the Fed is talking about introducing NIRP, making QE a ROUTINE policy tool, and considering zero bound interest rates.

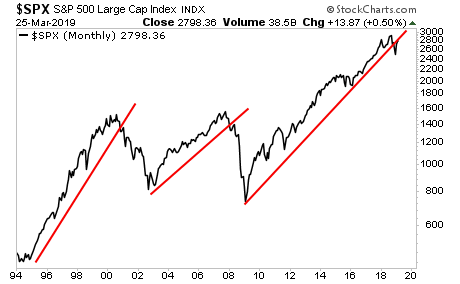

In chart terms, the Fed is seeing this:

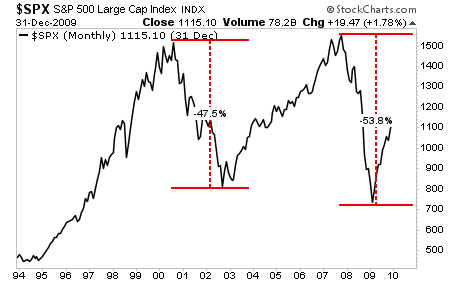

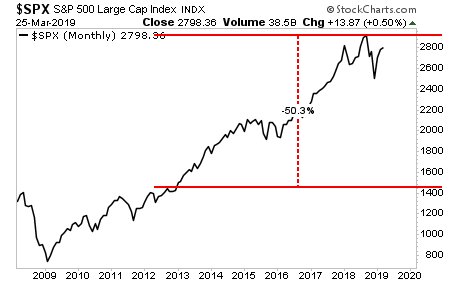

Every time the stock market has broken its monthly bull market trendline in the last 30 years, it’s retraced roughly 50% of its gains via a crisis.

See for yourself.

Using today’s market, this means the S&P 500 down near 1,500.

THIS is what the Fed is preparing for.