Last changed Apr 3 from a Fearrating

Updated Apr 8 at 12:49pm

******************************************

The number of stocks hitting 52-week highs exceeds the number hitting lows and is at the upper end of its range, indicating extreme greed.

skeena in the u.s. (skref) did ok. up almost 21%. not quite what it did north of the line, but it’ll do.

Published Monday, April 8, 7:06 p.m. ET

Considering the dour outlook for Q1 earnings, the stock market’s exuberant run-up over the last month feels like Tennyson’s Charge of the Light Brigade: “Into the valley of Death rode the 600…’ And yet, we know from watching the shares of Boeing, Apple (see chart inset) and Facebook go vertical into a steady stream of negative news concerning each that Wall Street’s ‘600’ really don’t give a damn about the news, or even about ‘fundamentals’. Earnings are expected to come in around 4.5% lower than a year earlier, and this will be the first quarter in three years with negative earnings growth. Bank-stock profits in particular have come under pressure because of the yield curve’s flatness, and financial shares are therefore likely to be laggards if the broad averages continue higher on vague emanations of possible Fed easing. This amounts to glue-sniffing, and although the habit will kill you, or at least your brain, eventually, at the time you are doing it, it probably seems like a small price to pay for a good high. . Click here for a free two-week trial subscription that will give you access to all paid features and services of Rick’s Picks, including daily, actionable trading recommendations and a ringside seat in a 24/7 chat room that draws veteran traders from around the world.

Considering the dour outlook for Q1 earnings, the stock market’s exuberant run-up over the last month feels like Tennyson’s Charge of the Light Brigade: “Into the valley of Death rode the 600…’ And yet, we know from watching the shares of Boeing, Apple (see chart inset) and Facebook go vertical into a steady stream of negative news concerning each that Wall Street’s ‘600’ really don’t give a damn about the news, or even about ‘fundamentals’. Earnings are expected to come in around 4.5% lower than a year earlier, and this will be the first quarter in three years with negative earnings growth. Bank-stock profits in particular have come under pressure because of the yield curve’s flatness, and financial shares are therefore likely to be laggards if the broad averages continue higher on vague emanations of possible Fed easing. This amounts to glue-sniffing, and although the habit will kill you, or at least your brain, eventually, at the time you are doing it, it probably seems like a small price to pay for a good high. . Click here for a free two-week trial subscription that will give you access to all paid features and services of Rick’s Picks, including daily, actionable trading recommendations and a ringside seat in a 24/7 chat room that draws veteran traders from around the world.

Last changed Apr 3 from a Fearrating

Updated Apr 8 at 12:49pm

******************************************

The number of stocks hitting 52-week highs exceeds the number hitting lows and is at the upper end of its range, indicating extreme greed.

LOL

“I keep positions smaller, stops tight, and stress-relief paraphenalia nearby”

This is why I totally despise this market environment; it not a real, free-flowing interaction between bulls and bears. While the day-to-day volatility is mere scenery to be used during the various acts within the trading-day play, the ending is unambiguous; it is pre-determined by the price managers and therefore without any hint of randomness. Furthermore, the longer it is allowed to continue, the greater the degree of moral hazard and the more precipitous the outcome when the curtain finally falls.

As you can see in the gold chart, everything on the surface appears tilted to the downside and it is my feeling that the set-up is one where the DUST and selected put options on the physical metals stand a superior chance of creating additional alpha rather than simply buying and holding those same metals and/or producers (or ETF’s). However, the thing I have to keep in mind is that in the absense of any regulatory monitoring, the bullion banks could run a screen play against a bearish set-up in order to create the kind of upside volume into which they could reload some of the 33,204 net shorts that they covered last week. So, RSI, the moving averages, trendlines, and the MACD/Histogram combo are merely rumination, a condition where these superficial negatives continue to replay themselves over and over again for no apparent reason other than the confirmation of recency bias dominating one’s actions.

For the record, I am trading from the short side of the metals via DUST:US and selected puts on the GLD. The position sizes are about a quarter of what I usually roll but rudderless ships are dangerous to follow and in the vernacular so commonly heard in the pork-belly pit, “Never short a dull market.”. What I mean by this is that I fully expect an intervention at any moment, especially if stocks begin to retrace their astounding move off the Christmas Eve lows but even more dangerous would be a shortlived downside gap in gold followed by enormous short-covering by the Commercials just as the Large Speculators assess and react to those conditions exactly identical to the ones you see in this chart and ramp up THEIR shorts at the same time.

How many times have we seen this type of whipsaw behaviour over the years? Far, far too many times have I donated discretionary capital to the Church of JP Morgan after which I curse, them first, me second and vow to never be fooled again? When the bullion bank behemoths are lurking (as they are now), I keep positions smaller, stops tight, and stress-relief paraphenalia nearby. One must be prepared at every turn, you know.

Zimbabwe to start paying white farmers compensation after April

HARARE (Reuters) – Zimbabwe is to start paying compensation this year to thousands of white farmers who lost land under former president Robert Mugabe’s land reform nearly two decades ago, the government said, as it seeks to bring closure to a highly divisive issue.

Two decades ago Mugabe’s government carried out at times violent evictions of 4,500 white farmers and redistributed the land to around 300,000 black families, arguing it was redressing imbalances from the colonial era.

But land reform still divides public opinion as opponents see it as a partisan process that left the country struggling to feed itself.

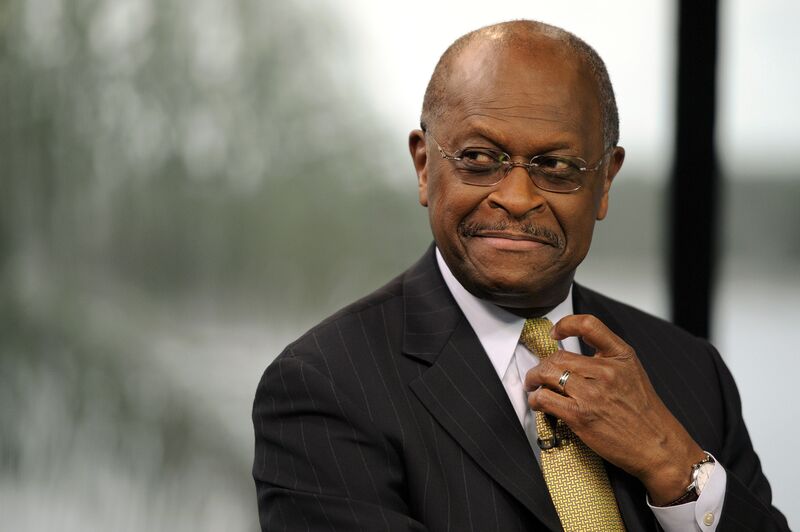

Trump told reporters at the White House on Thursday that Cain is in “good shape.” Cain would fill one of two open seats on the board; the president plans to name Stephen Moore, a visiting fellow at the Heritage Foundation and a long-time Trump supporter, for the other.

Herman Cain in 2012

In Cain and Moore, Trump would place two political loyalists on the board of a central bank that has frequently crossed him. The president has repeatedly attacked Jerome Powell, his own appointee as Federal Reserve chairman, for raising interest rates, and Bloomberg News reported in December that Trump had even discussed firing him.

One way the president can directly influence monetary policy is through nominations to the Fed board, though anyone he picks must be confirmed by the Senate. Asked Thursday if he’s trying to send a signal to the Fed with Cain and Moore, Trump said: “None whatsoever.”

Cain in September co-founded a pro-Trump super-political action committee, America Fighting Back PAC, which features a photo of the president on its website and says: “We must protect Donald Trump and his agenda from impeachment.”

Cain, who had a long corporate career, has previously worked in the Federal Reserve system. From 1992 to 1996, he served as a director of the Federal Reserve Bank of Kansas City, as well as deputy chairman and then chairman.

He advocated for the U.S. to return to the gold standard during his presidential campaign and as recently as December 2017 defended higher interest rates, a position that contrasts with Trump’s repeated criticisms of the Fed last year.

Cain ran for the 2012 Republican presidential nomination but dropped out in late 2011 after allegations he engaged in sexual harassment when he led the National Restaurant Association in the 1990s. An Atlanta woman said she had had an extramarital affair with Cain for more than 13 years.

During the presidential campaign, Cain became known for his “9-9-9” tax plan, which would have replaced much of the U.S. tax code with a flat 9 percent tax on sales transactions as well as corporate and individual income.

There were mixed reactions to Cain’s selection for the board among Republican senators.

Senator Richard Shelby, an Alabama Republican and a senior member of the Senate Banking Committee, said he would reserve his opinion until confirmation hearings.

“A lot of times they throw a nominee out there to see how it plays,” he said. “And then they vet them and they check them out.”

Senator David Perdue, a Georgia Republican who is one of Trump’s closest allies in the Senate, praised Cain.

“He’s a business guy,” Perdue said. “He’s got a great background for it. I know him personally. I think personally he’d be a great addition.”

— With assistance by Laura Litvan

but who cares about a $25 move when bitcoin can rip $1,000 in a 24 hour move in the last couple weeks. This stuff is under lock and key for another 10 years at least. 30 or 40 year waves is all we get.

Stating the obvious….but Gold has a special problem here, $1300 being a double zero….

That said there is obviously some really good buying around…..

WAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAY back…like up just 4 or 6 bucks…[that’s known as “shaking the tree”]….then buying came in and gold ended the day up an ole 20-25 bucks

Nice to see this pop in gold and a lot of the mining stocks … although many of the midgets seem to be trading with the general market and are down today … so far anyways.

Fingers crossed

Really surprised the Rubino curse didn’t strike this morning, you’re right R640 “damn hard to catch”

A couple weeks ago we had a nice Monday rally, only to give up the gains on Tuesday.

Nice to see us making a run back at $1300 though. USD down 1/3%

We’ll see what the day brings and whether they sell everything pm out of the gates – hope not.

But–as ALWAYS–IT’S DAMM HARD TO CATCH [& stick with] THESE RALLIES!! They are so ragged and divergent….that, if u do buy the bottom–u get shaken out…one day u have a bullish intra-day reversal from a down opening–then the next day, it looks like business as usual with no follow through…like on Friday–then today it takes off again…I got knocked outa my JNUG on Friday for a great one day trade but may miss out on a 2-3-4 bagger this week…

****************************************************************

Comex gold is down a. mere .4% [point 4%] & JNUG is down 9%–also silver is not leading…it’s down 3 cents-I like that earl is up $1.44…this set up has. almost always been a good risk/reward situation—DYOD-JMO-ETC

P.S.—on days. like these gold usually ends on the lows–so I do not expect. a late session bounce…looking. for tomorrow and following. days for gold to get its footing and start a move up…I am NOT talking about THEE “bottoms in”–but just a tradable bounce-if it’s something more, so much the better–I have not bought yet-I might do it just before the close, as is my want…

there is risk–JNUG just took out the March lows at $9—next stop the late Jan. lows at 8.16

by hoovering up all of Bolivia’s 1 st quarter production of Blow.