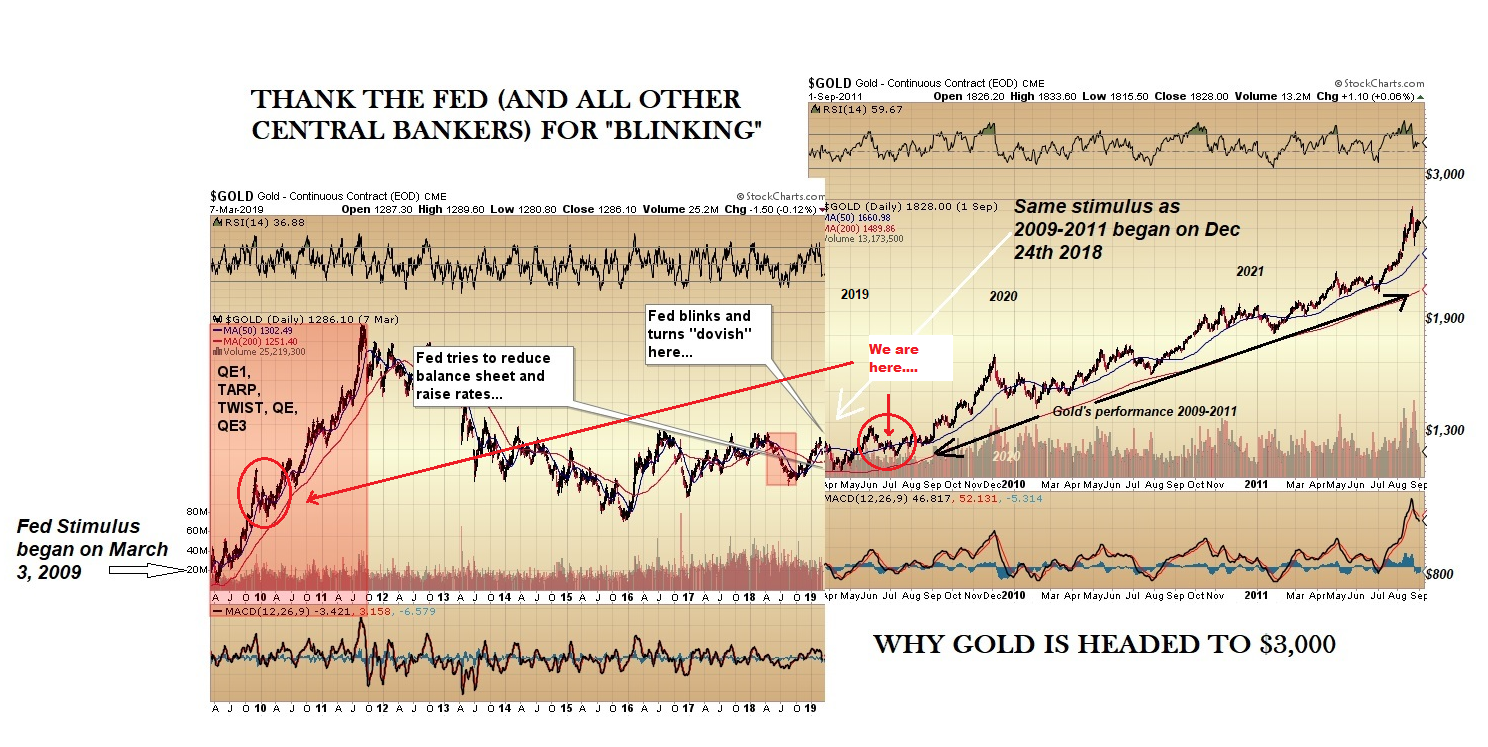

I continue to proffer the thesis that gold (and that ridiculously-underpriced stepchild SILVER) are in good shape technically with RSI, MACD, and Histograms all trending higher but nowhere close to even mildly overbought. The graphic below lays out my 2019-2021 thesis as I believe that the late 2018 “pivot” by the central bankers was a carbon-copy of the one that occurred in Q1/2009. If investors wade into the precious metals in the second half of 2019 the way they pounced in Q3/2010, hey will be doing so with an additional $9 trillion of credit creation as armament for the assault. It is important to recall that in 2010, the investing public was still reeling from the all-out devastation wrought upon them by the bankers and did not have nearly the liquidity then that they have today.

***********************************************

Yet, in the final analysis, forecasting gold’s direction, amplitude, and timing is an exercise in handicapping the odds in the same manner that you try to predict the outcome of a horse race and as everyone learned too painfully from this year’s Kentucky Derby, you can pick the horse and still lose all of your money if someone intercedes and disqualifies the winner. That is exactly what has happened to investors in gold that correctly predicted the monetary and fiscal turmoil that unfolded in 2009; they picked the right horse but the central bank racing stewards disqualified itin 2011. Total, complete, unadulterated disqualification the likes of which we are encountering here in 2019.

************************************************

WHY GOLD IS HEADING TO $3000–see chart below