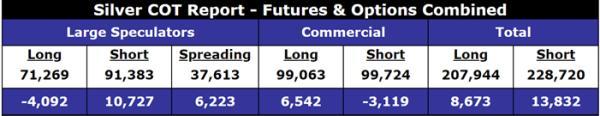

But silver’s story is a lot more interesting. In that market, speculators are now aggressively net short:

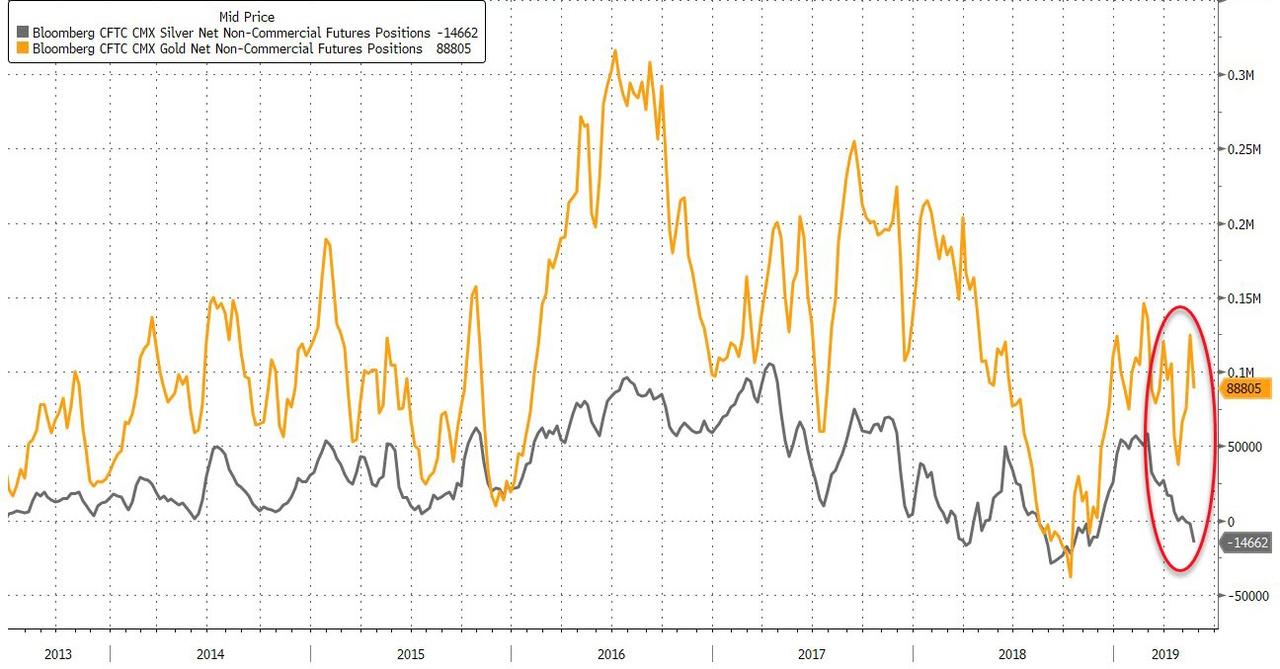

Here’s the same data in graphical form:

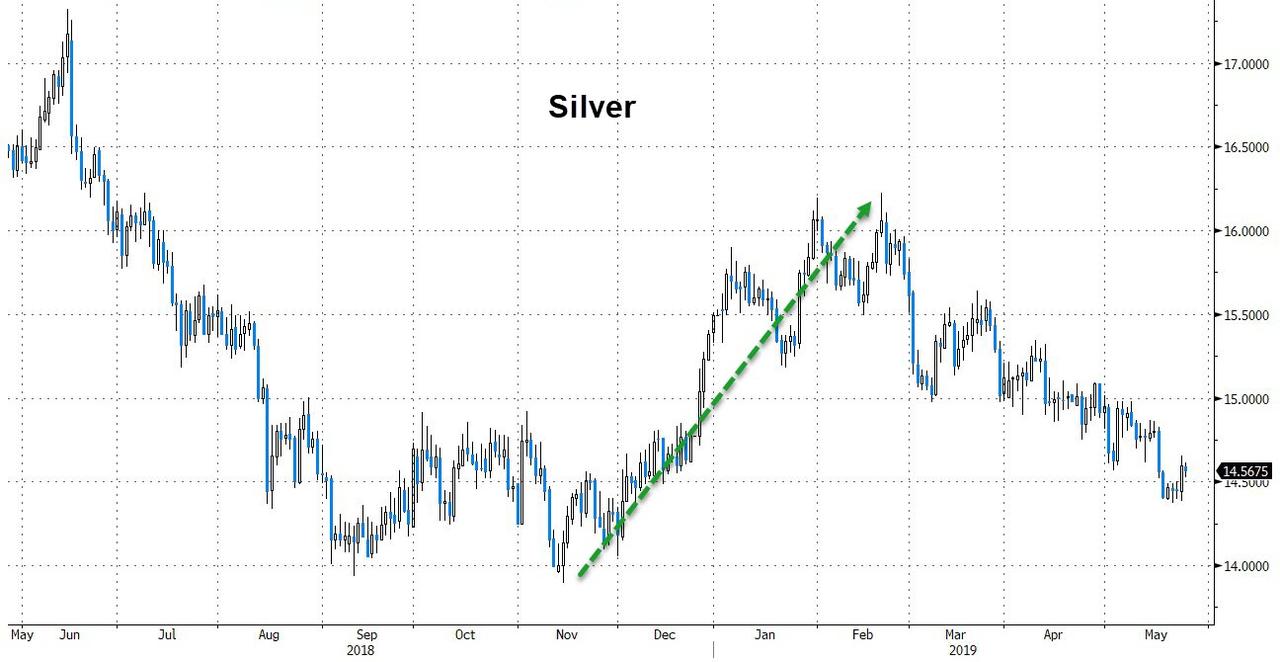

Note that in September 2018, the last time speculators were comparably net short (visually, with the gray bars below the above graph’s center divide), silver was putting in a bottom that preceded a nice run through February of 2019.

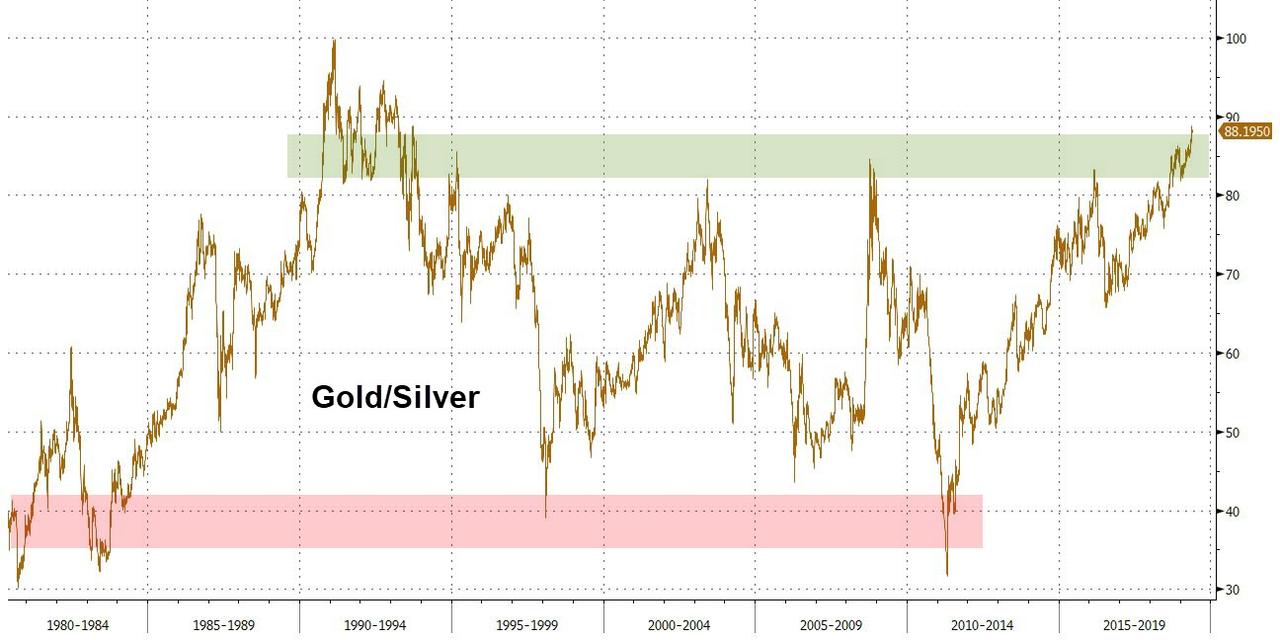

This divergence between gold (wait and see) and silver (start buying now) is confirmed by the gold/silver ratio, which is at a multi-year high, implying that silver is undervalued relative to gold.

Past spikes in this ratio have preceded precious metals bull markets in which silver outperformed gold.