The company was supposed to be the latest thing in something or other…he lost $400,000…there was an awful scandal and a lot of complaints lodged but the company was a fraud and there was no one in China to sue…I don’t know what. madness seized my friend…I guess he wanted to go for the Big Casino…he rolled the dice and got ace-deuce…

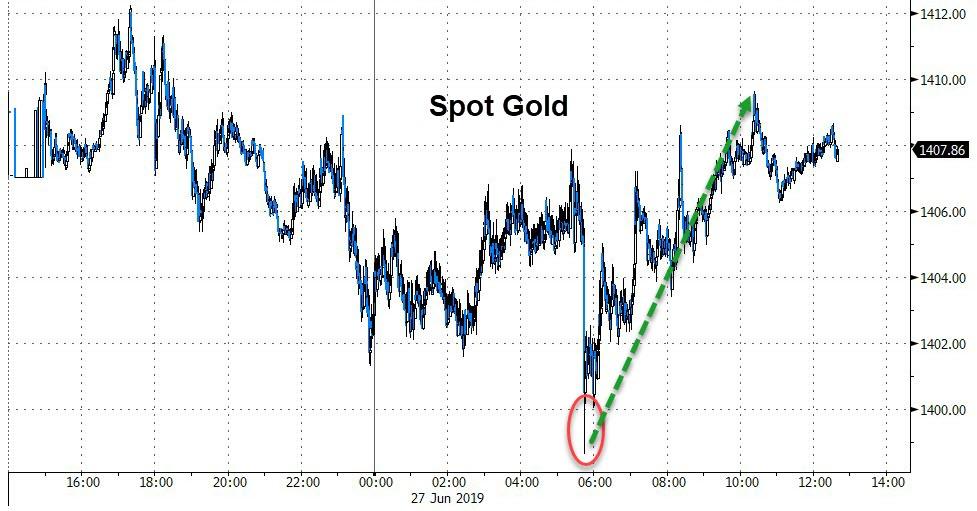

4:30–am–Just like before a FED. wednesday, the fire brigade was called out to get gold under control

Gold’s 10 bucks off its high–silver’s a dime off its high too…I think there’s a chance that those high could be reached again before the close…50/50…but first it looks like they may claw back ALL the overnight gains…a good time to do it in thin trading.

#1–A bit of subtle propaganda/jawboning=Bloomberg led off their. 4:30 segment featuring the head of the San. Francisco FED, Mary Daly, saying. that “it was still too early to tell if a rate cut is needed”

#2—U.N.=Iran to breach nuclear. agreement. within days

I would dismiss number one-that voice will get lost in the din of the crowd—number 2 showa that there are a lot more reasons to buy gold besides tariffs and rates….like the World-Wide. debt and derivative bomb aka Modern Monetary Theory

Who is behind Tether/Bitfinex…..surely not D’A Boyz

https://gizmodo.com/is-a-potentially-fraudulent-crypto-company-behind-the-b-1822812836

Oh Dear…what do we find here….spending his time between London and the French Riviera

https://www.crunchbase.com/person/giancarlo-devasini#section-overview

This will make u fell really good

Zhao Dong, a prominent Chinese early bitcoin adopter and shareholder in Bitfinex, recently posted on Weibo seeking to provide anecdotal evidence as to the integrity of Bitfinex and Tether’s financial reserves. The post claims that Zhao Dong and Lao Mao, the chief executive of Big.one, have witnessed first hand the balances of Bitfinex and Tether’s respective bank accounts during a meeting with Bitfinex’s chief financial officer, Giancarlo Devasini. The post alleges that the combined bank accounts of Tether and Bitfinex hold nearly $3 billion USD.

Vouching Bitfinex and Tether’s Bank Accounts Hold Nearly $3 Billion USD

Bitfinexd Blog

Tether is backed by ????? or just magicked up by a key stroke.

Has Tether Been Fueling The Bitcoin Bull-Run?

https://www.zerohedge.com/news/2019-06-27/has-tether-been-fueling-bitcoin-bull-run

People send real money supposedly to this site ??????

The dangers of low rates, forcing yield hunting, into trades that only work on paper

As Autocallable Issuance Explodes, Is This “Ground Zero” Of The Next Vol Catastrophe

Buygold

Indeed…that’s not the picture one would expect with a 3+% GDP print.

Somebody is lying.

Wonder who?

Cheers

R6, Hook, Ororeef, Maddog

Rates on the Ten Yr. dropped from 2.06% to 2% today. That’s not indicating anything good or dollar positive and gold negative.

I guess we’ll see what happens but this correction might be short and shallow after all.

A suucessful test of the 1400 level…and a kiss goodbye-we will not see that level for gold again in our lifetimes

12 bucks off the bottom–impressive, what!!

Comex Gold–Aug’19

1412.7–open

1415.3–high

1401.4–low

1413.0–[last]

Capt Hook-thanks ! You just further confirmed my call-Funny, I just completed my analysis too-u can bank on this=

THE PROOF

Sunday night gold will be up strongly and by the end of the week gold will be over $1500

So tomorrow will be the last day to add on or take an initial positon in G&S.

My main problem to solve was would the XI-Trump meeting be a success–it won’t be a dramatic failure–Trump is not going to throw a banana creme pie in XIs’ face and storm out–there will be. some B.S. joint statement that will sound O.K. but accomplish nothing–they will agree to keep negociating–how do I know this?

From the action in bonds mainly…secondarily from the dollar and stocks…I got further confirmation for what. I was suspecting from this article=

Bonds & Stocks Bid On ‘Bad’ Macro/Trade News

Finally, as Bloomberg’s Ye Xie notes, the collapse in regional Fed surveys leaves the stock market vulnerable. With the Kansas City Manufacturing Activity Index posting a reading of zero, all five regional Fed surveys of business activity deteriorated this month. That points to the risk that the ISM manufacturing index next week may fall below 50, the dividing line between growth and contraction.

Buygold

Yes that was a good close — not that the fun is over.

In the good news department the aggressive ETF speculators are now shorting the PM’s at present levels expecting at least a pull-back. And I wouldn’t doubt the COTS will improve too.

This is classic bull market action.

A gold close over $1400 tomorrow will paint a nice monthly candle for June.

Turns that begin in May often last into November – at a minimum.

Cheers

Ororeef–Buygold–I checked the $. at. 3:30–it was up .160—that didn’t last long–now it’s up .027

The 10 yr t-note has has a decent gain= up 18/64ths…IMO, the $ and the bonds-especially–are reflecting the fact that there isn;t a lot of confidence in getting a good outcome from the XI/Trump meeting. That they continue to buy bonds and stocks together is sooooo strange,,,,

Sunday night will definitely be wild

Hoping to see

a strong close and an end to this shallow pull back. Glad to see $1400 hasn’t been breached. Course with pm’s there’s no way to know, each day is different.

Not seeing anything unusual with dollar strength or rising rates.

We’ll see. Just hoping for short and shallow…..

Chart is $GOLD with ZERO Coupon Bonds gold broke through Long term MA ,soon to be followed by short term MA in a golden CROSS,since bonds will follow GOLD, Bond rates will go very negative ..Chart is 2010 till today !WE got a long way to go !

A JAPANESE style RENKO CHART that filters out small moves,but is very good at tops and BOttoms .Confuses dates a bit because of the filtering .Chart is 2010 till today ..

This can’t hurt gold=BITCOIN DROPS $3000

This can’t hurt gold=BITCOIN DROPS $3000

BitCoin has. fallen $3000 from it’s high today-and all the other coins have 10%-14% losses…I think I’ll get a list of all those coin buyers and send them a pamphlet about the benefits of owning gold

E wave suggests 1 st wave down is done in Gold

we should rally in a B wave from here minimum….lets see.

Ororeef

Yeah I wouldn’t be to worried yet but you could always hedge with the dollar. Even though it’s down it still hasn’t broken out of its bullish mode ” yet.” I have no ideas what it means if they both go up have haven’t compaired if their doing it the opposite of each other.

I can only have so much computer tribulations using a phone and already my fill for the day.

This is JUNE 27 ,bull markets start on JULY 4 dont get all bent out of shape

.Go smoke a cigarette and relax ,cause there only blowing smoke ,blow it back at em..Go to the beach for a few days …put your stink orders in to buy below the market !its going to be VERY short ,dont try to trade this market..Be in Place and wait.There blowin Smoke ! then the mirrors come in …Its all about smoke & mirrors ….to distract you ..Its a bull market ya know !

scum crushing every rally….

took gold sub 1400 and found no stops, or tonnes of buying..so happy to stop all rallies and hold it @ 1400….

if the Fed will eventually become a price insensitive buyer of Trillions of these securities? Why not take levered positions in German bunds at negative 29 bps

The QE naysayers at that time focused on the risk of inflation – and even hyperinflation – in consumer prices. However, the paramount issue was instead market distortions and hyperinflation in securities (and asset) prices, where perpetual QE essentially removes any ceiling on sovereign debt prices (floor on yields). Why shouldn’t exuberant traders imagine Treasury yields at some point trading at the current Swiss bond yield of negative 52 bps?

Why not leverage Treasuries (i.e. 10-yr at 2.06%) if the Fed will eventually become a price insensitive buyer of Trillions of these securities? Why not take levered positions in German bunds at negative 29 bps – better yet, Italian and Greek debt at 2.15% and 2.52% – appreciating it’s only a matter of (probably not much) time before the ECB fires back up the “electronic printing press.” Perhaps most consequential of all, why wouldn’t everyone speculating globally in the risk markets simultaneously leverage in sovereign debt, confident that aggressive global QE deployment devises the perfect market hedge? Why not hedge market risk with sovereign debt-related derivatives? In total, we have unearthed a recipe for history’s greatest episode of speculative leveraging (mortgage finance Bubble excess measly in comparison).

Buygold

RE GLD….the shares are way beat up still….they are @ 30 % below where they were in 2016 relative to Gold, in the Hui/Gold spread..the GDX/GLD spread is @ 20 % down.

Maddog

I’d take some profits out of the 1400 and wait out any pullback when it hit the 1420s and wait to see if the new support holds but I’m not trading right now. 1350 ish resistance should be the new support.

R6, Maddog – Re: Ballinger

Wow. Didn’t even realize the HUI got up to almost 300 back in 2016.

Been suffering for so long with this stuff I can’t even remember back 3 lousy years.

Funny thing about that is that GLD is higher now than it was back then. Go figure.

Here’s why it all fell over

Futures Tumble After Beijing Reveals Demands To Agree To Trade War “Truce”, Including Lift Of Huawei Ban

Doesn’t look like this is gonna be settled anytime soon….