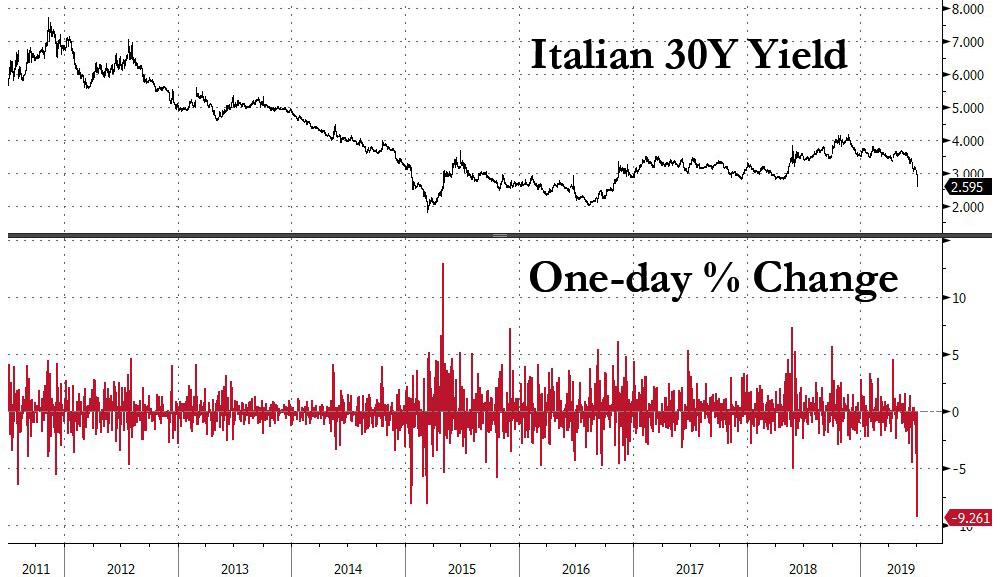

This latest curve inversion, which signals that a European recession is looming, has spurred investors to buy riskier assets such as 30 Year Italian bonds, which yesterday saw their biggest one day gain since Draghi’s 2012 “whatever it takes” speech.

10-year German bund yields fell 8bps this week to a record-low minus 0.41%. Italian bonds have outpaced the bund rally to narrow the spread between the two to below 200 basis points Wednesday, the lowest since May 2018.

Meanwhile, confirming that Albert Edwards’ deflationary “ice age” is upon us, 10Y bonds from Belgium, France and the Netherlands have already joined the sub-zero club, which now amounts to a record $13.4 trillion in negative-yielding debt.

ADM Investor Services strategist Marc Ostwald warned that the huge stock of bonds yielding below zero might pose risks if the global economy shows signs of a rebound in the second half of the year: —