Going to have to change my phrase

from:

and here THEY come…

to:

and here WE come….

Hecla Reports Second Quarter Production

“Established hedges that utilize put options on expected gold and silver sales through the first quarter of 2020, locking in a minimum average price of $1,400 per gold ounce and $15.13 per silver ounce.”

Idiots! The small position I have in this is gonna go!

Thanks

Silverngold and Maddog.

deer79….. up to date quotes

You might try this one. Lotsa other historical stuff too and you can get gold price in other currencies if you want it.

Morning Buygold

It’s so hard to see the daily moves, especially when the scum are sitting in the wings 24/7……but what I do see is huge long term B/O’s, which have barely started…..This is one I think where one should try and get set and then ride it.

I always remember Richard Russells comment, that all great Bulls run with the least number of people on it, especially Gold.

What’s the consensus?

We going to attempt to make another valiant comeback or just kind of consolidate some more?

Shares don’t seem too worried about the move in gold. I’m still stunned by the strength in silver.

USD has no mojo.

R6 – you’re right about the Philly Fed – that was a joke of a number.

Philly Fed Survey Soars To 12-Month Highs, Jumps Most In A Decade–worthless!

Do these ‘soft’ surveys have any value whatsoever when they can swing from 3 year lows to 1 year highs over the space of one month?

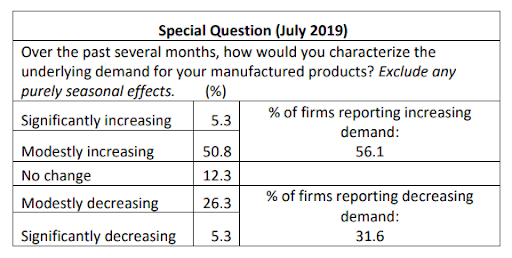

Finally, there’s the “special question” which suggests everyone is optimistic about the future…

https://www.zerohedge.com/news/2019-07-18/philly-fed-survey-soars-12-month-highs-jumps-most-decade

So why are we cutting rates again?

COMMENTARY

Is there ANY credibility or substance left in any of the swill we are feed by our “officials in charge”? This “survey”, like most other “data” disseminated to the public by the corporate/government conglomerate is total horseshit….can you smell it or not? That’s the only survey question that’s needs to be asked!

****************************************************************

All part of the DS anti-Trump regimen? And seems absurd when looking at the reality in the US today?

***************************************************************

Data means nothing right now. I expect a 50 basis cut and more come the end of July.

Richard640

NEM worries me somewhat short term, the scum have been sitting on it for the last few days and now Silver is looking good, they must be getting nervous.

Plus Redneckokie has taken some off the table and he has a v hot hand.

I wonder when someone big will ask why PM’s always have huge sellers out there, no matter the news etc….it can only a matter of time, as these mkts just don’t trade right.

Maddog–Looks like a bit of. scorched earth poilcy for openers-I hope the whole day doesn’t go like this

all the pm stocks gapped up and were immediately sold–also trying to bury. G&S…everybody’s got their cross to bear…

The $ index is barely green

Up to date quotes

Can anyone suggest a site for up-to-date quotes on Gold and Silver. So many seem to have delayed quotes these days…..

Maddog–this came out an hour ago–certainly can’t hurt gold…

Yield Is `Headed to Zero’-

July 18, 2019, 8:01 AM EDT

-

JPMorgan Asset Management CIO reckons rates will be slashed

-

Central banks will succumb to trade war, lowflation: Michele

Bob Michele, who in April told investors to enjoy the ride in risk assets, is now looking to ride U.S. Treasury yields “all the way down to zero.”

For 10-year notes “I think that’s where we’re headed over the next couple of years,” Michele, the chief investment officer and head of global fixed income at JPMorgan Asset Management, told Bloomberg TV on Thursday. “The rally in bonds hasn’t even begun yet.”

******************************************************************

Numbers out…who cares…smash AU…

buy Dollar and SM….scum never change.

Buygold–Except for USLV pre-mkt trade in PMs is quiet

USLV=

|

| 8:13:39 AM EDT

|

Volume | |

|

76.57

+ 2.25 (+3.03%)

|

Maya @ 1:48

Ya that’s right. Silver should have been up a few dollars yesterday with all the buying that occurred.

And the idiot hedge funds just keep buying those futures / derivatives.

This sets up the likelihood of a another smash down at some point, maybe post the Fed rate cut next week.

I would like to see some of them come out and say they understand the game and are buying physical.

That will never happen of course if they don’t want to get cut off the liquidity spigot.

So it will have to be outsiders.

This is why it’s taking so long.

Cheers

Morning R6

Fortunately, I get to sleep through all that overnight drama. I do agree with you, it has been a more bullish pattern lately. Way better than being up $20 overnight only to see it washed away during the day.

I see SLV is up $.15 or 1% this am. I actually thought it might have trouble at the $15 area – shows you what I know.

Gold down $5, should be able to come back if silver stays strong and rates fall a bit.

I’d love to stay overbought for months…

Here’s the “alibi” we need–just out now in the news-to have another nice day in PMs

Dammit! it bothers me that stocks and bitcoin can rise for weeks on end without the need for a daily alibi/pretext…but here is the story–note. that it says the news “slammed the euro”–I just checked the $ index and–thank god–it is still red. but barely so…and that’s all that is needed–also they are buying bonds–not by much–and that eliminates another point of worry for PMs–so gold has a green light to get its a** in gear and go up.

Buygold–this is becoming like an old Vaudeville routine…it’s almost comical…

The FILTH attack gold overnight when trading is thin…then. it slowly recovers by morning and goes on to have good day…last night they managed to drop gold to a 9 buck loss…but tonight gold tacked on 9 bucks in late day trading…it’s 3:14 am and gold’s only down $1.30-$10 off the high– at 1422….silver’s up 6 cent at 15.03–that’s 7 cents off the low…actually this pattern is bullish and what a gold bull should want to see…

Better this way, than coming in the morning with a $20 gain that gets whittled away all day…this keeps the longs nervous and cools off sentiment…of course none of this reasoning applies to stocks or the likes of a Bitcoin…they can keep going up for days, weeks and months on end with no discussion of RSIs or COTS…yeah, when the VIX gets real low, there’s some discussion…but the VIX can stay low for months and stocks just keep doing their thang..

Gold Train

Minneapolis/St. Paul commuters ride

the Northstar to rural Minnesota.

https://railpictures.net/photo/701595/

Silver

I can only hope silver runs. I have a lot of phyz silver stash. I love the TA showing possible runups in silver. But of course TA is always correct in hindsight. Predicting the future is problematic, so I will believe it when I see it… at which point it becomes 100% correct hindsight.

I think the system is stressing, and we will see the greater depression soon. A silver dime will again buy something of real value.

Silver on the run again tonight

Yikes, up another $.12

Gold only up $.70

Go figure

Ipso

I’d say we are permitted a smile at least for the last couple of days!

Something we don’t know about clearly seems to be going on, although I guess it could just be rates.

Whatever it is, I don’t care. Just happy to be on the winning team for a change. 🙂

I hope our Goldbug friends here

have decent sized positions … and aren’t waiting to load up on a pullback which may not come. At least you should be scaling in now …

Richard640 @ 16:54

NGD has a lot of debt … so it is already leveraged … then when you buy calls on it you are getting Double Leverage! 🙂

Good luck!