Yes and last week’s relatively strong close increases the probability of a good showing this coming week.

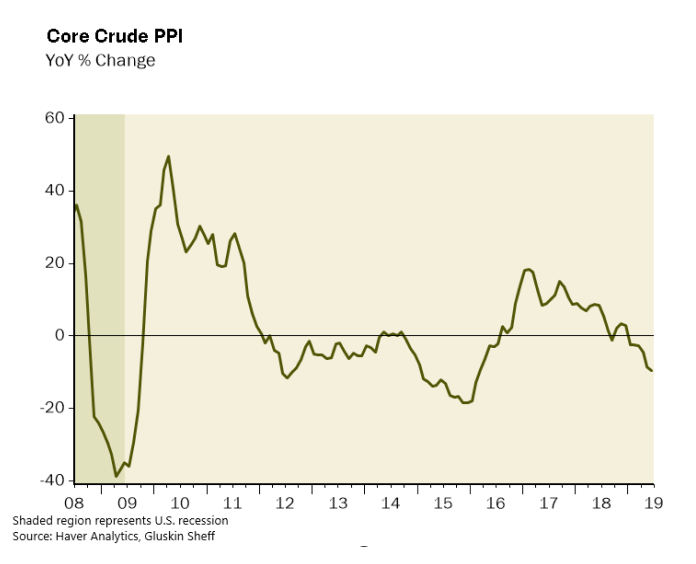

Add to that a ‘big picture view’ that is the most bullish for PM’s ever possibly – reminiscent of stagflation times in the 70’s, and we do indeed have the stars aligning for a big move.

Then we have The Donald wishing to be re-elected and knowing the only way this will happen is if the bubbles remain inflated. So he is populating the Fed with uber-doves. So administered rates will always be lower than market rates at least until the election next year, meaning real rates, the primary driver of PM’s in our present system, will always be negative too. This means ‘high powered money printing’.

Then we see a comment from Eric Sprott this week, for whom I have a great deal of respect, pointing out if Poland had directed the amount of capital required to buy 100 tons of gold towards the silver market, it would have bought all the available above ground silver by a factor of two (likely more like four of five because it’s not all available). That’s just one buyer…could have bought all the world’s silver by a factor of two, or five.

For me, that sounds like a bullish recipe all by itself…especially if the Chinese ever decide to start drawing down SLV silver in an attempt to secure the supply they need for manufacturing.

Then we will see if COMEX stock reports are just another lie.

One would think this is quite possible…no?

That’s why silver is not allowed to move…because da boyz are scared sh*tless the silver reverse bubble is about to explode.

Cheers