https://ceo.ca/@newswire/equinox-gold-achieves-commercial-production-at-the

We may not have to wait until friday=tomorrow the ADP report comes out with its monthly jobs estimate

The ADP National Employment Report (also popularly known as the ADP Jobs Report or ADP Employment Report) is sponsored by ADP, and was originally developed and maintained by Macroeconomic Advisers, LLC. The report’s methodology was revised in November 2012 by Moody’s Analytics. The report is a measure of non-farm private sector employment which is obtained by utilizing an anonymous subset of roughly 400,000 U.S. businesses which are clients of ADP. During the twelve-month period, this subset averaged over U.S. business clients and over U.S. employees working in all private industrial sectors.

Buygold–in the demi-monde of gold-bug circles many analysts assure us that silver will not only join g

old rally but will outperform it…I say one must throw out all the old assumptions–like gold can’t continue to rally causa cots and high rsi’s….similarly=gold can only rally so far without silver…maybe gold will have its big rally with silver lagging far behind…just let it rally first and we’ll work out the details later…LOL

I’m sure you guys saw this story

Arizona Blocks Nike After Kaepernick-Complaint Sparks Virtue-Signaling Sneaker Ban

I just want to say screw Nike and screw kapernick!

PS Love that flag version.

A depression is coming…not a recession…actually. it is here already=massive homelessness in the big cities

Hey buddy can you spare some change or bitcoin for a Soya Latte and Avacado Toast?

@Richie re Trade Truce Euphoria Fizzles? I Think We Can Count On That Forever

There can’t possibility be any compromise in my view. There is only one direction or plan. More for us and less for them. There was no discussion or compromise for the USA back in the day when “they” decided to give all our manufacturing away.

I saw an article lately using the de-globalization instead of reversal of the past. Its not JUST globalization that is reversing. Many other things like allowing unfetter immigration and corruption in high places etc etc

Buygold @ 8:09

Looks like it’s trying to play catch-up on the downside with gold.

Of course that could never happen — right?

Chuckle

R6, Maddog

Other than the scum and ridiculous COT’s, do you guys have any sense of what silver is doing or is going to do?

Almost completely detached from gold these days.

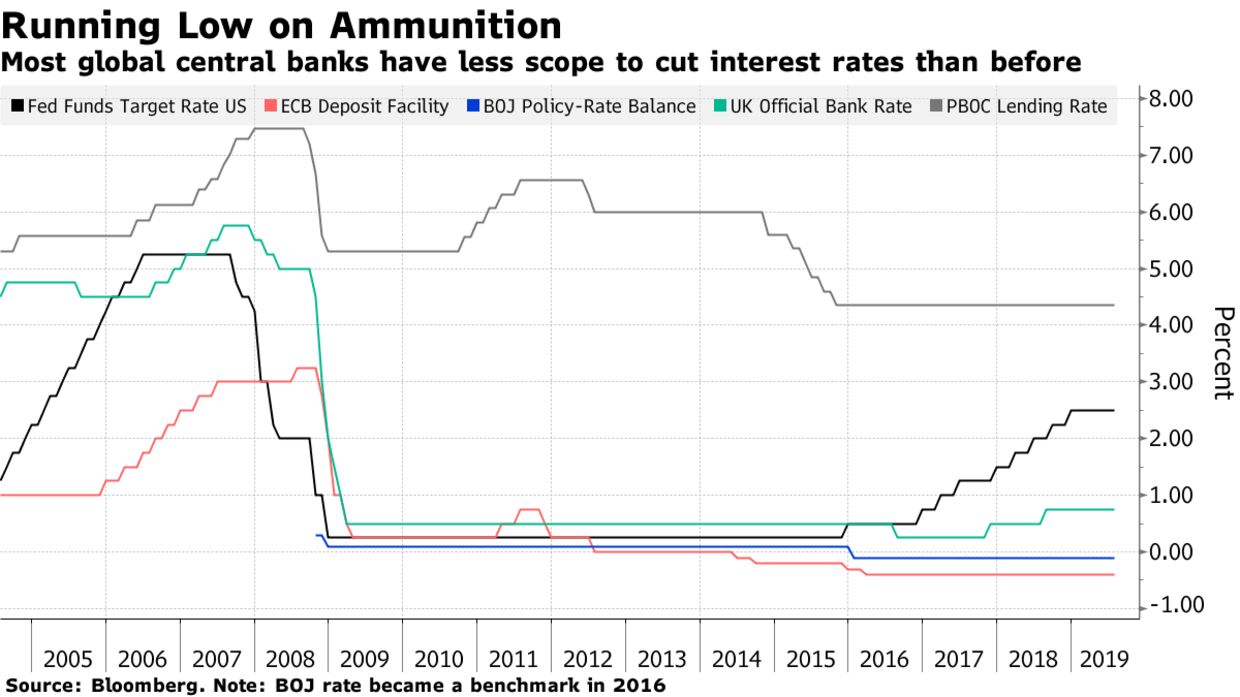

Recession bound?…here already??…maybe this is why the jobs reports have been stinko lately-A weak Friday # could really launch gold.

Guess what? Recession looming means rate cuts required to save the all important. stock mkt. and keep it on its journey to infinity.

Which means much higher gold!

Roubini

Good to have something to agree with Roubini on. I know he’s not generally been a friend of gold.

Would be nice if yesterdays’ drubbing was the extent of the downdraft and we bounce off Maddog’s $1380

Shares look supportive this am.

R640

it’s the most overhyped technology ever, it’s nothing better than a glorified spreadsheet,” Roubini said. “Nobody’s using it, and nobody’s ever going to use it.”

I’m no accountancy expert at all, but when I looked at Blockchain, it’s exactly as he says overhyped garbage, all it is endless duplications, as a system for checking that ain’t rocket science, it’s been around since man first learnt how to think !!!!

Roubini on cryptos

Speaking at a blockchain summit in Taipei, Roubini reiterated his skepticism toward cryptocurrencies such as Bitcoin.

“There’s massive, massive amounts of price manipulation” in cryptocurrency trading, he said in remarks at the conference. As for blockchain, “it’s the most overhyped technology ever, it’s nothing better than a glorified spreadsheet,” Roubini said. “Nobody’s using it, and nobody’s ever going to use it.”

Nice start to. the. day…

10. yr. note=up 11/64ths [yield lower]—check!

The $ index down-not much but down—-check!

Gold–up 6.40=that’s 9.50 off the overnight low–check

The U.S.-China trade war and a spike in oil prices from geopolitical tensions have the potential to push the world into recession next year, according to renowned doomsayer Nouriel Roubini.

Optimism will likely collapse “like in every other recession,” he said. Further unconventional monetary policy is likely to be needed, he added.

On top of that, an oil-price shock coming from Iran tensions would raise the prospect of 1970s-style stagflation as a rise in crude prices coincides with slower growth, Roubini said.

redneckokie1

Tks.

7-1-AVI GILBERT=So, until the market proves to me that it is not going to break out directly in the heart of a 3rdwave , I am going to remain on this train.

As for me, I have learned from many years of experience with metals not to automatically discount a major move in the metals if there is a reasonable interpretation for one. While the diagonal Zac and Garrett are tracking is quite reasonable, and supported by quite a few mining charts, I am giving the market room to blow out to the upside to confirm the more bullish standard impulsive count I am tracking in green on my daily charts.

Again, based upon experience, if I were not to view the metals’ potential break out directly higher as my primary count, and it fulfilled, then many would be left at the station as the train leaves. So, until the market proves to me that it is not going to break out directly in the heart of a 3rdwave (which still has a very reasonable probability of following through), I am going to remain on this train. Moreover, I have identified what action I would need to see to adopt my alternative count.

So, if the market does break down into the diagonal, then it just provides more opportunity to play the long side, and I will not have missed anything. But, if the market were to blow out to the upside while the great majority of the members were looking for more of a pullback from my analysis, then there would have been a major opportunity we may miss. But, allowing the market to PROVE the bigger pullback before I adopt it does not have us missing any upside.

Yet, the key here is that I am not suggesting any leveraged positions at this time. If the market were to not break out and prove to see more of a pullback, only those with leverage would be hurt. So, as you know if you have been following me, I stopped out of my leverage positions when GDX broke below 25.90, and am simply holding my core positions. Should the market prove to break out further in the parabolic potential on my daily charts, then there will be another opportunity to add leverage on the wave iv pullback/consolidation.

So, if the market will break down one of our supports over the coming weeks, then it would leave me watching the patterns outlined by the Stock Waves analysts in the video cited above. Yet, both are clearly quite bullish structures for the coming months.

JNUG

Today is a perfect example of why I don’t like straight up markets when I’m long. They go down the same way. Gold is in good support here. I may add to my positions.

rno

I saw the DOW down 9 pts–that lasted about 30 seconds–how it’s up 103–stocks are unstoppable

The S&P made its 95th new high today. since Trump was elected…it looks like this year will be like 2017 and 2018…where most of the year it was mind-numbing for the bears…day after day…month after month…up and up…if the stock mkt had an RSI it would have registered 400 or 500…yet not. a peep about the mkt being overbought..

Yet a lousey 100 buck gold rally get’s people hysterical: O the RSIs! O, the COTs! BEWARE!

Now we await friday but don’t hold your breath…

This is not a recoomedation-I now have 600 calls-1st 400 at a nickle

| Filled | Buy to Open | 200 | NGD Aug 16 2019 1.0 Call | Limit | 0.07 | — | — | 15:44:35 07/01/19 |

R6

IMHO -The Fed needs to set the need of a rate cut up with economic data. What better way to do that than come out with a weak jobs report on Friday?

In the meantime they can do a lot of damage to gold by goosing the dollar and rates.

Was hoping $1385 would hold but I guess now $1350 is in the cards.

Who knows how low the shares will go but if I’m right, HUI definitely shouldn’t go below 165.

Caveat….I’m always wrong.

Grumble! Gripe! Complain! if stocks roll over hard gold may have a chance-DOW down 9-russell down 2 pts

FilledSell to Close10 CDE Sep 20 2019 4.0 CallLimit0.60—-09:35:39 07/01/19

FilledSell to Close400 CDE Sep 20 2019 4.0 CallLimit0.60—-09:35:39 07/01/19

FilledSell to Close90 CDE Sep 20 2019 4.0 CallLimit0.60—-09:35:39 07/01/19