[and indicates the FED may have to do 50bps “shock and awe” to save stocks–(good for gold) in September]

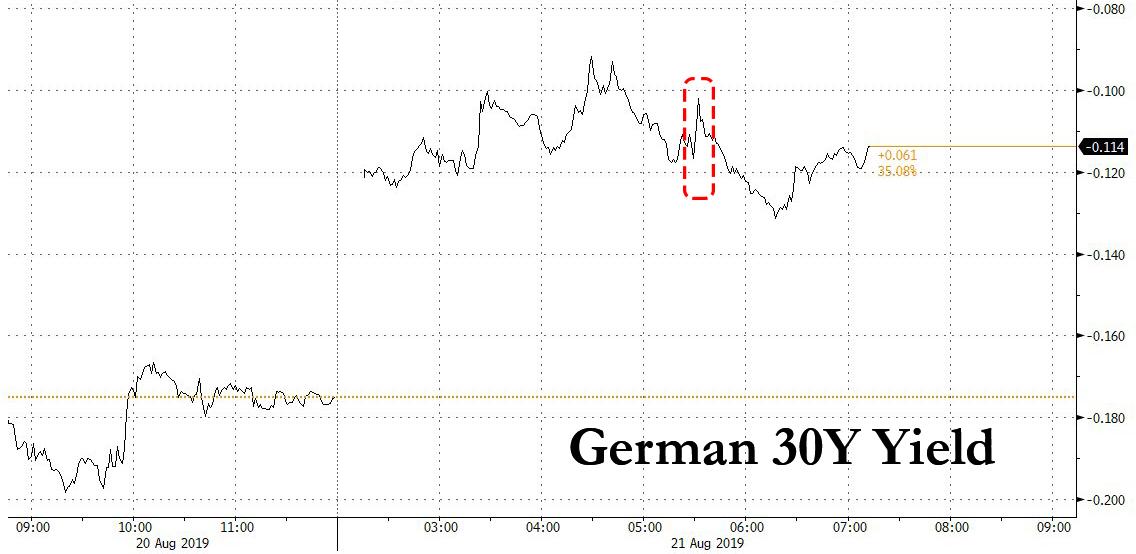

The German government auctioned 30-year bonds with a coupon of 0% at a yield of negative 11 basis points. And it didn’t go well. Of the 2 billion euros worth on offer, the Bundesbank was forced to retain 58% of it. Calling it a “technically” failed auction doesn’t make it any less actually the case.

And for those who think the ECB, or any other central bank, can keep plumbing the depths of negative interest rates to wring out ever-diminishing benefits, it should be cause to pause and consider

If you want an object lesson in long-term investing, as opposed to flipping, in this not-so-brave new world, take a look at the comments on Tuesday from the chief investment officer of Japan’s Government Pension Investment Fund. And when you do, keep in mind the words “largest pension fund in the world.” Over the last three months it has lost money in fixed-income, equities and foreign exchange. Half of the fund is in domestic assets, including negative yielding JGBs. And the returns on their overseas investments suffered from the safe-haven status of the yen.

It’s tempting to indulge in a little schadenfreude with these sorts of results. After all, it shouldn’t be easy to lose in every asset class. But if this is a peek at where the world’s investing landscape is heading, there’s little room for amusement.

You can understand why there is the belief among academics that, with rates as low as they are, and central banks having less and less leeway, a shock and awe approach to rate decisions may be the most effective policy strategy.

But that also smacks of the desperation of a Hail Mary pass. And they never happen when things are going well. Still, it does help explain some of the really aggressive fixed-income options trades that have been executed, just this week, around the upcoming events.