Posted by ipso facto

@ 20:32 on September 3, 2019

On The Media Censoring Tulsi Gabbard

When asked about the media’s coverage of his 2008 and 2012 Presidential run, Paul also noted that he thought Tulsi Gabbard was not getting a fair shake.

“She’s not getting a fair shake, but she has to realize that she’s in a hornet’s nest. She dramatizes how badly the progressive democrats have drifted away…”

“I think she should just put her head down and say what she believes, because she will reach people outside of Democratic circles…”

“I think she has been attacked and mistreated maybe more than I was…”

https://www.zerohedge.com/news/2019-09-03/ron-paul-i-believe-fed-stock-market-and-they-dont-want-us-know-details

Posted by treefrog

@ 20:29 on September 3, 2019

when? and how high? …why? that can wait. actually they all can wait. we will all see as it unfolds.

Posted by treefrog

@ 20:17 on September 3, 2019

metals prices moving up in early asian trading, silver taking the lead.

Posted by Buygold

@ 20:02 on September 3, 2019

at least so far, so good.

When someone figures out the “why now” please let me know.

OTOH, if it keeps going, I can wait to know why.

Posted by treefrog

@ 19:40 on September 3, 2019

Posted by Richard640

@ 19:32 on September 3, 2019

Posted by ipso facto

@ 19:15 on September 3, 2019

I doubt that the Epstein Devil’s place was spared.

Posted by Richard640

@ 19:06 on September 3, 2019

123.15+13.91 (+12.73%)

At close: 4:00PM EDT

125.75 +2.60 (2.11%)

After hours: 6:02PM EDT

Posted by treefrog

@ 17:35 on September 3, 2019

trump denies any collusion with Marie la Veau.

![[Image of cumulative wind history]](https://www.nhc.noaa.gov/storm_graphics/AT05/refresh/AL052019_wind_history+png/212619_wind_history.png)

Posted by Buygold

@ 16:47 on September 3, 2019

The only thing that seems to be holding gold back for now is the strong dollar.

As I said this am, no clue what’s going on with silver but it is on fire. Maybe JPM actually does have a bunch of phyzz and now wants it to fly?

Both metals are creeping higher again after the SM close.

Posted by treefrog

@ 16:40 on September 3, 2019

kitco’s showing a seventy cent rise in the new york silver spot price with a half hour to run. i’ve been watching for the last ten-fifteen years, and a fifty or sixty cent day was pretty good. there may have been a day better than seventy, but i don’t remember it.

beats working!

(edit) now seventy five and still ticking!!

eighty !!!

Posted by Richard640

@ 16:37 on September 3, 2019

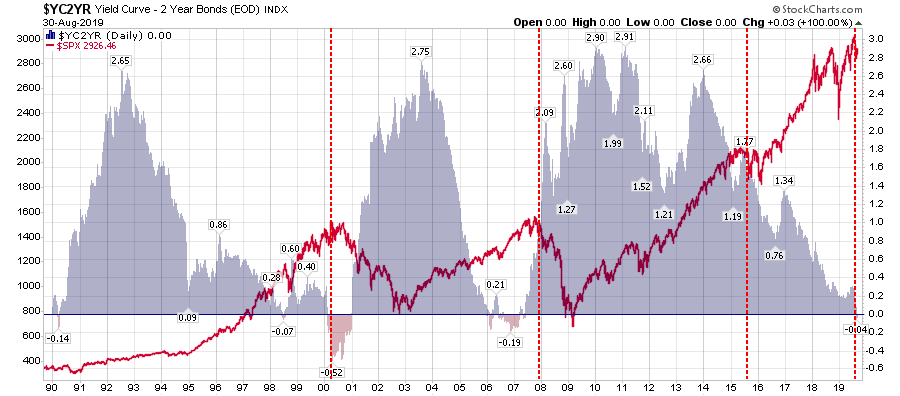

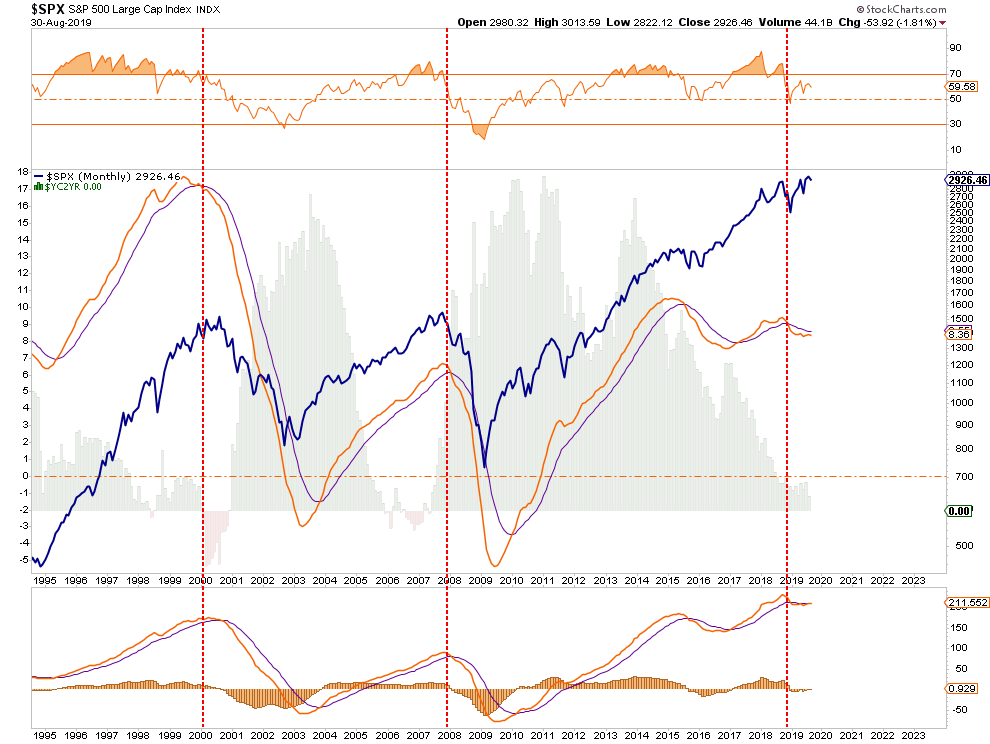

Investors should be very aware about the deviation in performances across asset markets. Historically, this is more of a sign of a late-stage market topping process rather than a “pause that refreshes the bull run.”

This is particularly the case when this crowding of investments is occurring simultaneously with an inverted yield curve.

On a purely technical basis, when looking at combined monthly signals, we see a picture of a market in what has previously been more important turning points for investors.

Sure, this time could turn out to be different.

Since I manage portfolios for individuals who are either close to, or in retirement, the risk of betting on “possibilities,” versus “probabilities,” is a risk neither of us are willing to take.

Let me restate from last week:

“Given that markets still hovering within striking distance of all-time highs, there is no need to immediately take action. However, the continuing erosion of underlying fundamental and technical strength keeps the risk/reward ratio out of favor. As such, we suggest continuing to take actions to rebalance risk.

-

Tighten up stop-loss levels to current support levels for each position.

-

Hedge portfolios against major market declines.

-

Take profits in positions that have been big winners

-

Sell laggards and losers

-

Raise cash and rebalance portfolios to target weightings.

We are closer to the end of this cycle than not, and the reversion process back to value has historically been a painful one.”

Remember, it is always far easier to regain a lost opportunity. It is a much more difficult prospect to regain lost capital.

Posted by Maddog

@ 16:10 on September 3, 2019

plus, the only reason that Gold is being held @ 1 %, is because the scum are selling like mad, so somewhere the short position just grows and grows and not by any small amount, looking at Volumes, it is growing at a massive rate.

Posted by Richard640

@ 15:54 on September 3, 2019

something has. changed and they. can’t. put. the horse back in the barn…I. dunno. where the lightning’s. gonna. strike…or how or. when…but there are. 3 more. reports to get through this week…I got a feeling gold could suddenly come alive…

I may have missed a mention here or. there but there seems to be a total blackout–

of PM coverage on the 3 Biz stations. I”ve checked CNBC and FOX Biz on the hour and half hour…the floor reporter when. showing the. few. winners has not mentioned any PM stocks or ETFs…The HUI is disappointing today—going after. PM. stocks/etfs. is. a familiar gambit when. they can’t control. the Comex prices—this is. a very busy data week—so anything can happen—gold. and silver are. very well bid—so. I. would not be. surprised. to. see another. big up day some time this week…there are 2 more big reports also…could get wild—I am amazed that NO ONE on TV has mentioned. silver today

All the guests on TV are calm and recommend. buying any dip…PM stocks could catch. fire…I reduced my positions a bit today but will still hold a core…

Posted by Buygold

@ 15:51 on September 3, 2019

One thing I do like is that we have had pretty good closes for the last few months.

I think the action in the shares sucks compared to the metals but they could be hitting us a lot harder into the close and they would have in the past.

Posted by Maddog

@ 15:41 on September 3, 2019

Posted by Buygold

@ 15:40 on September 3, 2019

yeah the t/a types will call it resistance, but it looks like plain old controlled algorithm selling to me. Funny thing is that there are a few stocks that are screaming higher like they should be, EXK, AXU for example.

Unfortunately not all boats are being lifted as they should be with the exception of the hedgers.

So we wait for the beach ball to explode. It’s coming.

Posted by Maddog

@ 14:54 on September 3, 2019

to try and the Algo’s to run the SM/Dollar up, etc …

Posted by Maddog

@ 14:47 on September 3, 2019

It’s the same old scum games…..Gold is up 10 bucks from the share openings and Silver is plus 30 cents, yet most of the shares are Unch from where they opened to plus a bit.

Posted by Buygold

@ 14:40 on September 3, 2019

are definitely trying to turn most of these shares into the usual shit show.

Except for a few of the silvers.

Posted by Maddog

@ 14:26 on September 3, 2019

NEM and PAAS under the scum cosh…slowing Hui down today…..same Old games plus they are holding spot AU @ + 1 %…

Posted by treefrog

@ 14:18 on September 3, 2019

somebody definitely has their thumb on the scale with the hui.

Posted by Captain Hook

@ 14:06 on September 3, 2019

Ya we could be setting up for a little break with the GSR essentially at 80 and many other key measures stretched.

We want strong monthly closes anyway so a break into mid-month works for me.

The Employment Report routine is coming up anyway, so this is to be expected.

Today is unexpected and I’m happy to see it.

The price managers double speak narrative is breaking down with all the weak stats coming out having low rates already.

Cheers

Posted by Maya

@ 14:02 on September 3, 2019

The Silver Streak! The Burlington Zephyr out of the museum

for a cruise.

https://railpictures.net/photo/703621/

Posted by Richard640

@ 13:47 on September 3, 2019

they can’t turn the comex but they can program their algos to sell PM stocks/etfs…that said, G&S may be kicking off an impulsive move today…if that. happens then PM paper could go ballistic too…there is a strong bid under PMs but it’s not mentioned much on the TEE VEE….and shoe shine boys and sophisticates at cocktail parties aren’t bragging about their gold stocks yet.

![[Image of cumulative wind history]](https://www.nhc.noaa.gov/storm_graphics/AT05/refresh/AL052019_wind_history+png/212619_wind_history.png)