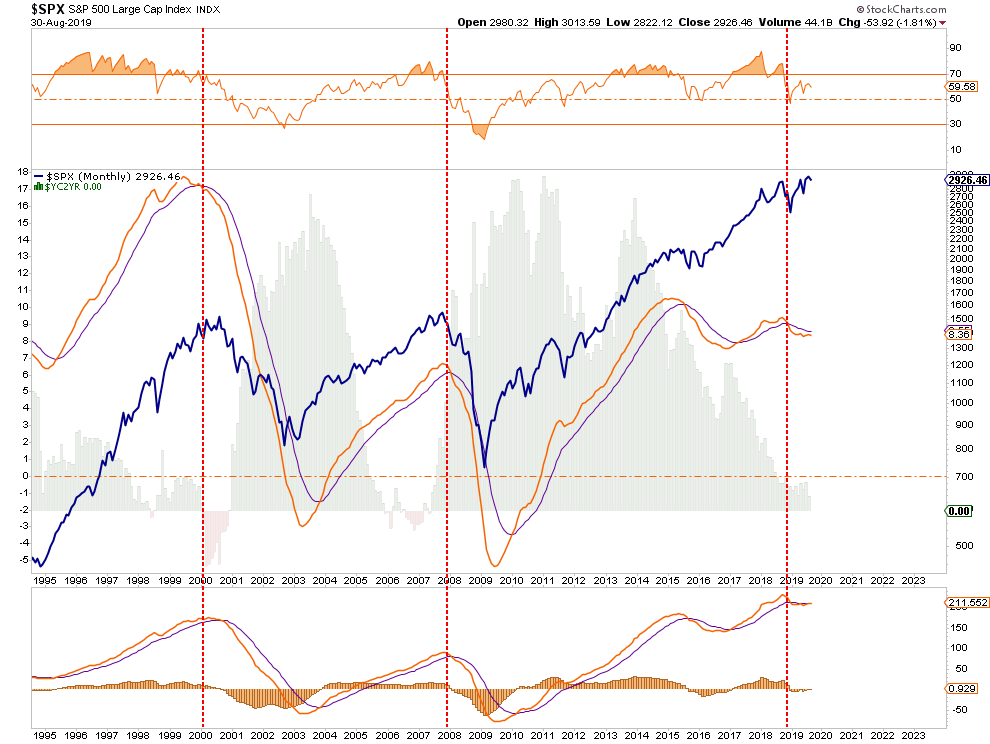

Investors should be very aware about the deviation in performances across asset markets. Historically, this is more of a sign of a late-stage market topping process rather than a “pause that refreshes the bull run.”

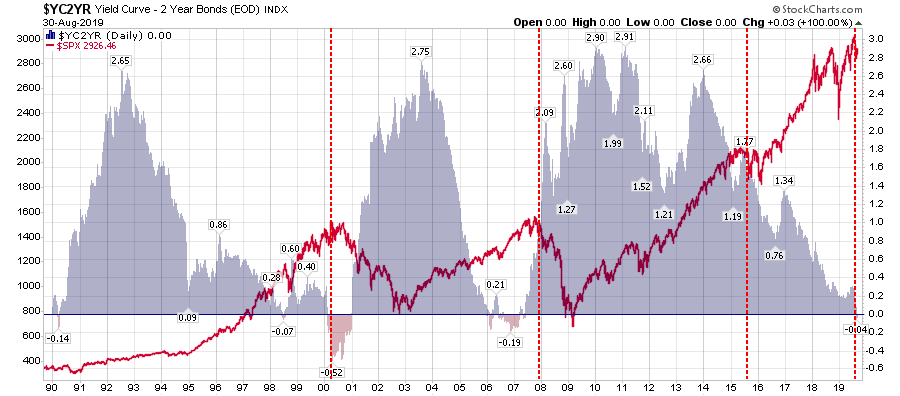

This is particularly the case when this crowding of investments is occurring simultaneously with an inverted yield curve.

Sure, this time could turn out to be different.

Since I manage portfolios for individuals who are either close to, or in retirement, the risk of betting on “possibilities,” versus “probabilities,” is a risk neither of us are willing to take.

Let me restate from last week:

“Given that markets still hovering within striking distance of all-time highs, there is no need to immediately take action. However, the continuing erosion of underlying fundamental and technical strength keeps the risk/reward ratio out of favor. As such, we suggest continuing to take actions to rebalance risk.

Remember, it is always far easier to regain a lost opportunity. It is a much more difficult prospect to regain lost capital.