Agreed. The USD ” should” have a bit to go yet and we’ll see how PMs and everything else reacts once its next target is hit. Not the only thing to look at but when buisy the fastest. Banks too but more complicated,

Oro 16:20

OAC is just a parrot with less brain cells or personality. She thinks it worked for the rest so she just follows. She probably knows being a parrot with no forethought to the consequences is what got her in so she’s gonna just play along.Same party that called Trumps not qualified? A parrot has more qualifications than she does.

So far what has she done except drive Amazon and a billion dollars a year out of her state.

Do the voters in her state have any clue or got the memo with the ding bats like Pelosi and what happened to California being voted the most hostile state for business or the homelessness on the streets including veterans and now seniors.

The Last Straw – New Episode

https://intellectualfroglegs.com

Intellectualfroglegs. Click home.

Gartman

We are simply in a brand new Intermediate Down cycle…just 4 days old. A very short Int. downcycle could be only 7 or 8 weeks in duration but, most go over several months. We could easily end up giving back 50% of the prior upcycle gains. Dead Cat bounces and cycle reversions are normal but, the bloom is off the rose already. Gartman is loading up long right now which proves that he really has not a clue. Beware and as Clive has stated: Protect Yourself.

Wow Gartman in, Bolton out???

I never thought I’d see the day! Although Gartman on our team does make me a little nervous…

If you think about it, Trump might be the only president in the last 20 years that hasn’t actually started a new war.

No wonder the media and deep state hate him so much.

Quant Quake Goes Global Amid Momo Meltdown, Bond Bloodbath

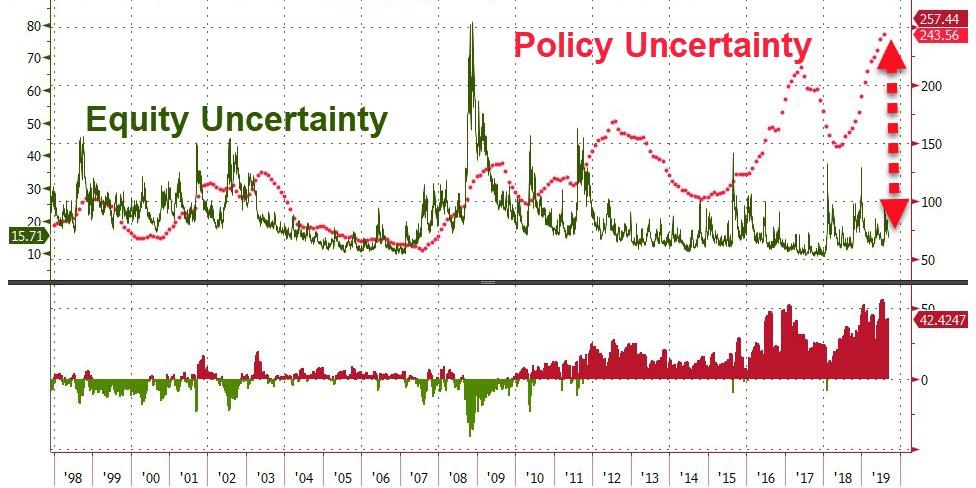

y, while policy uncertainty has hit record highs, equity market uncertainty remains delusionally low…

Source: Bloomberg

But the yield knows better what is to come…

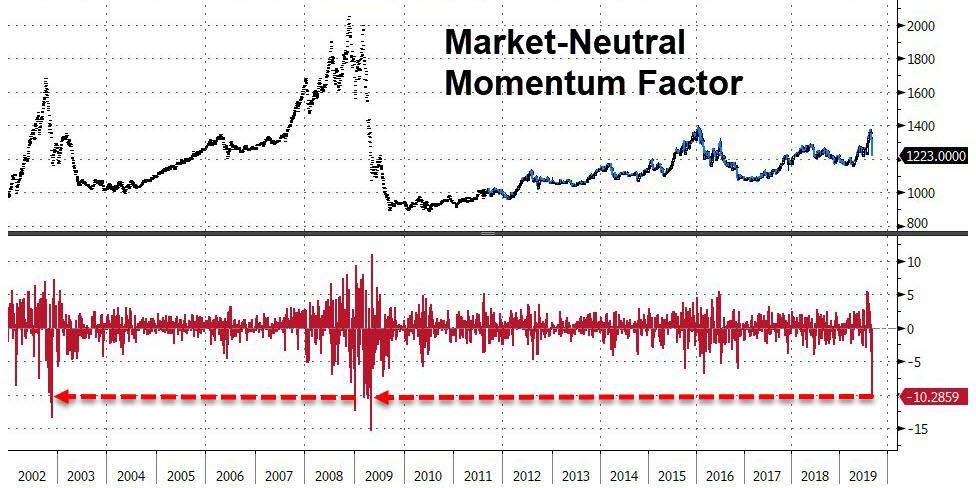

This is now the biggest collapse in the momentum factor since the dot-com era and the financial crisis quant crash…

Source: Bloomberg

How long before this weighs more directly in the broad index?

Source: Bloomberg

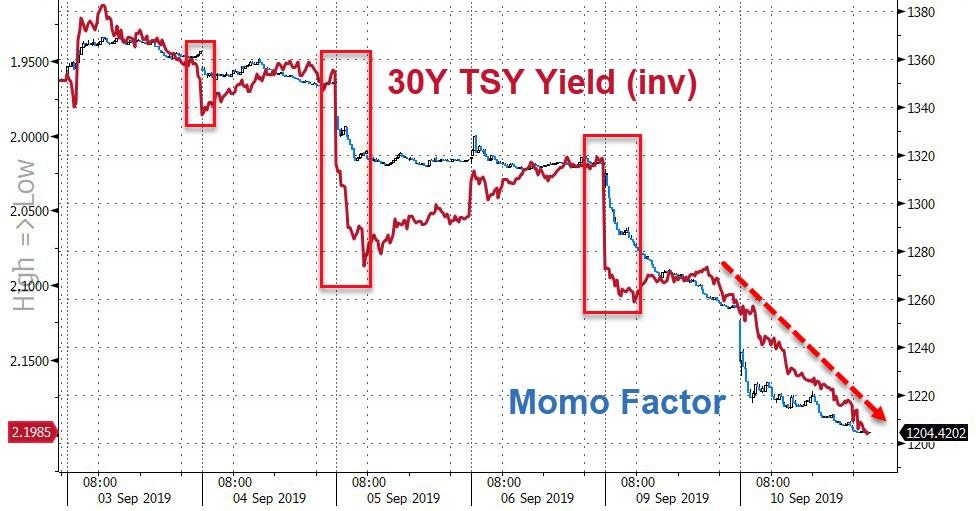

And as momo collapses, Treasury yields are soaring as CTAs are forced to dump bonds…

Source: Bloomberg

: Bloomberg

He’s been right for a while….

*Dennis Gartman…

what has our attention is that the volumes transacted in the futures market has plunged as prices have fallen. That we see as demonstrably bullish news!

we are still aggressively long of gold but as the rallies in gold and silver on Tuesday of last week had reached seemingly stunningly overbought levels, we cut that position back a good deal. We began buying back which we had sold Thursday of last week and we bought more on Friday and we bought back a bit more yesterday and are now almost as long as we were at our peak.

Ocasio Cortez is so “SURE” about what she knows on impeachment, but

,but as Reagan said “what she ” knows ” aint so ” ..

puptent @ 15:55

RE: KL I don’t own it but from all I’ve heard they’re a class act, a real money making machine. From a glance at the chart I’d guess most of the owners are happy campers.

DYOD

Ororeef-Thanks-u. made my. day–the usual chaotic trading today in the stock mkt-a sign of the end-

The rivets. are popping out of. the superstructure–the trannies up 137 and russell up 14…these are NOT bullish divergences…they are signs of desperation…to believe that the old sustainging narrative is still valid…it isn’t…

Does any one have an opinion on KL

Just asking

cheers

puptent

Want you to know I have often thought of wanka

My news is my ex husband passed and left me some money Now I can really invest.

i don’t see farm boy around

Comex silver reversal up

Comex silver traded to the 20 day moving average and bounced. Seems the gold/silver ratio is returning to sanity.

rno

WOW ! SOROS praises Trump!, I guess he’s not all BAD..

Left-wing billionaire and political donor George Soros wrote an op-ed for the Wall Street Journal on Monday in which he praised President Donald Trump’s policies toward China. He then urged Congress to maintain the president’s firm stand against Chinese telecom giant Huawei – overriding the White House if necessary, should Huawei become a bargaining chip in the larger trade war.

The leftist money man did not exactly shower Trump with praise in his op-ed. He portrayed Trump’s actions against China as the “greatest, and perhaps only, foreign policy accomplishment of the Trump administration.”

Soros, 89, lauded Trump’s policy as “coherent and genuinely bipartisan,” which necessitated ignoring a huge amount of Democrat partisan sniping at Trump’s position on China, coupled with fervent promises from most of the 2020 Democrat presidential field to undo those policies as quickly as possible if they win. Soros is one of the few prominent voices on the left to describe the trade war with China as anything but a disaster.

Good Article

Don’t buy GLD.

https://www.zerohedge.com/commodities/heres-every-reason-avoid-buying-gold-etf

He leaves out GLD buyers who buy calls looking for a bullish outcome screw themselves because the machines are programmed to exploit consensus no matter what the fundamentals.

That’s why shit on a stick can trade up to Pluto (because of put buyers — short squeeze) and gold is held back (because of the call buyers — no short squeeze — any market including gold needs a wall of worry to climb).

Of course I preached this for years about the ETF’s but the children don’t care.

Cheers all.

goldielocks @ 12:04 re: Bolton out

No matter what happens in the markets, today was a great day!

Looks like with Bolton and others

Are good warriors but status quo. War has its purpose or necessity when nothing else works but don’t know when to stop or try negotiations. Not that I have any hope for peace in Mid East and never will for women over there until they’re economys improves. As long as they’re using any money for terrorism status quo that’s not gonna happen.

John Bolton is out.

Disagreements with Bolton and Trump and other administration Trump asked him for his resignation.