Yep me too.

Richard

I was wondering about that when I heard people were demanding BiBi to do more about terrorism and accusing him of being too soft. Things always tend to swing too far one way or another. If Iran gets in it too Lieberman may get more than he asked for.

Thank you Mr. Lieberman?

Wow. God help us all.

Can only hope that someone grants the US the wisdom to stay out of the warmonger’s fray.

Get ready for. WW3=thank you Mr.Lieberman= But now Lieberman is in the catbird seat, and that means that Gaza is about to get flattened.

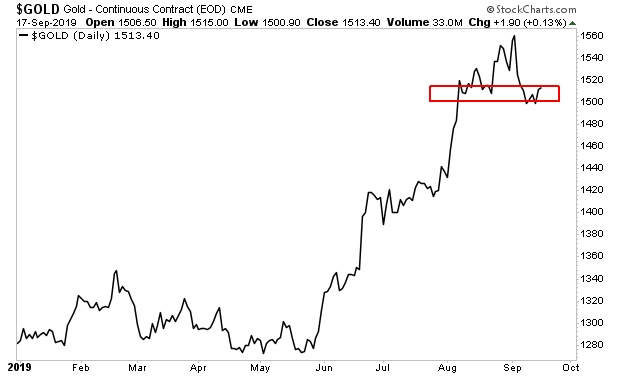

I like this lower chart from Phoenix Capital, don’t you?

Gold is currently taking a breather after one of its largest rallies in decades. As I write this, the precious metal is consolidating around support in the $1,500-$1,520 range per ounce.

The question now is what comes next?

For that let’s turn to the long-term charts.

Gold has been forming a massive triangle pattern over the last 15 years.

More from Denninger=Lehman, about a month before it blew up, did exactly this with a tri-party Repo with Citibank at the NY Fed.

I remind you that the Valukis Report disclosed that Lehman, about a month before it blew up, did exactly this with a tri-party Repo with Citibank at the NY Fed. They attempted to present collateral, were told to **** off by Citi which didn’t like their collateral, were asked what else they had and their response was NOTHING.

From that INSTANT forward both The NY Fed AND Citibank KNEW, at a matter of fact, that Lehman was insolvent. It did not have good collateral sufficient to back it’s ordinary OVERNIGHT liquidity requirements! Yet that FACT was not disclosed to the general investing public and NOTHING was done about it either, despite that factual knowledge — until Lehman finally collapsed. Well, except for all those who I presume WERE trading on that information.

These Repo transactions are ordinary, every-day commercial balancing transactions — they take place to balance the reserves and free cash among financial institutions in the ordinary course of business. They normally trade right near or at the overnight FFR because the collateral posted consists of either government or agency securities, the term is typically one day and thus the risk is very nearly zero, and the reason they’re undertaken is that funds move from place to place in ordinary commerce and financial institutions must maintain their cash liquidity levels at mandated amounts.

the claim being run about a “dollar shortage” leading to the repo market spasms is a bald-faced lie

[Comments enabled]

in Editorial , 228 references

[Comments enabled]

ZH-NY Fed to conduct third consecutive Repo Operation tomorrow at 8:15 EST

Don’t worry, everything’s fine. Powell said so.

Re: goldielocks @ 16:49

From what my old brain remembers, Obama was returning Iranian funds previously frozen by the US.

Buygold 16:35

I agree, both countries support terrorism that can affect us as well as others. Peace talks should be first. If Obama had a clue he should of negotiated sanction over PAYING them. That just creates hostage situations. He just created more problems that we have to pay leaders not to start up wars. Then next was North Korea sending out rockets expecting money too but by then Trump was in giving sanctions instead.

Iran would surely attack Israel too.

Negotiations lightening up on sanctions instead.

R6 – Concur with this statement…

“so the bottom line for gold was the initial statement at 2pm was a “hawkish” 1/4 pt cut….then he very sneakily negated that stance. at the press. conference…so no more rate cuts thru 2020. is just B.S….gold should be fine”

Anyone who bought this and the fact that QE isn’t coming before year end has completely lost their minds. The only thing they did today was try to appear not to have caved to Trump. Most of them are Libtard Academics that hate Trump.

If Obama was President, rates would’ve been cut but .50 today and QE announced. They are going to make the markets force their hand, by then it will be too late.

R6, Maddog

Powell actually said today the Fed may need to expand their balance sheet sooner than expected – I think that’s a nice way of saying more QE is coming sooner rater than later.

Iran is Saudi Arabia’s problem. The house of Saud is getting their asses kicked in Yemen. Their problem. Now if Israel wants to join the fray. God bless em’. I just don’t want US troops in another quagmire in the M.E. That’s the one thing Trump has prevented us from doing so far – that he promised. We’ll see if the Neocons pressure him into another major war. You probably will get your wish.

Other than the last 10 minutes this wasn’t a horrible day. We’ve certainly seen worse in pm’s from lower levels. If the Fed has more overnight Repo problems tonight they’ll have a helluva time glossing over them

The $’s up .335 but should not be a deal killer for gold–tonight. could be wild…I just can’t believe stocks

have a green light to go straight up for the next 2. yrs…izzit quad witch friday? If stocks come in down 400 on the dow in the morning…things could get wild…

Maddog–u got it. right, bro! Iran is now OFFICIALLY THE NEW NORTH KOREA

with the same shenanigans, bullying and manipulation–it. doesn’t need nukes-as I have said a zillion times, I. ran can wipe out Israel. in 5 minutes just with their conventional weapons=1000s of missles, drones-cruise missiles etc….at least a million would die inan all out war with iran

They seized on one line at the press conference and stocks are all the way back…but they can’t let gold come back today

Maybe tonight…silver’s starting to come back nicely that’s been the lead mule lately…still…it’s the. same routine…I thought gold was done. with that…we need. that sponsorship to come back…it’s so obvious…stocks coming. back gave the “all clear” signal that “it” was all good…what a farce…I picked. up 300 calls. about. 1/2 an. hour ago on SAND-the Oct 18 $6’s…paid 15 cent…so the bottom line for gold was the initial statement at 2pm was a “hawkish” 1/4 pt cut….then he very sneakily negated that stance. at the press. conference…so no more rate cuts thru 2020. is just B.S….gold should be fine

So Iran can literally take out the opposition

in an act of war and that means nothing to the PM mkts…Gold is now $3 Cheaper than Fridays close….

If nothing happens soon, then the Donald is a paper tiger.

The mkts are now mad, as this news is way bigger than any Fed talk…yet tks to the scum..nothing happens…

Aramco Attacks An “Act Of War” By Iran: Pompeo After Arriving In Jeddah

https://www.zerohedge.com/geopolitical/pompeo-saudi-arabia-aramco-attacks-act-war-iran

Same BS

Every time……

classic scum hit

I wonder how those JPM traders feel, watching this crap…they stand accused of rigging the mkt, while the scum do it day in day out.

When was the last time we had a Fed announcement, that did not get sold in PM;s…it is 100 % of the time…u gotta wonder what the deal is..though my wife reckons they have been told, take the hit, or u swim with fishes.

Oh dear now we got problems the SM is cratering…so PM’s gotta be killed, as well….of course the miners were the tell…so another ripping day for GS and JPM.

TREE–I. said earlier that this rate cut was the most expected/discounted one in a long time…

but looking. at bonds especially…and the trannies don 190…and the HUI down 1.73. with gold up $3…I gotta think we see an extreme reaction–either at 2pm or after the 2:30 press conference…my bets stocks start a down sequence and gold possibly have a big jump

Hey treefrog

with 5 minutes to go I can say I’m “braced” but never quite ready for what happens.

Usually the outcome is not good, but times may or may not be changin’

fed announcement coming up

is everybody braced for an abrupt move up, down, or sideways?

…or some combination?

Maddog, R6

Maddog – ZH has another article that discusses the Fed may announce QE today but describe it as Permanent Open Market Operations (POMO) rather than say QE that may panic the markets. I’d think if they use that POMO language we’re going to see some pretty good volatility after the announcement. I’d also expect Powell will get some questions about the Repo activity of the last two days in the Q & A. Hope he’s prepared to tread lightly.

R6 – Looks like they are shaking the pm tree prior to the Fed announcement. Either someone knows something or they are giving themselves some room to cover. I’d almost prefer to see a pre-announcement hit like we’re seeing now. But who knows?