Don’t worry, everything’s fine. Powell said so.

Re: goldielocks @ 16:49

From what my old brain remembers, Obama was returning Iranian funds previously frozen by the US.

Buygold 16:35

I agree, both countries support terrorism that can affect us as well as others. Peace talks should be first. If Obama had a clue he should of negotiated sanction over PAYING them. That just creates hostage situations. He just created more problems that we have to pay leaders not to start up wars. Then next was North Korea sending out rockets expecting money too but by then Trump was in giving sanctions instead.

Iran would surely attack Israel too.

Negotiations lightening up on sanctions instead.

R6 – Concur with this statement…

“so the bottom line for gold was the initial statement at 2pm was a “hawkish” 1/4 pt cut….then he very sneakily negated that stance. at the press. conference…so no more rate cuts thru 2020. is just B.S….gold should be fine”

Anyone who bought this and the fact that QE isn’t coming before year end has completely lost their minds. The only thing they did today was try to appear not to have caved to Trump. Most of them are Libtard Academics that hate Trump.

If Obama was President, rates would’ve been cut but .50 today and QE announced. They are going to make the markets force their hand, by then it will be too late.

R6, Maddog

Powell actually said today the Fed may need to expand their balance sheet sooner than expected – I think that’s a nice way of saying more QE is coming sooner rater than later.

Iran is Saudi Arabia’s problem. The house of Saud is getting their asses kicked in Yemen. Their problem. Now if Israel wants to join the fray. God bless em’. I just don’t want US troops in another quagmire in the M.E. That’s the one thing Trump has prevented us from doing so far – that he promised. We’ll see if the Neocons pressure him into another major war. You probably will get your wish.

Other than the last 10 minutes this wasn’t a horrible day. We’ve certainly seen worse in pm’s from lower levels. If the Fed has more overnight Repo problems tonight they’ll have a helluva time glossing over them

The $’s up .335 but should not be a deal killer for gold–tonight. could be wild…I just can’t believe stocks

have a green light to go straight up for the next 2. yrs…izzit quad witch friday? If stocks come in down 400 on the dow in the morning…things could get wild…

Maddog–u got it. right, bro! Iran is now OFFICIALLY THE NEW NORTH KOREA

with the same shenanigans, bullying and manipulation–it. doesn’t need nukes-as I have said a zillion times, I. ran can wipe out Israel. in 5 minutes just with their conventional weapons=1000s of missles, drones-cruise missiles etc….at least a million would die inan all out war with iran

They seized on one line at the press conference and stocks are all the way back…but they can’t let gold come back today

Maybe tonight…silver’s starting to come back nicely that’s been the lead mule lately…still…it’s the. same routine…I thought gold was done. with that…we need. that sponsorship to come back…it’s so obvious…stocks coming. back gave the “all clear” signal that “it” was all good…what a farce…I picked. up 300 calls. about. 1/2 an. hour ago on SAND-the Oct 18 $6’s…paid 15 cent…so the bottom line for gold was the initial statement at 2pm was a “hawkish” 1/4 pt cut….then he very sneakily negated that stance. at the press. conference…so no more rate cuts thru 2020. is just B.S….gold should be fine

So Iran can literally take out the opposition

in an act of war and that means nothing to the PM mkts…Gold is now $3 Cheaper than Fridays close….

If nothing happens soon, then the Donald is a paper tiger.

The mkts are now mad, as this news is way bigger than any Fed talk…yet tks to the scum..nothing happens…

Aramco Attacks An “Act Of War” By Iran: Pompeo After Arriving In Jeddah

https://www.zerohedge.com/geopolitical/pompeo-saudi-arabia-aramco-attacks-act-war-iran

Same BS

Every time……

classic scum hit

I wonder how those JPM traders feel, watching this crap…they stand accused of rigging the mkt, while the scum do it day in day out.

When was the last time we had a Fed announcement, that did not get sold in PM;s…it is 100 % of the time…u gotta wonder what the deal is..though my wife reckons they have been told, take the hit, or u swim with fishes.

Oh dear now we got problems the SM is cratering…so PM’s gotta be killed, as well….of course the miners were the tell…so another ripping day for GS and JPM.

TREE–I. said earlier that this rate cut was the most expected/discounted one in a long time…

but looking. at bonds especially…and the trannies don 190…and the HUI down 1.73. with gold up $3…I gotta think we see an extreme reaction–either at 2pm or after the 2:30 press conference…my bets stocks start a down sequence and gold possibly have a big jump

Hey treefrog

with 5 minutes to go I can say I’m “braced” but never quite ready for what happens.

Usually the outcome is not good, but times may or may not be changin’

fed announcement coming up

is everybody braced for an abrupt move up, down, or sideways?

…or some combination?

Maddog, R6

Maddog – ZH has another article that discusses the Fed may announce QE today but describe it as Permanent Open Market Operations (POMO) rather than say QE that may panic the markets. I’d think if they use that POMO language we’re going to see some pretty good volatility after the announcement. I’d also expect Powell will get some questions about the Repo activity of the last two days in the Q & A. Hope he’s prepared to tread lightly.

R6 – Looks like they are shaking the pm tree prior to the Fed announcement. Either someone knows something or they are giving themselves some room to cover. I’d almost prefer to see a pre-announcement hit like we’re seeing now. But who knows?

Trannies down 189–they are buying the sh*t out of bonds–sure looks like stocks want to go down–but they never do…quad or triple witch on friday???

During the last five trading days, volume in put options has lagged volume in call options by 43.88% as investors make bullish bets in their portfolios. This is among the lowest levels of put buying seen during the last two years, indicating extreme greed on the part of investors.

Last changed Sep 9 from a Neutral rating

Updated Sep 18 at 12:39pm

P.S. Stocks Bonds and Real Estate Have Gradually Evolved After 1913 To Replaced Money

Stocks bonds and real estate should be included in money supply. So, if everything is in reverse, those assets that are used as money, should gradually lose status or function of money. A store of value.

Buygold

yeah 2nd day and short dated Dollars are a mess….they were over bid by $ 5 billion, which means someone is short of $ 5 Billion….reading some posts. no-one has a clue as to why..as one said, is it 1 big fish like DB or are loads of fish in trouble…but trouble is what it is, seeing as this is the 2nd day and the amount has near doubled.

Richard640 @ 10:11 re Inflation

The result of inflation (increase in money supply) used to be called “Too much money chasing too few goods.” These days we have too much unspent excess unneeded surplus money, in the wrong hands, chasing too few US gov’t Bonds.

I think the massive inflation everyone talks about already happened gradually from 1913, the Dollar lost 98% of its value. If everything is in reverse, (my observation after the ’08 crash) maybe the its time for the US Dollar (and gold) MONEY, to gain value.

Maybe its time for all those long term Bond investors (and real estate investors) to get their teeth kicked in with higher rates. And have to hold Bonds to maturity to MAYBE get their money back?

Maddog

ZH all over the overnight Repo action again. They seem to sense something is breaking but you sure can’t see it in the stock market. Another day of smooth sailing courtesy of the algo’s.

Not really liking the action in pm’s even though gold is up a bit. Shares seem to be smelling a hit coming. Hope I’m wrong as always.

Gunfire a little unusual in these circumstances

Russia Detains Over 160 N.Korean Sailors After Attack On Border Patrol Boat

It’s the second major Russia-North Korea incident on the high seas in as many months: on Tuesday a clash between North Korean fishermen and Russian border patrol ships in the Sea of Japan ended in an exchange of fire and 161 North Koreans held captive.

The North Korean vessels, described as poachers given they were said to be fishing in Russian economic territory, were halted by Russian border patrol, after which one of the North Korean boats opened fire on the Russians, which wounded at least three border patrol guards.

First Pour

Victoria Gold: Eagle Mine’s First Gold Pour Completed on Tuesday, September 17, 2019

https://ceo.ca/@nasdaq/victoria-gold-eagle-mines-first-gold-pour-completed

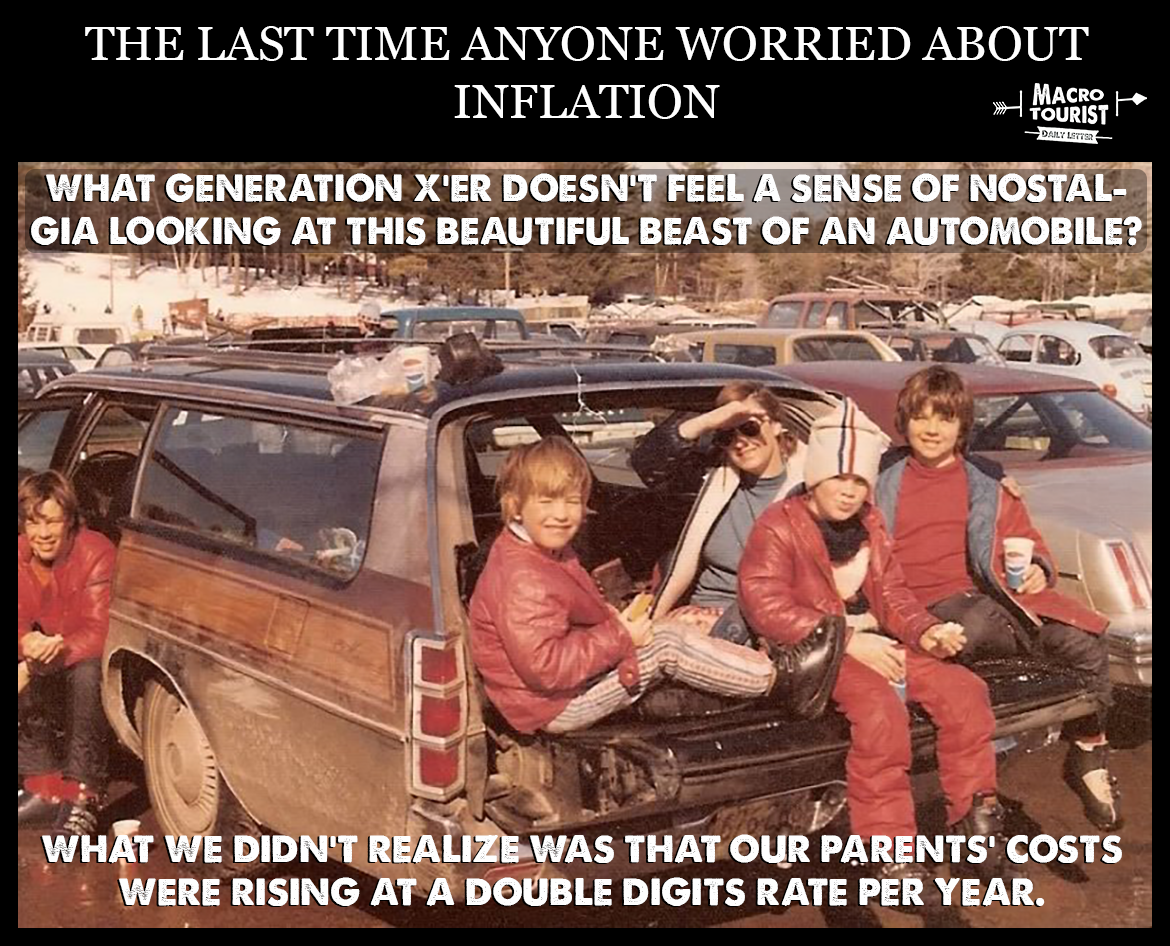

I believe the next great financial crisis will not be a deflationary shock, but a return of inflation no one is positioned for.

INFLATION BREAKEVENS: A CORE HOLDING

2019-09-18 9am EDT | #TIPS #inflation breakevens

I have an outlier view of inflation. Contrary to the debt-will-overwhelm-us crowd, I believe the next great financial crisis will not be a deflationary shock, but a return of inflation no one is positioned for. Don’t assume I am a hyper-inflationary doomsayer though. At first the inflation will feel great. It’s not until much later will it actually cause any real problems for the economy.

Don’t bother sending me chuffed emails about how inflation will never return in our current environment of the three D’s – debt, demographics and deflation due to technological innovation. I have heard them all. Your insistence they will overwhelm the financial system will only reinforce my belief that these worries are fully priced in.

And please don’t send me your philosophical arguments about how inflation is immoral and will hurt group blah-blah-blah the worst. You could be correct, but I am not here to decide what should be, rather what will be.

One of these days, society will wake up to the understanding that monetary policy is ineffective at kick-starting the economy and fiscal stimulus will begin in earnest. It will be effective. Too effective. For a variety of reasons it will seem like a free lunch…. at least for a while.

Now don’t get me wrong. It will be abused. Just like monetary policy has been abused (negative rates throughout much of the world is an abomination we should be ashamed of), fiscal stimulus will be taken too far.

Right or wrong, that’s my call. You might debate different points, but I believe a return of inflation is the best long-term macro risk reward trade out there. Hands down. No other trade even comes close to offering this payoff asymmetry.

Yet how do you play it? What’s the trade that will benefit if I am correct?

https://www.themacrotourist.com/posts/2019/09/17/breakevens/