|

||

|

||

|

To short. or not to. short, that is. the question.

Mr Copper 12:30 Sept 27

Good post. Something to educate the people especially young who never knew a good economy.Post war didn’t end for us. Now pulling a blanket over their eyes with lying to them the reason jobs are going is environmental. Without the concept of what it means to them because the young never saw them. Now they see fast food chains. Since a war we didn’t even want Europe couldn’t contain their own rogue enemies were now expected to fight the majority of any future conflicts to infinity. While we bury our soldiers who have no jobs to go back to they send their kids to college. They still have their car manufacturing too.

Elon

This is wild stuff, check out the video below. Try the full-screen button on the lower right hand of the video player.

Got oil? Got gold?

“If in the next wave of drone attacks 18 million barrels a day of Saudi crude are knocked out, it would represent a catastrophe of epic proportions. The US does not want the Houthi to believe that they have such power through such fourth generational warfare as drones that cannot be defended against. But they do. Here is where a tiny country can bring down not only a Goliath such as the US, but also the whole world.”

“It would not be possible to bring Iranian crude on line for the world to replace the rest of what was destroyed,” said one.

https://www.zerohedge.com/geopolitical/escobar-how-yemens-houthis-are-bringing-down-goliath

R6 – Re: Morris Hubbart

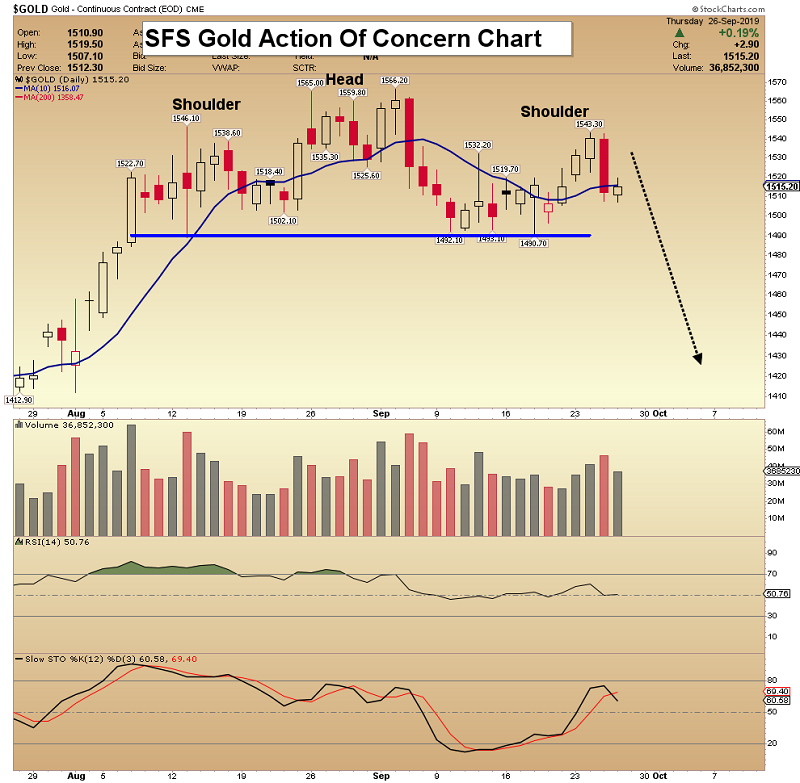

Certainly the table appears to be set for the pm bears when it comes to gold, silver and the shares.

COT’s are unbelievably bearish when it comes to gold and silver. The fact that the HUI didn’t even eclipse the highs from 2016 is pretty concerning. Almost reminds me of 2011 when gold made new highs, but the HUI did not.

Pretty concerning.

Not sure if I hope all those folks hoping for war with Iran and the end of days get what the are hoping for, but it’s definitely out of our control. They all gotta do what they gotta do. I’d like to see my kids live to see a better world, but I have my doubts.

Ha Ha!! LOL!!!!! Lotsa fun on. ZH today-The Israel. haters. are. swarming. all over. an article about Israel bombing Iran forces in Iraq-I finally found one pro-Israel post

But I am sure you love Jewish technology. On the verge of cures for cancer and AIDS. That’s the Jews. Inventors or high tech non-invasive medical equipment. That’s the Jews. Inventor of many of the software and hardware that goes in your phones and computers and devices. Yup, that’s those horrible Jews. On the cutting edge of agriculture technology. Yup, that’s those horrid Jews again. Inventors of technology that increases efficiency of electrical transmission by more than 30% and which nearly every country in the world uses. Yup, it’s those Jews again causing trouble. Oh yes, and all those safer drugs that have been invented by Israelis to cure all sorts of diseases. Those Zionists are up to their evil.

And don’t forget how the Israelis were the first to set up a field hospital in Haiti and the last to leave after the earthquake. Same in Nepal. Those nasty Jews…

But those wonderful Arabs and radical Muslims have been lovingly spreading terrorism, peacefully raping women, delicately using children and civilians as human shields, gently enslaving Africans and Asians, democratically insisting that their women wear hijabs or else they will considerately stone them to death; and in an entrepreneurial spirit, selling children and women as sex slaves. Now that is a list of benefits to humanity that the Arabs and radical Muslims can be proud of.

Got to just love your lies, don’t you? And to think that less than 2/10,000th of 1 percent of the population are your masters shows how weak your thinking is. And how weak you are. Now you can crawl back to the sewer you were born in.

America and the Middle East

Pento intervie=when we have the next recession=we are going to go from $1 trillion to 3 trillion. $3 trillion of deficits every year

Well, let’s just go over a couple of things you said there. So, candidate Trump said he was going to pay off the national debt. And let me caveat this by saying that I voted for President Trump. I think he’s infinitely better than what we have to face possibly in November of next year. But candidate Trump said he was going to pay off the national debt, which was under $20 trillion is like $18, $19 trillion at that time. It’s now $22.5 trillion.

So, not only did we not pay off the debt, we’ve added to it, and we’re adding to it now at the pace, as you correctly point out, of over $1 trillion per annum. And this is when the unemployment rate, Mike, is at multi-decade lows. And when we have the next recession, when the automatic stabilizers kick in, welfare, food stamps, unemployment insurance, =. And that’s assuming that the interest on the debt stays quiescent. So that’s a pretty big assumption, by the way, so we could be adding close to 15% of GDP, 15% of GDP per annum to our national debt. That’s how scary things could be.

And who’s going to buy all this debt? And at what interest rate? We were talking about repo market before, banks are loaded with Treasuries. By the way, these treasuries have a zero risk rating in the capital ratios. That’s how they’re calculated. What happens when these Treasuries really tank in price, what happens to the bank solvency? So, that’s a big question for us.

You and I talk about things all the time about how awkward and how tenuous and fragile the global economy has become. But so far, it hasn’t really become acutely manifest other than we had that little slight hiccup. We had one in 2016, we had one at the end of 2018, but central banks are doing something. Global central banks have printed $22 trillion worth of counterfeit money in the past decade to re-inflate asset prices and try to make the massive $250 trillion global debt pile serviceable. That’s a tremendous amount of printing to paper over what’s really going on in the world.

Let me repeat that. $22 trillion worth of new money, of fiat paper, has been created in the past decade. Think about that.

https://www.gold-eagle.com/article/michael-pento-scary-warning-signs-cash-funding-markets

They’re blocking this on FB. Clobes Pushes pharmas on damage control. Someone managed to get it posted from another site.

It kept saying it goes against their community standards. So much for their community standards. Paid for by pharma?

Catie Clobes’ Story Drives Big Pharma’s Hit-Squad Into Damage Control

@Richie

Your posted Gold charts, look almost the same as US Dollar charts below.

Have some poison with your Joe? That damn glyphosate is everywhere these days.

Nestle Steps Up Testing After Finding High Levels Of Dangerous Weedkiller In Coffee Beans

Iran

The attacks in May and June on Gulf installations and shipping were the first shot across the bow. The downing of a U.S. drone was another step up the ladder of escalation. These larger attacks are the third step. So far the attacks have drawn no significant retaliation against Iran and also no breakthrough on their goal of lifting at least some sanctions.

President Donald Trump is in a very difficult position, largely of his own making. He signaled a great reluctance to retaliate or escalate after the drone downing, and later fired his hawkish national security advisor, John Bolton. These are likely seen in Iran as signs of weakness, which in a sense they are, and encourage further escalation.

Trump and Iran have each other over barrels. Trump’s sanctions are badly hurting Iran, and their escalation is putting enormous political pressure on him.

If he does nothing, the Iranians will keep raising the temperature and oil prices will steadily edge upward, impacting his reelection campaign. If he retaliates militarily, the Iranian Revolutionary Guards will take the blow and then have license to stage a larger counterstrike in the Gulf, driving oil prices more steeply upward. If Trump concedes and extends waivers or suspends a few sanctions, he might defuse the crisis, but he will look very weak politically.

What he is trying to go for is a quick photo-op negotiation in which Iran gives some minor concessions on sunset clauses and perhaps the range of its ballistic missiles, and he can relievedly announce the lifting of at least some sanctions, and trumpet the “Trump Deal” over the terrible Obama one. So far, the Iranians are playing hard ball and not offering him that off ramp. Indeed, Iranian hardliners might not even want to offer Hassan Rouhani and Javad Zarif that off ramp.

But there is a deal that can and should be made, at least to ward off a ruinous escalation between now and the U.S. elections in November 2020. The Iran issue will be on the desk of the next president, whether it’s Trump 2.0 or a Democrat.

Gold Stocks: An Evening Star Kills The Rally

Here are today’s videos and charts. The videos are viewable on mobile phones as well as computers. Double-click to enlarge the charts.

https://www.gold-eagle.com/article/gold-stocks-evening-star-kills-rally

Silver Train

The Coast Starlight, coming ‘round the mountain

on Cuesta grade, into San Luis Obispo

https://railpictures.net/photo/708522/

Samb

Close below $1485 on December Comex gold confirms correction.

rno

Oh Well

Gold 1495.90

Silver 17.50

Message to the banksters.

Samb @ 17:41

Thanks for the reply. Sounds reasonable.

For me I guess I’ll just stand pat full long. You never know when some economic land mine will change all.

Plus it seems to me the metals did great in this last run up when the SM was falling. The PM shares were winners too at this time.

Cheers

Ipso @ 14:44

Yes, The shortest Int. Cycle that I can recall over so many years came in after only 7 weeks but, that was a one time outlier. Two months would bring us to early Nov…that would still be quite short in time for this downtrend to end. I don’t try to say how long in time or deep in price because then I would then only be guessing.

We have many options on how to play these corrective downtrends. You can simply stay with Buy and Hold because in a major Gold Bull you will eventually be rescued even if you had bought at the very top of the last cycle.

Far better would be to sell some and rebuy at the next Int. low providing you have some decent trend reversal signals. What I did was to buy DUST. Some prefer PUT options but, I prefer the 3x ETF’s as I am then not so concerned with time erosion. We might get off easy this cycle in terms of both time and price…Who knows? I just won’t assume the best happens.