Because things are so good …

Moody’s downgrades Ford to ‘junk’ status on weak outlook

https://finance.yahoo.com/news/moodys-downgrades-ford-junk-status-weak-outlook-210253793.html

Vote in the Poll Vote in the Poll

Vote Vote

Maya did your new PW work?

If not contact me at the address, bottom of the right panel.

Spot back below $1500 and $18

but futures still trying to hang onto the round numbers

Shares don’t look horrible pre-market.

Hey Puptent

Good to see you back!

I never protested ..is it too late to start now ? All are wearing Masks ,Hoodies and using umbrellas to mask identifying themselves from cameras…..maybe I need to invest in umbrellas !

Hong Kong Official: Young Girls Offering ‘Comfort Sex’ to Protesters

Morning puptent

yes, course we remember. Welcome back!

We’re all waiting to see what happens as well. Some claim to know. Articles from guru’s get posted who claim to know.

I think most of us are just hoping we bought gold and silver for the right reasons and held for those same reasons over the years.

Richard640 @ 8:30

No worries.

We have another rate cut next week to remind people just how F’ed things are under the hood of this dilapidated ’57 Chevy.

Cheers

Aguila-I woke. up at. 4 am and checked G&S-

The DOW was. down 91–G&S had come waaaay back from over nite lows–yields were lower–now they’ve turned it all around…

taking another look at. silver…I see a “parabolic” move…I. can’t help but speculate: could that. be a blow off top? Parabolic moves are often retraced. 100%….Nah! Impossible…or. Izzit? Now all the mainstream funds, banks, etc are. on board the. “gold bull”…they weren’t even looking at it 2 or 3 months. ago…yesterday Citibank said gold could go to a new high over. 1900…

If he be right=good news for gold

|

||

|

||

|

Now I don’t feel so bad.

Sold some last week and just waiting. I’ll decide later if I should of sold more or wind up taking a small loss buying it back depending.

Puptent

I remember you. Gold has been going up, hit its first target. Hopefully it will also hit its next.. before a couple of years from now anyways so I’m watching.

Treefrog,you get around. First thing I thought before I read your post is where is that dogs little boots. You know they have designer cloths for those little ones.

two fools and a dog on a glacier in wyoming

ms spot pucci says, “all right already, take your stupid picture and let’s go! you guys have shoes but i’m barefoot. this white crap is COLD!!”

The boyz finally got the metals down below 1500/18.00 !

It’s only temporary my tent friends — We know what will happen, we just don’t know when. It’s so revealing to see the scumbags breaking the law without any fear of retribution.

Puptent welcome back.

Hi gang. Don’t know it you remember me

Thanks fully for renewing my membership. Now that gold and silver are going up I want to read what the tent has to sat

cheers

puptent

Clive Maund

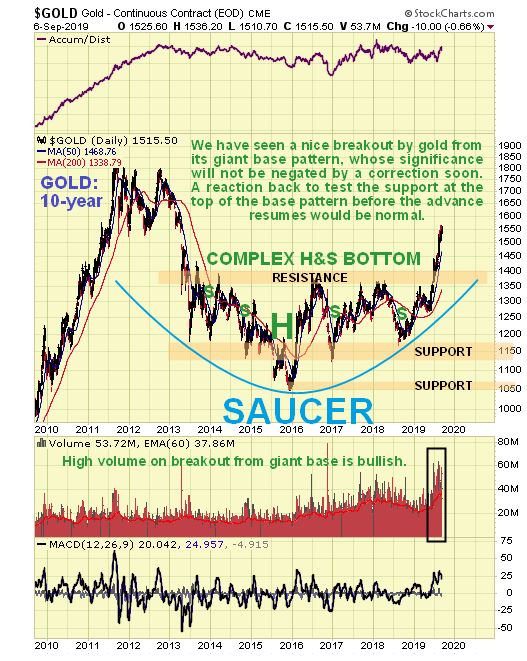

Starting with gold’s 6-month chart, we can see that it doesn’t look too bad – yet, but if we look more closely we can see that it is on the point of breaking down from the rather steep uptrend in force from late May, with it having dropped back on quite high volume the past 2 trading days, and it is noteworthy that Thursday’s drop was the biggest 1-day drop for a long time, making it more likely that it signals a reversal. In addition, the MACD indicator shows that momentum is starting to flag

So, how far could gold react back? It happens more often than not that after a price breaks clear out of a giant base pattern, as gold did from its giant complex Head-and-Shoulders bottom or Saucer base shown on our 10-year chart, that it then returns to test support at the upper boundary of the base pattern before turning higher again. That could happen again and it would throw a lot of investors in the sector who are now of the view that we are “off to the races”. So, if it does react back that far don’t be dismayed – on the contrary it would throw up one last great buying opportunity

So, how far could gold react back? It happens more often than not that after a price breaks clear out of a giant base pattern, as gold did from its giant complex Head-and-Shoulders bottom or Saucer base shown on our 10-year chart, that it then returns to test support at the upper boundary of the base pattern before turning higher again. That could happen again and it would throw a lot of investors in the sector who are now of the view that we are “off to the races”. So, if it does react back that far don’t be dismayed – on the contrary it would throw up one last great buying opportunity

We have had a rather unusual situation in the recent past where the dollar and the Precious Metals have been strengthening together. This is because, in a risk off environment both have been considered safe havens. In a risk on environment this logic works in the other direction so that the dollar and the Precious Metals may both react back together. On the 3-year chart for the dollar index we can see that it is at a good point to turn lower, despite its still bullishly aligned moving averages, as its persistent gentle uptrend has brought it up to the significant resistance level shown.

https://www.kitco.com/commentaries/2019-09-09/Gold-market-update.html

A. promise is a promise, Bill-and I’m gonna hold. u 2 it-!!

Biggest Inflation in the History of History Coming – Bill Holter

Holter says a failure to deliver is not a maybe but a sure thing. Holter says, “Whether it is this year or the first few months of next year, it doesn’t matter. It is going to happen.

***********************************************************************

Holter is warning of a failure to deliver metal because demand is out-running supply. Holter says, “So far, this year . . . for gold, they have already EFP (Exchange for Physical) 4,200 tons just for the first eight months. . . . They don’t have the inventories to deliver. . . . The point being that is 4,200 tons in eight months. The world only produces 3,300 tons (of gold a year) and if you take out Russia and China, which do not export (gold), the whole total for the year is 2,800 tons. So, it looks like we are going to end up with 6,000 tons of gold EFP demand for delivery in a world that is only producing 2,800 tons. In silver, it’s worse. In silver in the first eight months, there has been 1.6 billion ounces EFP. That number is going to end up to about 2.4 billion of silver ounces (EFP) and the world produces less than 800 million ounces a year. The bottom line to what all this means is there is going to be a failure to deliver. Once there is a failure to deliver, only the Lord knows what kind of prices we are going to be looking at for gold and silver.”

********************************************************************

Holter says a failure to deliver is not a maybe but a sure thing. Holter says, “Whether it is this year or the first few months of next year, it doesn’t matter. It is going to happen. . . . I can basically guarantee there is going to be a failure to deliver, and that failure to deliver is going to unmask and scare the crap out of the entire fractional reserve banking system and the fractional reserve commodity system. The whole thing is going to come down in a panic because somebody gets a failure to deliver. . . . If you listen to what Trump is saying, he wants a lower dollar. How much of a lower dollar does he want? He’s talking about debasing the currency to make the debt payable. . . . That is the most palatable way for any government to pay debt and that is to debase the currency and pay it off in monkey money.”

Join Greg Hunter as he goes One-on-One with precious metals expert Bill Holter of JSMineset.com.

Buygold

Maybe it’s time for Skeena to do something. I certainly hope so!

Impact’s been doing well since their trip under 20 cents. Probably some players with decent profits they’d like to take.

I’m ready for this correction to be over!

R6, Ipso

R6 – Agree on ZH, not sure what their definition of “plunging” is but we certainly haven’t seen much in the way of plunging on the SM for quite a while now. The day that ZH actually posts a potentially bullish article on the SM is the day that the SM may go down and actually correct.

Ipso – Nice hits for Skeena, was wondering if they were worth throwing a few bucks into. I see that Impact silver ISVLF – US is back below $.30. Probably worth getting back in for a few bucks.

Nice hits

Skeena Intersects 18.13 g/t AuEq over 22.65 metres in New High-Grade Vent at Eskay Creek

NR: 19 – 15

Vancouver, BC (September 9, 2019) Skeena Resources Limited (TSX.V: SKE, OTCQX: SKREF) (“Skeena” or the “Company”) is pleased to announce the first gold-silver drill results from the recently initiated Phase I surface drilling program at the Eskay Creek Project (“Eskay Creek”) located in the Golden Triangle of British Columbia. The 2019 Phase I program is being performed with two surface drill rigs in the 21A, 21E and 22 Zones to infill and upgrade areas of inferred resources to the indicated category. Drillhole results reported in this release are from the 21A Zone. Reference images are presented at the end of this release as well as on the Company’s website.

Phase I Eskay Creek 21A Zone Drilling Highlights

•SK-19-052: 16.52 G/T AU, 73 G/T AG, (17.49 G/T AUEQ) OVER 7.54 METRES

•SK-19-055: 28.38 G/T AU, 1 G/T AG, (28.39 G/T AUEQ) OVER 5.83 METRES

•SK-19-057: 17.38 G/T AU, 113 G/T AG, (18.88 G/T AUEQ) OVER 18.50 METRES

•SK-19-058: 17.93 G/T AU, 15 G/T AG, (18.13 G/T AUEQ) OVER 22.65 METRES

Sprott shells out some more beans

Americas Gold and Silver Announces Strategic Joint Venture with Mr. Eric Sprott at the Galena Complex

TORONTO, ONTARIO – September 9, 2019 – Americas Gold and Silver Corporation (TSX: USA) (NYSE American: USAS) (“Americas” or the “Company”), a growing North American precious metals producer, today announces a strategic joint venture agreement (the “Agreement”) with Mr. Eric Sprott to recapitalize the mining operations at the Galena Complex, located in the Silver Valley of Northwest Idaho.

•The strategic joint venture – expected to be 60/40 Americas/Sprott respectively – will allow Americas to increase development, modernize infrastructure, purchase new mining equipment, and target exploration below current operating areas with the goal of positioning the Galena Complex to significantly increase resources, production, and reduce operating costs at the mine over the next two years.

MetalsGuy – Thanks for the update

I have been having trouble accessing that site for some reason , for some time…maybe two or three months the browser link didn’t work . Today I searched in earnest and was surprised , because I was used to seeing a higher price in Shanghai that here . I appreciate your comeback .

Watching those RSIs…could they get to 30-35? In a bull mkt a 40 RSI is about all u. get…

https://stockcharts.com/h-sc/ui?s=sand