US Trade Representative Lighthizer has released some details of the phase one US-China trade deal… there’s just one big elephant in the room that is raising a few eyebrows.

Apparently confirming President Trump’s comments, Lighthizer told reporters that China has agreed to purchase USD 40bln in Agricultural goods in the first year (with best efforts to increase that to USD 50bln), that there will be additional negotiations and the deal is expected to be signed in early January (at a ministerial level – not Xi and Trump). Lighthizer confirmed that China’s expectation is that there will be further phases and further reductions in tariffs, and he confirmed that the agreement will increase US Trade to China by USD 200bln over 2 years. (There will reportedly be a more detailed factsheet released this afternoon).

That all sounds awesome, right?

Well, to reach $40 billion next year, China would have to quadruple its US Agricultural imports!!

All of which explains two things:

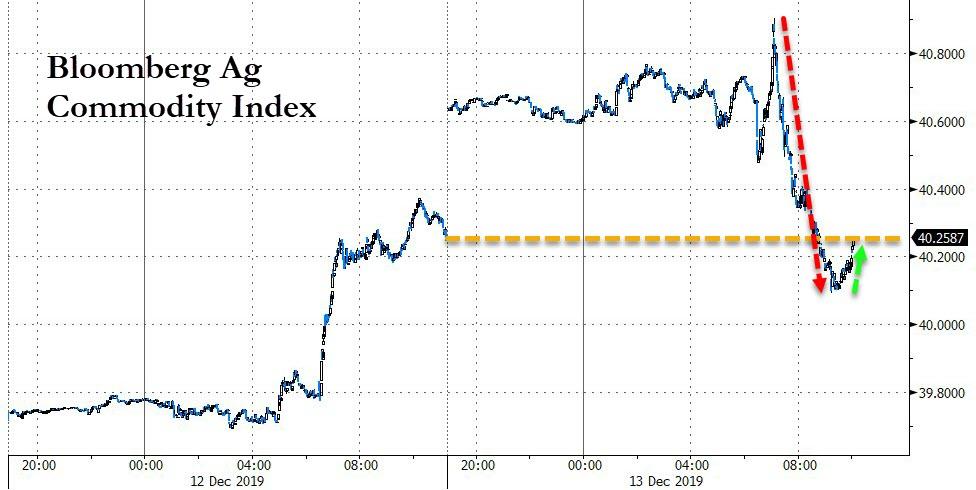

Why Agricultural commodities are not screaming higher…

And neither are stocks, yuan, or copper, as investors appear to be discounting the rising probability of the Phase One Deal being busted within a few months as the “promised” purchases do not occur… and if that is close to the elections, it could well mean an ugly market reaction.