The only question is how much longer can Jerome Powell continue “pushing on a string.”

Think “Lehman crisis” multiplied by a factor of four.

U.S. Treasuries are the most rehypothecated asset in financial markets, and the big banks know this. [They] are the core asset used by every financial institution to satisfy its capital and liquidity requirements, which means that no one really knows how big the hole is at a system-wide level.This is the real reason why the repo market periodically seizes up. It’s akin to musical chairs – no one knows how many players will be without a chair until the music stops.

“Some hedge funds take the Treasury security they have just bought and use it to secure cash loans in the repo market. They then use this fresh cash to increase the size of the trade, repeating the process over and over and ratcheting up the potential returns.”

“The repo-funded [arbitrage] was (ab)used by most multi-strat funds, and the Federal Reserve was suddenly facing multiple LTCM (Long-Term Capital Management) blow-ups which could have started an avalanche. Such would have resulted in trillions of assets being forcefully liquidated as a tsunami of margin calls hit the hedge funds world.”

Bernie for Prez in 2020-!!! Soak the rich!!

“The financialized economy – including stocks, corporate bonds and real estate – is now booming. Meanwhile, the bulk of the population struggles to meet daily expenses. The world’s 500 richest people got $12 trillion richer in 2019, while 45% of Americans have no savings, and nearly 70% could not come up with $1,000 in an emergency without borrowing.This approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose and long-term interest rates fell when investors began to anticipate the most recent action. Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending.”

“The financialized economy – including stocks, corporate bonds and real estate – is now booming. Meanwhile, the bulk of the population struggles to meet daily expenses. The world’s 500 richest people got $12 trillion richer in 2019, while 45% of Americans have no savings, and nearly 70% could not come up with $1,000 in an emergency without borrowing.

We’re merely citing this as an example of how quickly financial markets can go from full functioning to complete breakdown.

Financial Markets Don’t Have The Faintest Inkling Of Potential Geopolitical Risk

“Every generation suffers its particular fantasies. So it was a century ago. Investors had grown so immune to the consequences of war that bond markets from London to Vienna didn’t flinch after the assassination that provoked World War I.“Three weeks later, in the summer of 1914, the fear premium amounted to a total of one basis point. Then, in quick order, European markets ceased to function. A notable feature of this paralysis is that nothing of substance had changed – war had not been declared by any of the parties, but by now, minds were hyperventilating.”

Geopolitical Shocks and Financial Markets

VXX doesn’t need a 2000 or 2008-it is $14-in the Dec. 2018 sell off it was $46-[no splits since 2017]-even half of that would be a good trade

Mux

Just looking at charts

Thank God for my Petty Officer 1st Class (SGT) who I’m still in contact with 40 years later. I would killed that soldier who was just another kid, likely being told what to do by someone higher up in an effort to impress US Spec Forces. Unfortunately in Iran, whoever fired that missile, may lose his head over it, but he was likely just a kid thinking he was protecting his country against “The Great Satan” and scared out of his wits.

Can’t think what to say about that except it is so true. Too bad we can’t make everyone understand.

R640

“Taco Bell Offers $100,000 Salaries and Paid Sick Time.”

Sounds like a job I need to look into.

I see a high probability of a 2020 financial accident.

So long as financial conditions remain extraordinarily loose, I don’t know why the U.S. economy can’t surprise on the upside. With momentum building throughout 2019, expect some housing market “crazy” this year. “Tech Bubble 2.0” – growing only crazier. Los Angeles Times headline: “Taco Bell Offers $100,000 Salaries and Paid Sick Time.” Good to have that sick leave. Lavish cheap “money” on an overheated economy and one thing is a given: it will be borrowed and spent.

But when things go wrong they will really go wrong. Every passing month ensures maladjusted financial and economic systems only further hooked on unrelenting loose finance. I see a high probability of a 2020 financial accident. And I know most would say this is crazy talk. But we were close in the U.S. last September and January. China began to unravel in the early summer.

Business is booming!

January 9 – Bloomberg (Molly Smith, Michael Gambale, and Hannah Benjamin): “Companies around the globe, concerned that heightened tensions between the U.S. and Iran could roil bond markets, are rushing to borrow cheaply while they still can. Investment-grade firms have sold more than $61 billion of notes in the U.S. through Thursday, double the same period in 2019… Borrowers from around the Asia Pacific region sold more than $28 billion in dollar notes this week, in a record start.”

January 10 – Bloomberg (Hannah Benjamin and Priscila Azevedo Rocha): “Europe’s bond market is wrapping up its biggest week ever, with over $100 billion of new debt sales underscoring its status as a major global funding vehicle. Issuers from China, Indonesia, Japan and the U.S. joined local borrowers in tapping Europe’s super-low funding costs and increasingly mature bond market, helping push sales for the week to 92.5 billion euros ($103bn).”

Global central bankers granted the type of guarantee markets had only dreamed of.

What really makes this so dangerous? Markets know that policymakers know the system is acutely fragile. Central bankers are not only trapped, the situation is so dire that they have no choice but to move early and aggressively to ensure Bubbles can’t begin deflating (no corrections or adjustments allowed).

Central banks cut funding costs and afforded speculative financial markets hundreds of billions of additional liquidity. More importantly, global central bankers granted the type of guarantee markets had only dreamed of. Monetary policy will be used early and aggressively to backstop the markets, while no amount of excess would elicit any degree of monetary restraint. The Endless Punchbowl (with free salty snacks) – the “insurance rate cut”.

Bubble markets reacted with a vengeance. Global bond markets experienced a historic “melt-up” with yields collapsing over the summer. Global equities ended the year with a fit of panic buying. Bond and equities bears were squeezed to death. By their nature, speculative blow-offs create acute vulnerability. The final euphoric outburst ensures excessive underlying speculative leverage. Price momentum becomes unsustainable, with the inevitable reversal inciting de-risking/deleveraging dynamics. Some degree of illiquidity is unavoidable. Progressively powerful policy responses become necessary to suppress panic and crisis. Trapped.

The probability of a global crisis during 2020 is the highest since 2008. The nucleus of “The Bubble” in 2008 was in U.S. mortgage finance. “The Bubble” today is global, across virtually all financial assets (sovereign debt, stocks, corporate Credit, and derivatives), real estate (residential and commercial) and private businesses. From a Credit perspective, “The Bubble” has spread to – and corrupted – the foundation of global finance (central bank Credit and sovereign debt).

How can it end other than with a systemic crisis of confidence? Mispricing of U.S. government and corporate securities is unprecedented. The excesses in Chinese finance have moved far beyond any historical Bubble episode (Japan during the eighties and the U.S. mortgage finance Bubble mere kids’ stuff). All the punditry fuss over predicting a year-end S&P500 level seems especially pointless.

What really makes this so dangerous? Markets know that policymakers know the system is acutely fragile. Central bankers are not only trapped, the situation is so dire that they have no choice but to move early and aggressively to ensure Bubbles can’t begin deflating (no corrections or adjustments allowed).

http://creditbubblebulletin.blogspot.com/2020/01/weekly-commentary-issues-2020.html

R640 – Makes sense

“The claim foreigners are selling US debt is absurd. Foreign buying of US debt is intensifying as European banks ship cash to their US branches who are buying the debt and posting cash at the Fed in the excess reserve facility because of the fear of a banking crisis in Europe.”

Makes total sense as to the strength of the USD and US Bonds, regardless of our debt. So, I guess Armstrong is thinking the crisis is going to originate in Europe, probably with Deutsche Bank, but of course their derivatives will affect every major bank around the world, just like Lehman and Bear Stearns, except larger.

The question is, why have the banksters kept pressing their short bets in the pm markets if they know this is coming? Or, is this going to be a repeat of 08′-09′ where pm’s go down with the SM?

Ipso – yes

Thank God for my Petty Officer 1st Class (SGT) who I’m still in contact with 40 years later. I would killed that soldier who was just another kid, likely being told what to do by someone higher up in an effort to impress US Spec Forces.

Unfortunately in Iran, whoever fired that missile, may lose his head over it, but he was likely just a kid thinking he was protecting his country against “The Great Satan” and scared out of his wits.

The super rich…

…are vaulting physical gold.

https://www.rt.com/business/476400-worlds-super-rich-hoarding-gold/

If it’s good for them it should be good for you…no?

Cheers

the mother of all financial crises that is over the heads of domestic analysis and mainstream press will NEVER report it unless it would impeach Trump.

QUESTION: There are people claiming that Fed cannot buy directly from the Treasury and they are buying the same day issue in this Repo Crisis so that means they are monetizing the debt because foreigners are fleeing us Debt. This seems to lack any real substance and is nothing but opinion once again. Would you comment on this new conspiracy theory?

DU

ARMSTRONG=ANSWER: You are correct. This makes no sense. The Repo Market is overnight. Banks buy the T-Bills because they are Primary Dealers and MUST buy in the auctions to retain that position. Simply because they put them into Repo the same day means nothing. They buy them back the next day. This is complete nonsense and it once again demonstrates that all people look at is domestic issues. The claim foreigners are selling US debt is absurd. Foreign buying of US debt is intensifying as European banks ship cash to their US branches who are buying the debt and posting cash at the Fed in the excess reserve facility because of the fear of a banking crisis in Europe. So they are supposed to be selling US debt forcing the Fed to monetize because they prefer negative yielding debt in Euro with the Euro declining? Perhaps if you need to lose money for a tax write off!

The Repo Crisis has NOTHING to do with the Fed hiding some problem in the USA and the Fed is not monetizing the debt using Repo. We have a major crisis unfolding and neither the central banks nor the primary dealer banks will talk about what is taking place behind the curtain. This is a very MAJOR CRISIS, and it will get far worse. I am rushing to get this report out ASAP because this can be the mother of all financial crises that is over the heads of domestic analysis and mainstream press will NEVER report it unless it would impeach Trump.

Armstrong Economics–The Mother of all Financial Crises

COMMENT: Sir,

While taking a break from reading the Repo Report, I came across these words written by Albert Einstein before he passed away

“Not one statesman in a position of responsibility has dared to pursue the only course that holds out any promise of peace…” he wrote. “For a statesman to follow such a course would be tantamount to political suicide. Political passions, once they have been fanned into flame, exact their victims.”

I fear we are going to crash and burn as you have said

Keep up the good work

*******************************************

REPLY: That is a very good quote. It is so true. With all the disinformation circulating around about this Repo Crisis, one must question can they really be that stupid? This is really the Mother of all Financial Crises, which will impact everything it touches. This will make the 2007-2009 financial crisis look like a trial run. There is no politician who will stand up and talk about this crisis nor will they dare to even ask pertinent questions for fear of what will be revealed.

This is why this report does not end with this report alone. We will update it next year as everything unfolds. So it is more like a subscription to this catastrophe.

Buygold

Good story and thank God for your sgt!

There’s some young Iranian soldiers with heavy weights on their consciences. Yes pretty stupid of Iran to not have systems in place which distinguish take offs from the airport from enemy attacks!

How many take offs follow the same flight plan from Tehran airport day after day?

Morning Ipso

Glad they told the truth. Imagine being a 20 year old kid with your hand on the trigger of an anti-aircraft missile just a few hours after having attacked the bases of the largest military might in the world. A jet comes across your radar, you think you’re being a hero.

Shame on Iran or the Ukraine for allowing that passenger jet to take off so early, in the dark no less, after a missile strike in the middle of a potential war. They are responsible for the death of those passengers, that plane should have been delayed.

Quick story. I was in the Sudan, stuffed in the back of a military truck with 7 or 8 of my teammates, approaching a Sudanese military base. We were there to train their army. We get to the guard shack and the guard jumps out with his rifle pointing his weapon at us and screaming. My instinct is to pull my sidearm. Fortunately, my 1st class (sgt. equivalent) puts his hand lightly on my arm and lets things play out. They let us through, the Sudanese guard was trying to impress us. I was 19 y/o, but would’ve shot him without thinking of the consequences had it not been for a more experienced member of my team.

I wonder how many wars or deaths happen by inexperience or mistake?

Surprise Surprise

In Stunning Reversal, Iran Admits Accidentally Shooting Down Ukrainian Passenger Jet

After multiple denials, and demands for proof from foreign entities – accusing them of spreading “psychological warfare” lies, President Hassan Rouhani has admitted Iran accidentally shot down the Ukrainian jetliner that took off from Tehran’s international airport amid this week’s tensions.

and another take on Trump which is largely true, but what’s the alternative? – Brandon Smith

In the end, the Trump bandwagon is meant to accomplish many things for the globalists; the main goal though is that it is designed to change liberty conservatives into rabid statists. It is designed to make anti-war pro-constitution activists into war mongers and supporters of big government, as long as it is big government under “our control”. But it’s not under our control. Trump is NOT our guy. He is an agent of the establishment and always has been.

For now, the saber rattling is aggressive but the actions have been limited, but this will not be the case for long. Some may ask why the establishment has not simply launched all out war now? Why start out small? Firstly, they need conservatives psychologically invested in the idea. This may require a false flag event or attack on American civilians. Secondly, they need to execute an extensive troop build-up, which could take a few months. Declarations of a “need for peace” are always used to stall for time while the elites position for war.

War with Iran is pointless, and frankly, unwinnable, and the elites know this. It’s not just a war with Iran, it is a war with Iran, their allies, and every other nation that reacts negatively to our actions. And, these nations do not have to react militarily, they can react economically by dumping US treasuries and the dollar as world reserve.

The establishment wants the US embroiled in Afghanistan, Iraq, Iran, etc. until we are so hollowed out from conflict that we collapse.

The War Pigs Are Finally Revealing Themselves – And This Is Just The Beginning…

R640 – Interesting take on the Repo’s

Maybe we’re getting fed a load of crap from ZH about the Repo’s. They certainly aren’t indicating any crisis is imminent and if it is some form of “QE” we wouldn’t know it by the action in the USD or the SM.

As far as Iraq/Iran/US/Israel/Militia’s etc. – it’s a tinderbox and won’t take much. Fortunately, Trump says he doesn’t want war and I believe him. Unfortunately, he has some advisers that are trying to slow walk him into war with Iran.

Like I mentioned yesterday. Anyone hoping for war, is only playing with half a deck, and that would be most of D.C’s “Think Tanks”

This is why I believe Trump:

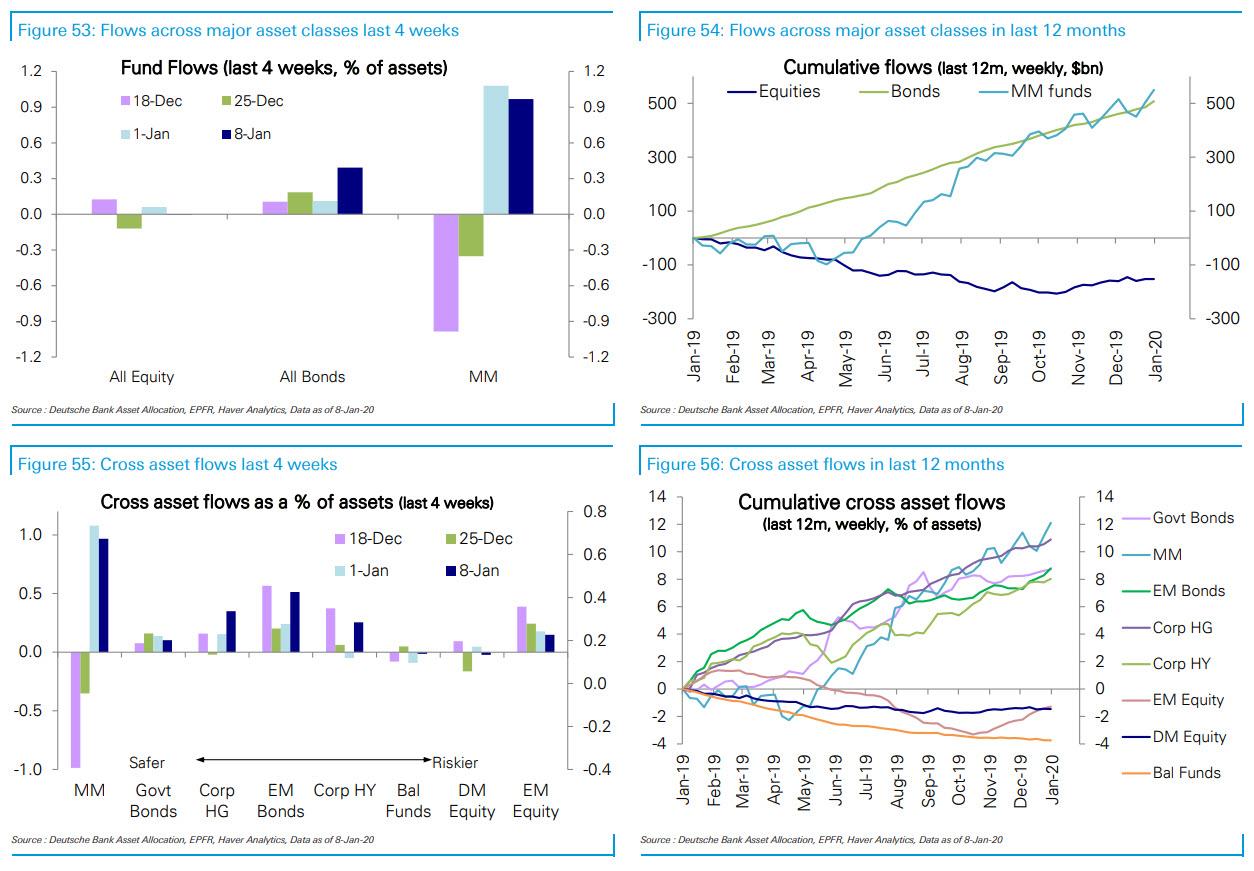

“Money on the sidelines”

Bobber,

You picked some really good ones. “Money on the sidelines” is one of my favorites. And it’s immortal. It has been cited all my investing life, and it will still be cited long after I’m gone, to be passed proudly from generation to generation, no matter how often it gets debunked :-]