Have any more garbage to post Rich? That’s basically what you have been doing lately! Fear Porn Zero Hedge Bullshit…Your more then knee deep in it …give it a break.

But in a world of free money, conservatism no longer makes sense. Why worry about wasting money…when you can print more? Why worry about balancing the budget when deficits can be financed for practically nothing, apparently forever? And besides, doesn’t government spending stimulate the economy?

Bullion Vault

America’s 2 Colossal 21st Century Mistakes

Monday, 1/13/2020 09:01And today, we take up the other most bone-headed, society-destroying mistake of the 21st century.

We’re talking about money. When the money goes, everything goes. You can quote us on that.

In the panic of the crisis of ’08-’09, for example, Ben Bernanke, the Federal Reserve, Congress, leading economists, Republicans, Democrats – and almost everyone else – lost his mind.

Bernanke stood before Congress on Thursday, September 18, 2008, and told the clowns the most preposterous thing: “If we don’t do this,” he said, “we may not have an economy on Monday.” And nobody laughed.

With Bernanke’s urging and guidance, the feds had the “courage to act”…like morons. They went to the pumps…adding trillions of new money into the economy over the following ten years. And while, today, America’s money world seems in decent shape on the outside, on the inside it is rotting.

Stocks are at all-time highs, but only because of front-running by speculators and buy-backs by corporate insiders. Real, pre-tax earnings growth is falling.

Unemployment is near all-time lows, but only because people are forced to take low-paying “gigs” in the service economy. Real, “bread-winner” jobs continue to disappear.

GDP growth is still positive, but only because the Fed lends money below the rate of consumer price inflation. Worldwide, central banks lowered rates some 90 times last year. And now – using its Repo Madness program – the Fed is pumping even faster than it did during the crisis of ’08-’09.

Meanwhile, the US government is headed for the biggest default in world history. For 20 years it has added debt twice as fast as GDP.

How long can you keep that up? That’s what we’re going to find out. Because, now, with 11,000 baby boomers retiring every day…and the armed wing of the Deep State insisting on more and more money…there’s no way to stop it.

And here again, you can blame traditional conservatives.

Typically, Liberals (in the American sense of the word) believe in Big Government. They want it to cure the world’s ills – as they see them – by force. They may or may not trust the free market to create wealth; but they damned sure don’t want it to decide where the money goes. They’ll do that themselves.

They’ll tell you where you can smoke, too. And what you can put in your body. And what you have to do with your trash…and what kind of deal you can make with an employee. And so on…and so on…And the cost? Don’t worry about it. “There’s always money available,” as Elizabeth Warren remarked recently.

Traditionally, you could count on conservatives to say “no.” They knew there were limits. They were suspicious of the Liberals’ motives (what they were really after was power)…and skeptical about their programs (war on poverty…war on drugs…war on terror…taxes…regulations – none of them would work, conservatives grumbled). They opposed budget-busting foreign wars…and domestic boondoggles alike.

But in a world of free money, conservatism no longer makes sense. Why worry about wasting money…when you can print more? Why worry about balancing the budget when deficits can be financed for practically nothing, apparently forever? And besides, doesn’t government spending stimulate the economy?

Over a nearly 50-year period since the fake money was introduced in 1971, the old conservatives disappeared, died, or became new conservatives – who joined the Liberals as supporters of Big, World-Improving Government.

So, in 2008, when the financial crisis hit hard, and the feds turned on the stimulus taps, who was there to stop them?

Nobody.

From Murph tonight

*From Trader Rog this afternoon, who owns a zillion dollars worth of physical silver, bought around $5 many years ago…

from roger on Monday

hi bill,

i just love all this positive talk! a commercial signal failure

is around the corner.

if we can just close above this level.

if we can just hold this level. you’d be crazy to be short PMs. really? baloney. in your dreams.

let’s look at the facts. gold, silver, HUI, XAU, GDX,

SIL and GLD are all in four month bear trends. look

at the charts if you doubt that.

common sense says the bears are running the

show in the short term anyway. the only reason

metals and miners went up very temporarily was

due to a dire Black Swan geopolitical event.

the COT report is horrible. 356,000 net short for

gold and 91,000 for silver.

some heavy hitters like jim rogers feel gold and

silver are going to be hit hard in 2020 for the final

bottom. jim is smarter and richer than us, and owns

a lot of both.

i still feel JPM and friends are going to cause a collapse,

dump their shorts, go massively long, and buy metals

cheap directly from the mines (which we can’t do). that

scenario makes all the sense in the world.

keynes said, “markets can stay irrational longer than

you can stay solvent”. that’s a fact.

roger in wilmington

goldielocks

“Moggy a bit under the weather.”

Sorry to hear that. I hope for a good recovery.

Ipso

Nice of you to think of dear Moggy.

Moggy gives her regards. She’s a bit under the weather right now. Prayers sent her way.

Cheery Land

“The dead are born in Cheery Land: their buttocks, Nay!”–Gregory Corso

None of these indicators mean much in isolation, and they don’t all tell the same tale. It is messy! But were investors growing wildly optimistic, many of these gauges would likely be zooming or reaching extreme levels.

News headlines also offer insight into sentiment’s state. Especially dour coverage reflects and amplifies negative feelings, and vice versa. Presently, we seem to be somewhere in the middle. We see some pundits noting 2019’s great returns while urging caution—or (erroneously, in our view) claiming a partial US/China trade deal and Fed rate cuts temporarily propped up markets. However, we see few warning the bull market or expansion is in immediate danger. Most seemingly anticipate positive returns—lackluster, but positive.

On the whole, euphoria appears distant today, hinting at continued bull market in 2020. But sentiment’s improvement also suggests the gap between reality and expectations is smaller than last year. This means the bar for reality to clear is likely somewhat higher now, raising the probability of lower returns in 2020. We still anticipate a fine year for stocks, but perhaps not a steep climb like we saw in the last 12 months.

https://www.fisherinvestments.com/en-us/marketminder/a-new-year-sentiment-checkin

Maddog @ 15:26 re In the UK we pay $ 7.38/ gallon of petrol….over 85 % of that is tax

How much are your property taxes?? Over hear in NY suburbs $10-$12,000 is common, many are $16, 18, and $20,000, and HIGHER in wealthy neighborhoods. $30-$40k/yr

Mr Copper

In the UK we pay $ 7.38/ gallon of petrol….over 85 % of that is tax…..lazy governments love green taxes.

Farewell Paul Volker Prime Rate 1971-1981 21%, Good bye Prior Monetary Madness

They took the Dollar off Gold in 1971 (monetary madness) the dollar dropped, oil gold etc rapidly climbed inverses. They blamed the Arabs the Lower Dollar higher cost, imported oil, then they blamed the United Auto workers high tax payer wages for ruining the economy. Normal rates and normal wages were not the problem. But they created HIGHER rates to put a headwind on the prices.

Actually the higher rates sucked up sponged up money into the banks. Dead money. If the people had a brain, of if the Gov’t media was our friend they would have told everyone you could by 30 year gov’t bonds paying 16.4% for 30 years. Instead on CDs whose rates kept falling. Holding the bonds for 30 years was not mandatory. In fact they gained value as rates dropped.

during the next economic contraction, the US national deficit should rise towards $3 trillion per year (15% of GDP)

And speaking of recession, during the next economic contraction, the US national deficit should rise towards $3 trillion per year (15% of GDP) and that will add quickly to the National Debt, which is already at $23 trillion (106% of GDP). Meanwhile, while US Treasury issuance will be exploding in size, the $10 trillion worth of US corporate debt will also begin to implode. This means the Fed should be forced to purchase trillions of dollars in Treasury debt at the same time it has to print trillions more to support collapsing corporate bond prices.

That amount of phony fiat money creation would eclipse QEs 1,2,3, & the Fed’s currently denied QE 4 all put together. I wonder what name Jerome Powell will put on his non-QE 5 when the time arrives? If investors are unprepared to navigate the dynamics of depression and unprecedented stagflation, it could mean the end of their ability to sustain their standard of living. A totally different kind of investment strategy is needed during an explicit debt restructuring as opposed to one where the government pursues an inflationary default on its obligations. I believe governments will pursue both methods of default at different times. Determining when and how the government reneges on its obligations is crucial. That is what the Inflation/Deflation and Economic Cycle Model SM was built to do

Could be a sticky wicket

Ecuador court casts doubts on mining projects future, allows public referendums

Ecuador’s constitutional court has ruled that communities have the right to hold public referendums on whether or not to allow a mining project to go forward, paving the way for opposition to future developments.

The ruling comes after the court analyzed three decisions made last year on the topic, including one that rejected requests to vote on the future of SolGold’s (LON, TSX:SOLG) flagship copper and gold Cascabel project — set to become one of Ecuador’s biggest mines.

Ecuador court casts doubts on mining projects future, allows public referendums

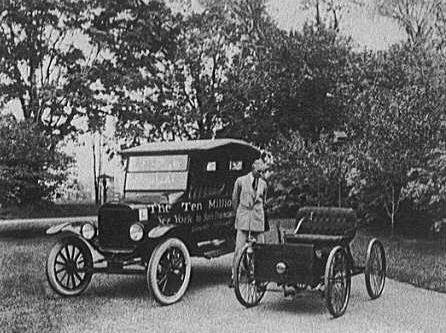

Model T Deals a Blow to Electric Vehicles

The mass-produced Model T makes gas-powered cars widely available and affordable. In 1912, the electric starter is introduced, helping to increase gas-powered vehicle sales even more. Pictured here is Henry Ford with the first Model T and the 1 millionth. 1901

https://www.energy.gov/timeline/timeline-history-electric-car

Keep in mind, there was no gov’t support or tax breaks for Henry Ford.

Why Should We Save Energy? And Be More Efficient? For Who?

The electric battery vehicle is terribly inefficient. It’s completely unpractical in the year 2020. The electric battery vehicle in the United States was developed in 1890-91.

It was not until 1895 that consumers began to devote attention to electric vehicles, and was a dream gone bad, could never replace and internal combustion engine, and still not in wide spread use after 125 years.

All things are in a constant state of change. EXCEPT the internal combustion vehicle, just like the original Toilet Bowl is basically no different than the first ones. Can’t be improved. Accept the basic old standards and stop trying to use less oil.

Its big business that wastes too much oil, and they need to convince the public to stop using oil so THEY can continue wasting it. On artificially cheap air travel and air shipping. Ocean and train shipping combined with over the road tractor trailer delivery of Chinese “screwdrivers” imported cars etc from the west coast to east coast.

If “they” can convince us little people to use less they can continue wasting it for extreme excess profits as they add to the US Trade Deficit..

eeos

Beyond Meat Soars 40% In Days As Record Shorts Scramble To Cover… Again

https://www.zerohedge.com/markets/beyond-meat-soars-40-days-record-shorts-scramble-cover

Plus Netflix has put out some Film saying Real Men don’t eat meat and all the millenial snowflakes are lapping it up and no doubt buying BYND…..there is a collective madness in the SM, that will take prices to insane levels….it is not reality based.

now now on electric cars

The ICE is terribly inefficient. It’s completely unpractical in the year 2020. The ICE was an experiment gone bad for 100 years. All things are in a constant state of change. Accept differences and move on.

R640

TSLA’s up on rumours that the world has run out of oil, so all transport will be electric.

New bell weather TSLA up 24–amazon opened up 14–so it’s gonna be hard to get

the DOW to print red for more than 15 seconds…but let’s see–turning this market down will be slow and labored–like trying to turn an oil tanker around in a swimming pool..but I think the 14 minute correction so far is just about over

FilledSell to Close80VXX Jan 17 2020 16.0 CallLimit0.08—-09:34:09 01/13/20

FilledSell to Close120VXX Jan 17 2020 16.0 CallLimit0.08—-09:34:09 01/13/20

NEM looks strong to start the day

Not much else just yet, but NEM being up might be a good signal

Sounds pretty good

Great Panther Announces 2019 Production of 147,000 Gold Equivalent Ounces and Corporate Update

https://finance.yahoo.com/news/great-panther-announces-2019-production-133000671.html

Maybe there’ll be peace in Libya

Libyan rivals, cajoled by Putin and Erdogan, to hold Moscow peace talks

MOSCOW/CAIRO (Reuters) – Libya’s warring leaders were due to hold peace talks in Moscow on Monday with Russia and Turkey urging the rivals to sign a binding truce to end a nine-month-old war and pave the way for a settlement that would stabilize the North African country.

Shout out to Moggy

Howdy Moggy. Hope everything is going OK for you.