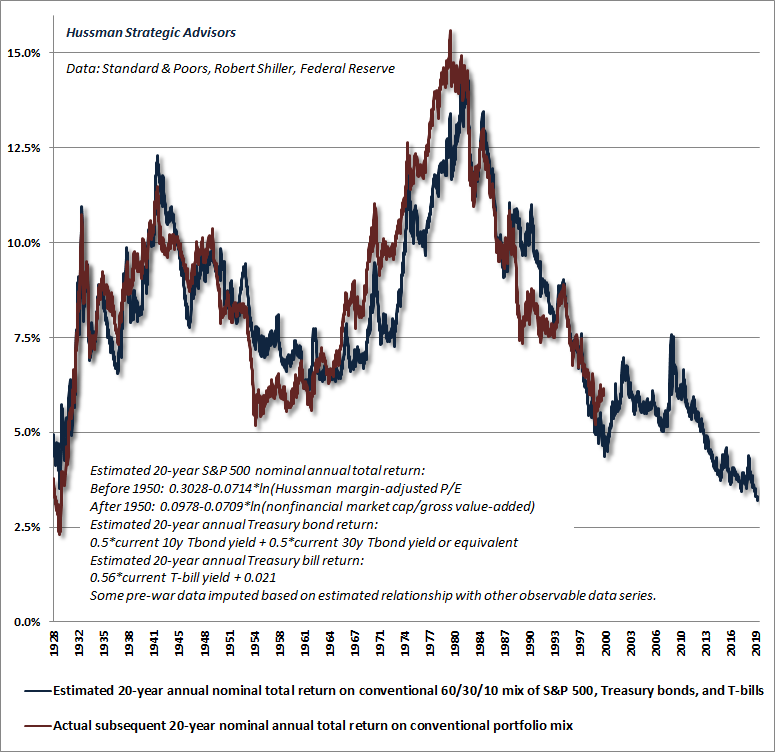

And so how do we get back to historically run-of-the-mill valuation norms?

The answer is simple:

“Wait nearly 30 years, allowing both the U.S. economy and U.S. corporate revenues to grow at the same rate as the past two decades, while stock prices remain unchanged, with no intervening periods of recession or investor risk-aversion, or alternatively (and far more likely), watch the S&P 500 lose two-thirds of its value over the completion of this market cycle.”

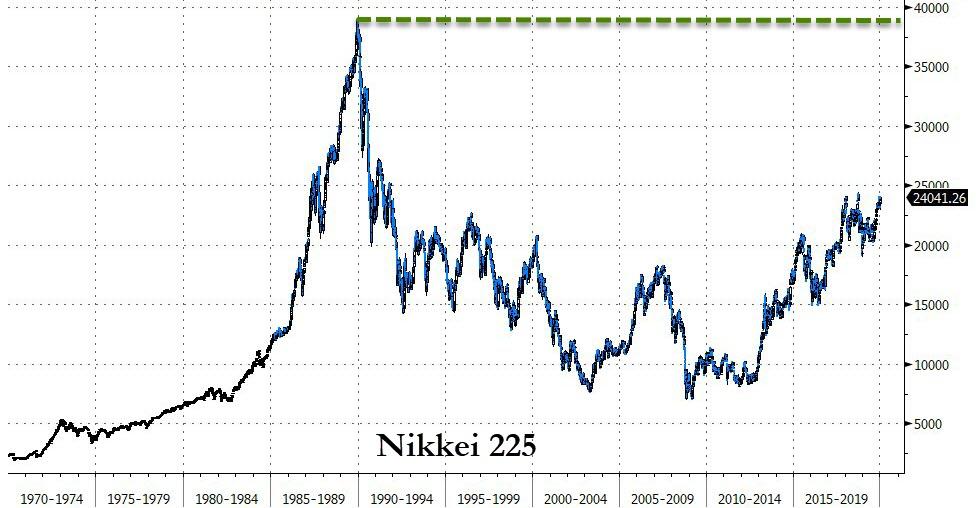

Couldn’t happen? Ask the Japanese…

Buy… and wait passively.

https://www.zerohedge.com/markets/investors-face-grave-danger-wait-30-years-nothing-or-lose-67-now