Pam Martens and Russ Martens: January 3, 2020 ~

Lily Tomlin is credited with the quote: “No matter how cynical you get, it is impossible to keep up.” Wall Street regularly brings that message home.

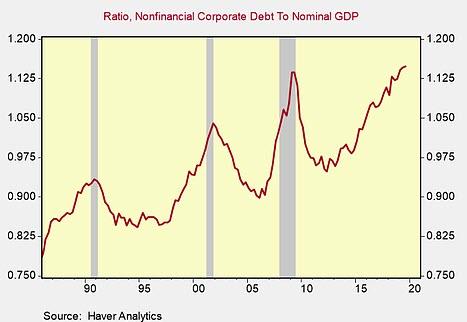

According to the latest derivatives report from the Office of the Comptroller of the Currency (OCC), Citibank, the federally-insured, taxpayer-backstopped bank owned by Citigroup, has sold protection to other banks, hedge funds, insurance companies or corporations on a staggering $858 billion of Credit Default Swaps. When a federally-insured bank sells protection to others on Credit Default Swaps, it is effectively taking on the risk of a default event. At a time of unprecedented levels of debt in the system and growing warnings about leveraged loans, that seems like a very unwise move by Citigroup.

The OCC notes that Citibank has bought protection via a larger amount of Credit Default Swaps – a total of $898.8 billion. (See Table 12 in the Appendix of the report.) There is no guarantee, however, that these bets are properly aligned and will not, once again, blow up this bank along with a chunk of Wall Street firms or insurance companies that may be its counterparties.

Credit Default Swaps played a central role in the 2008 financial collapse on Wall Street, as did Citigroup. It is an indictment of every federal banking regulator in the United States, as well as Congress, that Citigroup has been allowed to return as a major player in this market while using its federally-insured Citibank once again as a pawn in this game.

Adding to the outrage, it was Citigroup that was responsible for overturning the portion of the Dodd-Frank financial reform legislation of 2010 that would have pushed these derivatives out of federally-insured banks.