By Pam Martens and Russ Martens: January 22, 2020 ~

On Monday, a member of the New York Fed’s own Investor Advisory Committee on Financial Markets, Scott Minerd, published a critique which he headlined as follows: “Global Central Banks Fueling a Ponzi Market,” with this scary subhead: “Ultimately, investors will awaken to the rising tide of defaults and downgrades.”

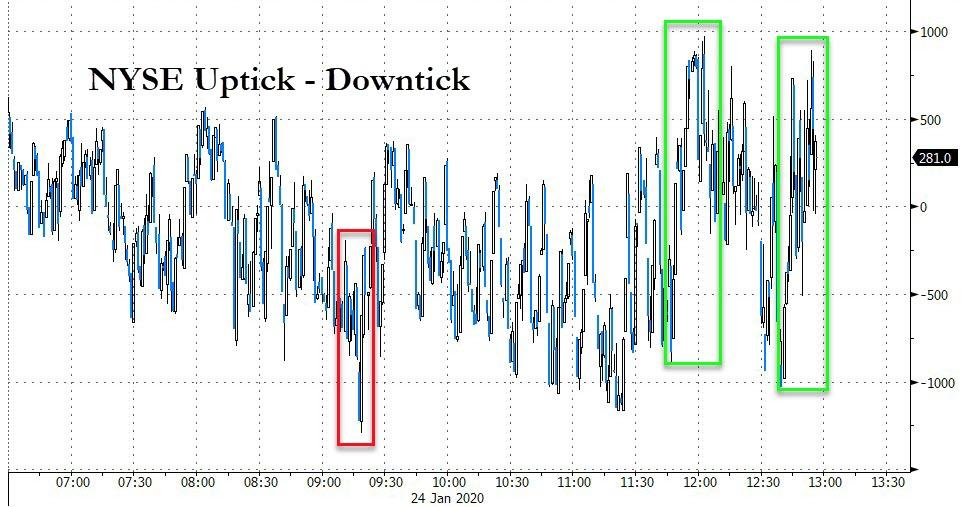

The thrust of the article is that central banks (which include the New York Fed’s Wall Street money spigot that was launched on September 17, 2019) are creating a Ponzi scheme of liquidity that is hiding the true state of risk in both the stock and bond markets. The implication is that without the Fed’s cheap money flooding markets, interest rates on questionable debt would be much higher, thus providing a red flag for investors.

Minerd develops his thesis as follows:

“The disturbing trend is that despite the rally in risk assets in the prior year, the number of defaults rose by approximately 50 percent, according to data compiled by J.P. Morgan. Additionally, the number of distressed exchanges increased by 400 percent.

“This correlates well with our observation that the number of idiosyncratic defaults has been increasing. Ultimately, markets will need to reprice for this rising risk with increased bond spreads relative to Treasury securities. However, that day of reckoning when spreads rise is being held off by the flood of central bank liquidity and international investors fleeing negative yields overseas.

“And let’s not forget downgrade risk of BBBs: today 50 percent of the investment-grade [corporate debt] market is rated BBB, and in 2007 it was 35 percent. More specifically, about 8 percent of the investment-grade market was BBB- in 2007 and today it is 15 percent. It has more than quintupled in size outstanding, from $800 billion to $3.3 trillion. We expect 15–20 percent of BBBs to get downgraded to high yield [junk bond] in the next downgrade wave: This would equate to $500–660 billion and be the largest fallen angel volume on record—and would also swamp the high yield market.