He’s been in the biz for decades …so cannot say too much, u will not find a more secretive biz than bullion…. but if he is that bullish then it’s serious.

Looks like it’s all over cause the TRANNIES are leading today–they have bounced

over 120 pts and are down just 2….

Bears need to watch and wait today…there is a chance for more roll over this afternoon…a slim one,,,at least the ice is broken and the major indexes are staying red for more than 15 seconds….trannies now up 10…”they” [FED NY trade desk] always have a gimmick & today it’s the trannies

9:45 am—-IT’S THE BOUNCE–IT’S ALL IN THE BOUNCE

we had the opening 200 pt DOW dump…let’s see if they can stop this with the obligatory bounce/rescue…or will we finally start a much needed—and non-threatening itsy-ibitsy 3 or 5 or 10 percent correction—even the NY FED desk should have the wisdom to allow it for no other reason than to try to give some legitimacy to the U.S. stock market as a non-corrupt—non-supported independent entity…don’t u agree? ……SQUEAL!!

Quarantine of Wuhan

11 million people. Take a look at that city on Google Earth. Good luck quarantining a place like that!

Alex Valdor @ 6:33

Good story!

From the Macro Tourist–Kevin Muir–he is awesome-

https://tinyurl.com/rofl7gx

OpEx Drift

For those who aren’t aware, OpEx stands for Option Expiry. Over the past few years, there has been a pronounced tendency for markets to rise in the week in front of a big expiry (typically the quarterly quad witching dates).

|

Why is that? I couldn’t really confidently explain it until Brent from SpotGamma spelled it out in a language that my option-trader-brain could understand.

In most environments, the way the dealers’ books are setup means that the theta decay results in a short covering of hedges.

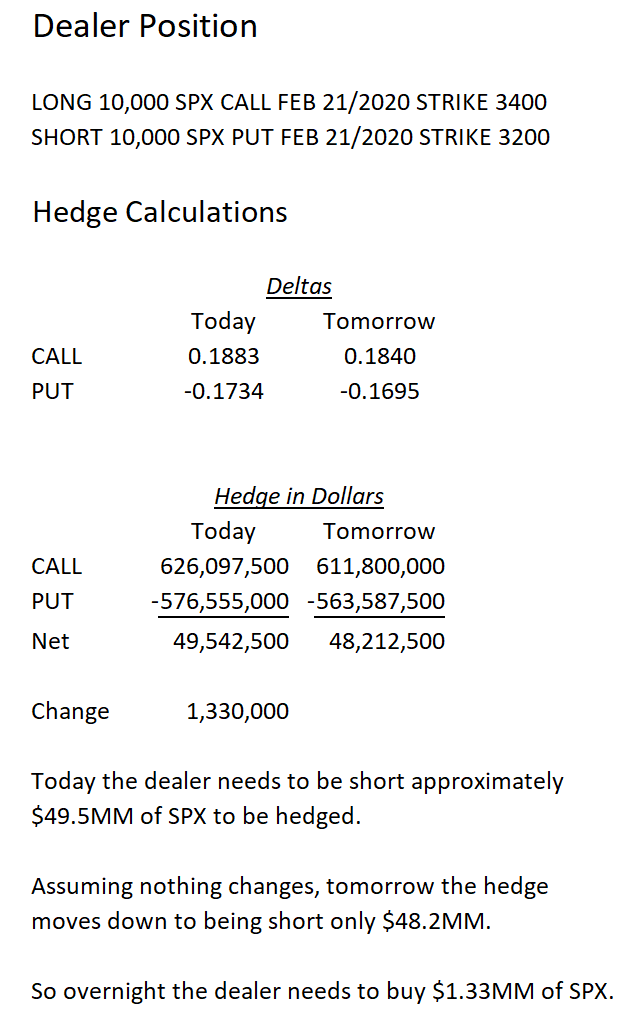

Let’s make up some theoretical positions to get a sense of how this works.

Typically, clients buy out-of-the-money put protection and fund that by selling out-of-the-money calls. Obviously that’s not 100% of the trades, but on the whole, that’s the way most dealer books set up.

So let’s go through the option math of that position. I have chosen February’s expiry and used 9% vol on the long call position and 12.5% vol on the short put position. Nothing changes between the two days except there is one less day in the calculations of the hedging deltas. What happens to the dealer’s book between those two days?

|

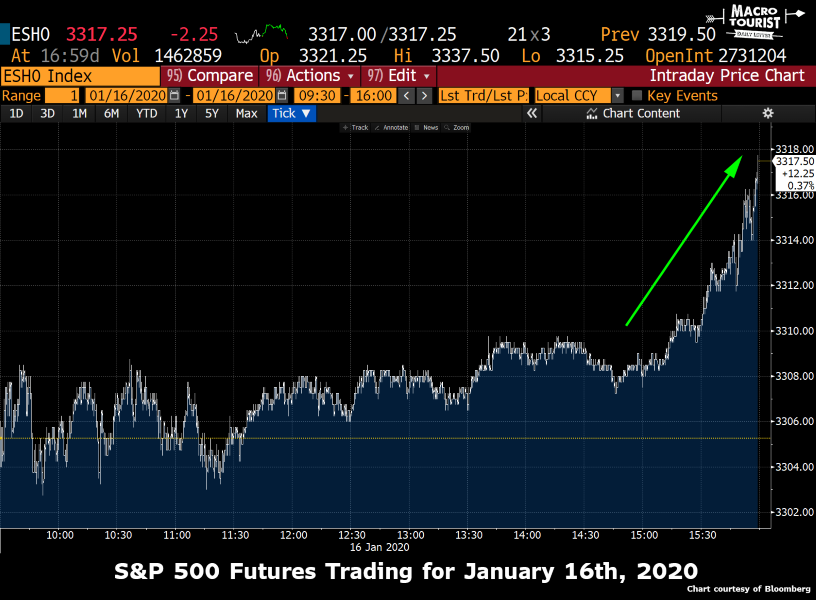

If you have ever wondered why we tend to rally on OpEx week – here is your answer. This tendency only gets more pronounced in the final days of expiry and the decay of the needed-hedges accelerates.

Remember last Thursday and Friday? Both days saw end of the day spikes higher.

|

|

Do I think these spikes were solely the result of option hedging by dealers? Not a chance. Passive flows are often benched to the close so that is a contributing factor. But option expiry weeks are typically stronger than other weeks (with the next week being often showing weakness), and this option math shows why this is the case.

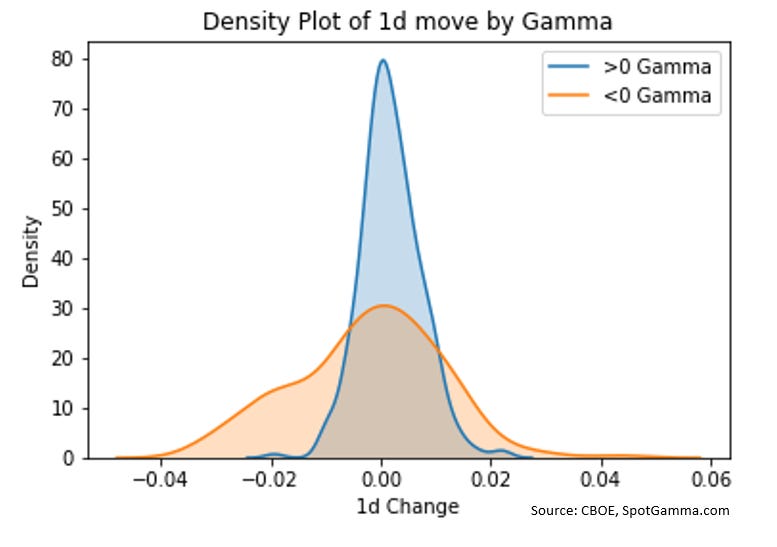

Don’t underestimate the upward pull of the dealers’ option book. All you need to do is look at Brent’s chart:

|

Look closely at the blue curve. The center is not at zero. Its mean is positive. And yes, I know that it might be self-fulfilling (quiet rising markets result in positive returns), but then again, maybe the option market is driving these tendencies more than some participants realize. I certainly used to be counted in that camp. Not anymore!

Mr.Copper

“Don’t get in trouble in Japan.”

I’m grokking on that!

Maddog

Good to hear you have confidence in Norman, I’ve only heard his name a couple of times.

I’m going to pick up some shares on this down open and see if I can scalp.

R640

Re Ross Norman

He sees all the flows, if he is that bullish then he sees the buyers not going away.

Mr Copper

That is interesting about guns and thought.

I suppose so come the saying when comes to independent thinking when it comes to a business is don’t try to fix it if it isn’t broke.

I suppose I can see it like if a woman comes over with ingredients for spaghetti wanting to make it a different way to a Italian family that has their own way of cooking it although I myself am open minded as they’re are different styles.

I’ve seen the same with Mexican food when I went out to dinner at a Mexican place that was making Mexican food different and called it Mexican health food lol

The rice which is usually Spanish rice was plain white rice with Mexican chili spices. I said this different lol A half Mexican said to me THIS IS NOT MEXICAN LOL The food was pretty good but a Mexican would not like them passing it off to people as Mexican food. They have their customs too.

However on the other side lack of individual though can hinder progress “ not talking political progressive insanity” in some forms and foster group think. It could seem robotic and boring in some ways to us as far as jobs. Individual though should be handled with care though. Group think can cause people to be blind in a warning for instance something is wrong. Then group think could change to looking for someone to blame other than them. Like when that space ship went up in the 80 s when the devils advocate noticed something was wrong with the O rings. They did not listen, group think had a schedule that was more important. O rings failed the ship went down with all those people including a school teacher.

Gotta be some balance between the two.

Alex , Maya

It’s true they do not see Koreans as the same as them. They have a strong bond with their ancestry. On the positive side they will not tolerate invasions or PC to accommodate others. My Japanese friend of Japanese ancestry who we have lunch together every month also mentioned how foreigners would come expecting them to speak their language instead of learning theirs. Japanese women especially our generation were more oppressed in that they were raised different basically sheltered from the head of household side of things. She wondered how I learned so much about different things for instance but we may see it as normal.

These wives less things changed maybe didn’t mention especially with Japanese ancestry how they look down on women marrying foreigners. In our time when she was young they still had arranged marriages. Her family would pick the best person out of different family’s with pictures and a story about them like what they do for a living and the family they came from. The best suitors that would guarantee survival.

When she decided to marry a American all hell broke loose in her family and her family was alienated for years.

It gets more complicated than that?

One thing she told me that made me kinda mad but I guess had a positive affect on her later. Someone on her sons wife side also Japanese acted like she was to good for my friend. She would never talk to her. She was Japanese but born here not raised in Japanese customs. She said some Japanese Americans look at Japanese women who marry foreigners which is ironic if their Americans calling Americans foreigners as prostitutes. Apparently a long time ago when things were hard they’d come here for that but had nothing to do with her.

I told her a few things including she is more Japanese than her and educated. Now this woman talks to her. I figure no loss for my friend if she didn’t.

Starting from a hole again

I guess we’ll have to see how the shares handle things today.

Not really sure why G & S are down. USD flat, Rates down, SM futures down a little.

London…

Maya – an amusing incident with that colleague in Japan

I was considered an ‘expert’ in condenser/feed water plant systems , and my colleague was the Japanese in-country water chemistry representative for the major American company designing AC generating plants . We had been invited to tour a generating station in the north of the country , about this time of year and were to be treated to a Binto?/Bento? Box lunch in the plant engineering office . The office was laid out in typical Japanese fashion – rows and columns of engineers’ desks , all facing the manager’s desk and a divan next to it , with a low coffee table in front of it . That was where we as guests of the manager were served our box lunches in beautiful polished wood boxes , compartmentalizations inside – with chopsticks .

The engineers – about 50 to 70 of them had already had their lunches brought from home , and would normally have a post-lunch nap at their desks , but today was different ! They would be entertained by two Gai-Jin (foreigners ) fumbling with chop sticks as we ate . All eyes were upon us as we opened our special boxes . All I can remember about the contents were two enormous hothouse strawberries in the dessert compartment that I am sure cost about $10 each (in 1983 dollars ) . ( I had seen cantaloupes in a grocery store which were over $20 apiece there in winter !) . Anyway , both my colleague and I were adept at using chop sticks , so the Gai-Jin clown show was not to happen that day . You could see the visible disappointment , as the engineers lost interest in us , and put their heads down on their desks for their customary naps .

Maya – re: Korean ancestry in Japan

I , too , had a colleague who married a Japanese woman of Korean ancestry . A very beautiful woman ! They told my wife and I that full-blood Japanese look down on those with Korean ancestry . If a Japanese child misbehaves , the parents will say “ Are you Korean ? “ as a put-down .

Japan is a very strictly contained culture.

My friend married a Japanese wife. Her parents are of Korean ancestry, living in Japan. She was born and raised in Japan, yet still has to register as a foreigner living in Japan. She has interesting and derisive observations of the native people there.

From young, the students are taught exactly how to behave and become a good Japanese citizen. Individuality is not tolerated. Left-handed students are forced to use their right hand. The saying goes: “The nail that sticks up gets hammered flat!” People would stare rudely at me as I ate left-handed with chop sticks.

I was a guest of a large Japanese electronics company that I was a customer of, on two separate occasions with two tours of the country. I spoke with one company engineer who was American educated and he noted how difficult it was to be a creative engineer when that attitude runs counter to the culture there. Independent thought is not encouraged.

The US has the highest interest Rates than all the rest

its no wonder the rest of the world is flooding money here.All the inflation we exported for 30 years is coming back into our Stock Markets ..negative rates makes it so.Yield….!then Capital Gains ,along with easy money printing to keep the economy going…….All the Dollars in the world are coming home,and there were more of than outside the country,than in. Our economy can double ,if inflation stays tame ! We can pay down our debt to zero if Trump stays in office..We are creating a Giant Sucking for Dollars into a deep dark hole called US Debt markets.

We can then do a reverse split in the Dollar and start all over again…

@ipsofacto @goldilocks Re my 11:34 No Crime In Japan, But Like Hitler, No Guns Allowed, and Less Human Rights.

Don’t ever get in trouble over there. I copied and pasted parts of a story, describing guns are 99% not legal, and what the few gun owners have to go thru. The story implies all countries would be better without guns. But the bad guys always find a way.

Parts:

If you want to buy a gun in Japan you need patience and determination. You have to attend an all-day class, take a written exam and pass a shooting-range test with a mark of at least 95 percent.

There are also mental health and drugs tests. Your criminal record is checked and police look for links to extremist groups. Then they check your relatives too – and even your work colleagues. And as well as having the power to deny gun licences, police also have sweeping powers to search and seize weapons.

That’s not all. Handguns are banned outright. Only shotguns and air rifles are allowed.

The law restricts the number of gun shops. In most of Japan’s 40 or so prefectures there can be no more than three, and you can only buy fresh cartridges by returning the spent cartridges you bought on your last visit.

Police must be notified where the gun and the ammunition are stored – and they must be stored separately under lock and key. Police will also inspect guns once a year. And after three years your license runs out, at which point you have to attend the course and pass the tests again.

This helps explain why mass shootings in Japan are extremely rare. When mass killings occur, the killer most often wields a knife.

“They are the first nation to impose gun laws in the whole world and I think it laid down a bedrock saying that guns really don’t play a part in civilian society.”

To underline the taboo attached to inappropriate use of weapons, an officer who used his gun to kill himself was charged posthumously with a criminal offence. He carried out the act while on duty – policemen never carry weapons off-duty, leaving them at the station when they finish their shift.

According to Iain Overton, the “almost taboo level of rejection” of guns in Japan means that the country is “edging towards a perfect place”

“The criminals pack the guns inside of a tuna so it looks like a frozen tuna,” says retired police officer Tahei Ogawa. “But we have discovered cases where they have actually hidden a gun inside.”

From Murph tonight

Ross Norman, meanwhile, has proved the LBMA’s (London Bullion Market Association) number one forecaster over the last 22 years, proving even more reliable than the 144DMA. He pinged me an email with his forecasts for the gold and silver price in 2020. “2019 was the year we learned that central banks are locked into QE-forever,” he said. He has a point. The Fed’s recent actions coming to the rescue of the ‘repo’ market, which had ground to a halt back in September, and lending money directly, was QE (quantitative easing) by a different name.

Ross continued: “With global debt-to-GDP ratios hitting a record 322% and with equities massively overvalued… it just depends upon when and not if the proverbial hits the fan. Financial markets are trapped and we expect gold to respond by hitting an all time high in the second half of 2020.”

Ross forecasts an average price of $1,755, a high of $2,080 and lows at $1,520. The LBMA’s number one gold forecaster being as bullish as that will be music to the ears of gold bugs.

Silver, meanwhile, was up 15% last year. Ross sees something similar in 2020 with an average price of $19.25, a high of $23.00 and lows around $17.50. Plenty to ponder then. Currently gold sits at $1,560, while silver is at $18.

I don’t think I’m quite as bullish as Ross or Jim. But I like the cut of their jib. I’m long gold, I’m long silver, and the trend is up.

Enjoy 2020!

WHEN BEEBLES POP

When Bubbles Go Bang

Gary Tanashian – Wednesday, 1/22/2020 09:01

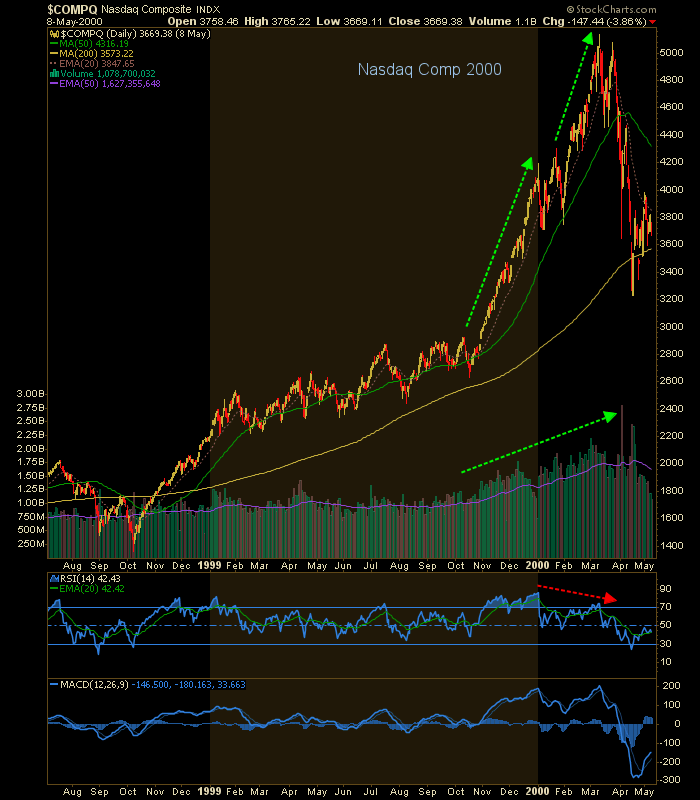

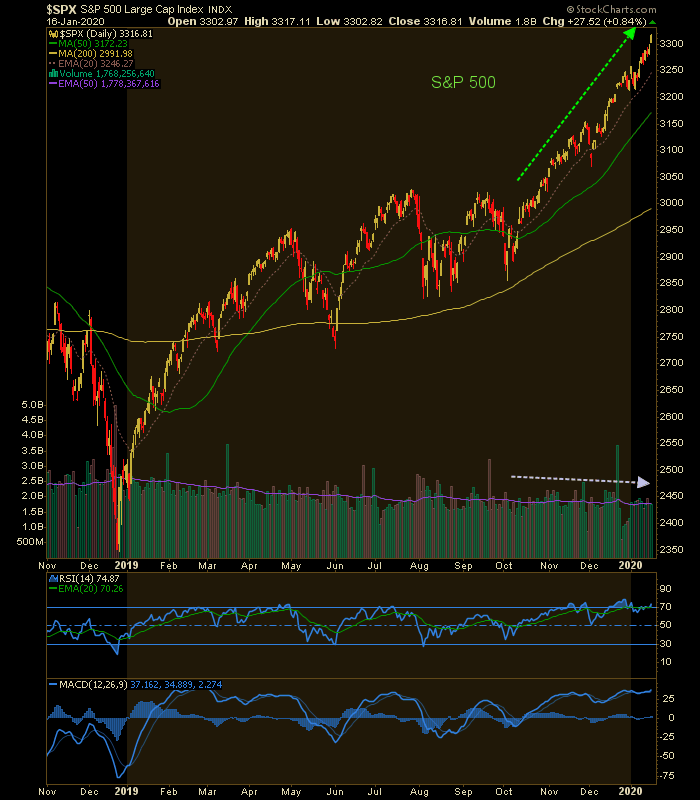

Watch price, volume, RSI…

The NASDAQ bubble popped in 2000 after motoring upward on increasing volume in two separate phases, writes Gary Tanashian in his Notes from the Rabbit Hole.

Volume rammed upward and RSI diverged [relative strength index, measuring an asset’s current price moves against recent history]. Like shootin’ fish in a barrel it was, except that at the time I was too inexperienced to see it. It was a steep slope and blow out.

And that brings us to the current headline bubble du jour. Oh wait, it’s not vertical and volume is not building. What is the meaning of this??

Well just maybe, this one is going to expire of its own bloat as volume continues to be less interested.

It’s been supported by panic monetary policy every step of the way and, since 2016, a heaping layer of fiscal (read: political) policy as well.

The above are all daily charts showing the approaches to and crack at the top of the respective bubbles. SPX excepted of course, because it has not cracked.

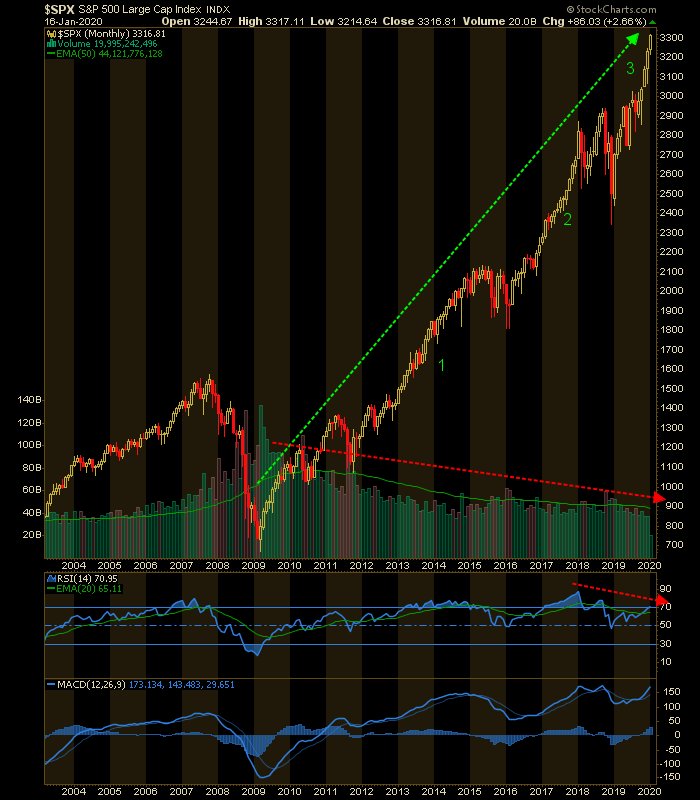

This monthly chart shows that SPX has gone up in 3 major phases with what could be the final one in process now. In this view the current rally looks vertical. Hmm…

RSI is diverging negatively, unlike some of the momo volume bubbles of the past. But again, my thesis is that the bubble is in the extreme policy propping it literally from 2008 to the current day.

It’s going to stop where it stops. Our targets have been 3200 and 3300, which SPX hit last week. There’s another up higher.

But among the things I’d be looking for on the daily chart above is a short burst of volume and a short burst of parabolic activity. May happen, or as noted above, the pig may just roll over of its own bloat (legacy and current policy is bloated beyond comprehension in support of this monolith to the folly of man).

-END-

Good Doom porn

*IMF warns of new ‘Great Depression’, Russia ahead of the curve due to increased cash & gold reserves

January 22, 2020

Last week, the IMF issued a stark warning about the global economy. While most large Western states are vulnerable to a new crisis, Russia has prepared its defenses.

Kristalina Georgieva isn’t any sort of conspiracy theorist; she’s the head of the International Monetary Fund. And when she warns that the global economy risks another “Great Depression,” you would think everyone would listen.

But the Western reaction to her statement last week has been muted, with plenty of media outlets leaving it ‘buried in the mainstream’. Or simply ignoring the story.

For instance, rudimentary Google searches suggest neither the Financial Times nor the Economist have covered her comments at all. If so, it’s ethically questionable but also understandable, in a cynical sense, given their complete attachment to the doctrine of Neo-liberal economics.

One place Georgieva’s words haven’t fallen on deaf ears is Moscow, because her warning merely confirms what experts in the Russian capital have been saying for years: a major Western financial crash is both inevitable and reasonably imminent. And it’s going to make the 2008 meltdown look mild by comparison.

The reasons are simple, according to insiders in Russia: western governments have accumulated too much debt over the past decade, and there are a number of concerning bubbles in the system. These include US stocks, German and British property, and the oversized valuations of tech companies, especially startups unlikely to ever return their costs. Throw in aging workforces, wage stagnation, higher living costs, and disruption to traditional industries from IT innovation, and you have all the ingredients needed for a ‘big bang’.

Mr Copper

Not everyone in Japan is Japanese anymore. A lot of S Koreans going their for jobs. They’re having less kids slowing their population so a lot of lower level start up jobs are vacant.

They reward law abiding there.

It looks like high profile not wanting to look bad thing going on.

You don’t think we have corruption here? Look what their doing to Trump. The average person doesn’t have the resources or backing to fight that kind of corruption even if it’s a obvious sham. Show their side even with no evidence just speculation not the defense. The people know it too. Democrats showing their corrupt colors for all to see. It’s pathetic that weak accusations they would even get away with it. They’re lousy at it but doesn’t matter when it’s a partisan hack job.