Posted by silverngold

@ 19:13 on February 16, 2020

Posted by Buygold

@ 18:00 on February 16, 2020

You mean to say you agree with me?

Nobody here ever agrees with me!!

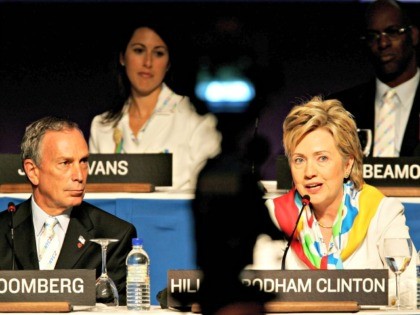

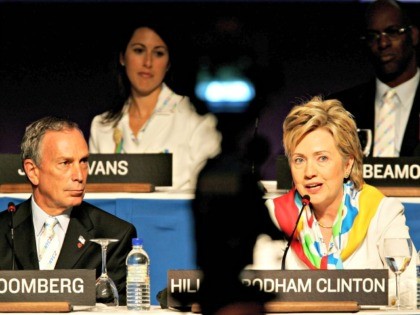

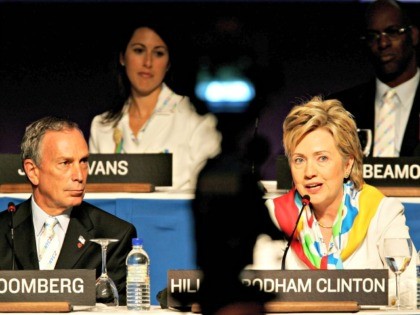

Have to agree with you though, Hitlery is her and Bloombugs worst nightmare. Together, they couldn’t win a Demonrat beauty pageant, much less an election.!!

Posted by silverngold

@ 17:41 on February 16, 2020

Posted by Maya

@ 15:35 on February 16, 2020

I gotta agree with Buygold. Genius move… for Trump!

I can read her mind…. Bloomie gets elected, Hildebeast has her CIA operatives do another JFK job on him, and VIOLA! She finally gets to be President!

I wonder how her brain disease is progressing…

Posted by Buygold

@ 13:45 on February 16, 2020

Ooreef – I believe that move from Bloomberg to get Hitlery as his VP is genius – for Trump!!

He’ll beat them even worse now!

R640 – Nothing matters. The SM is going higher as long as the Trumpster is in office.

Bet accordingly, JMHO?

Posted by Richard640

@ 13:35 on February 16, 2020

But it’s the “perfect storm” still, right? I mean it’s always the “perfect storm” with Sprott. It was the “perfect storm” for gold to break $5000 in 2014, 2015, 2016, 2017, and 2018. Silver (especially those Panda coins they sell) is just about to go “parabolic” in the “perfect storm” because… well, you know… fiat and the fed and all that. Just wanted to make sure it’s still the “perfect storm”

Anywho… it’s the “perfect storm” y’all… and Sprott is selling bullion as fast as they can… cause it’s about to skyrocket any minute now. So they are selling… good deals too.

There is a weekly of silver, the low was 2016( these things take time, so do not get in a hurry).

late 15, early 16 low, then 1-2-3-4-5, to 1 Up to July 2016 which is 1 of 1. Then an ABC into Nov 2018, low, That was 2 of 1.

We are working on 4 of 1, or starting 5 of 1 which should go above wave 1.

So this year we should see 21-22 silver, then wave 2 of 3 of 1( maybe 3 months pull back).

I would expect 2021 to be spent above 20.

Wave 2 took 2 years, Wave 3 should top in 2023 at or above 50.

How is that for you?

Look we had a bull in silver from 2000-2011, same with gold.

Gold led the first one, and pre-2007, gold was up way more than silver.

Now we have had a 10 year bear, and we are getting ready for the next one.

In this one silver leads, but even bull markets in PM’s has a ton of volatility, so protect yourselves.

Pull some Fib’s on silver from 2011 high’s will give you a road may and where the rest stops are at.

Posted by Richard640

@ 10:35 on February 16, 2020

Equities at record prices garner all the attention. Yet the manic behavior in global bond markets is more extraordinary and consequential. U.S. fixed income ETFs attracted another $7.3bn this week (ETF.com), as “money” keeps rolling in. The $64 TN question is how much speculative leverage continues to accumulate throughout global bond and derivatives markets. Here again, the timing of the coronavirus outbreak is of great consequence – inciting speculative excess and attendant leverage when global fixed-income was already engulfed by powerful Inflationary Biases. Added leveraging works to inject additional liquidity into already over-liquefied global markets. And the last thing overheated global risk markets – with such powerful Inflationary Biases – needed at this point was additional liquidity.

I view the equities Bubble as an offshoot of the greater Bubble that continues to inflate in global debt, securities Credit and derivatives markets. On the one hand, it is extraordinary to see equities markets essentially dismiss such consequential developments in China. It does, however, present important support for the Bubble Thesis. Equities rallied to record highs just months before the LTCM/Russia collapse in 1998. Stocks rallied to record highs in 2007 even as the mortgage finance Bubble faltered.

It’s only fitting that global stocks rally to record highs as the faltering China Bubble places the global Bubble in serious jeopardy. If the coronavirus stabilizes over the coming weeks and months, attention can then shift to November U.S. elections. It’s poised to be One Extraordinary Year.

A Friday CNBC headline: “White House Considering Tax Incentive for More Americans to Buy Stocks, Sources Say.” A strong equities market boosts optimism for a Trump reelection – bullishness that spurs further stock gains. Yet there is potential for self-reinforcing dynamics to the downside. A break in stock prices would incite election nervousness and heightened market risk aversion. Can this game sustain for another nine months?

Posted by Richard640

@ 10:26 on February 16, 2020

That equities can run higher in the face of mounting risks is not as confounding as it might first appear. Credit drives the global Bubble – and Credit in the near-term is further benefiting from the outbreak.

Overheated securities (speculative) Credit is really benefited.

Global monetary stimulus is further assured – rate cuts and more QE. One can now add aggressive PBOC liquidity injections to the Fed and global central bank QE throwing gas on a speculative fire raging throughout global fixed-income markets.

Posted by Richard640

@ 10:22 on February 16, 2020

Beijing has declared a “people’s war” against the forces of Bubble deflation. And this explains why markets so confidently operate under the assumption a bust won’t be tolerated. Extraordinary fragilities only ensure epic stimulus; Chinese and global Punchbowls Runneth Over. “Washington will never allow a U.S. housing bust.” “The West will never allow Russia to collapse.” There are monumental presumptions that underpin historic boom and bust cycles. “The Beijing meritocracy has everything under control.”

Posted by Richard640

@ 10:05 on February 16, 2020

Staring at a rapidly unfolding economic and financial crisis, Beijing has made the decision to move forward with efforts to get their faltering economy up and running. This comes with significant risk. Global markets, by now fully enamored with aggressive monetary and fiscal stimulus, are predisposed to fixate on potential reward (keen to disregard risk). That future students of this era will be more than a little confounded has been a long-standing theme of my contemporaneous weekly chronicle. Booming market optimism in the face of what has been unfolding in China will ensure years and even decades of head-scratching.

China is definitely not alone in gambling with aggressive late-cycle stimulus, as it desperately tries to postpone the unavoidable dreadful downside after historic Bubble Inflations. Coming at this key juncture of end-of-cycle fragilities, it’s a challenge to envisage more delicate timing for such an outbreak – in China and globally. Clearly, when global markets hear “stimulus” they immediately salivate over the thought of bubbling liquidity and ever higher securities prices. Critical nuances of global Inflation Dynamics go unappreciated.

http://creditbubblebulletin.blogspot.com/2020/02/weekly-commentary-one-extraordinary-year.html

Posted by Ororeef

@ 7:03 on February 16, 2020

as a Run Mate until he realizes How many have died getting in the way of her ambitions…..Its a DEATH wish…Its a BAD IDEA MIKE ! ya better rethink that one !

A Mike Bloomberg presidential ticket with Hillary Clinton as vice president would mean California-style gun control for everyone.

I wouldent sell you a Life Insurance Policy for NO amount of money ….

Posted by Ororeef

@ 6:58 on February 16, 2020

My real Estate TAX reassessment is up 18.71 %….Im gonna be Rich !

Posted by Ororeef

@ 6:54 on February 16, 2020

Posted by Ororeef

@ 6:53 on February 16, 2020

Posted by Maya

@ 2:40 on February 16, 2020

Hubei Doctors Warn Of Even-Deadlier Coronavirus Reinfection Causing Sudden Heart Attacks

https://www.zerohedge.com/health/hubei-doctors-warn-even-deadlier-coronavirus-reinfection-causing-sudden-heart-attacks

Apparently one cannot acquire immunity from the COVID-19 virus. Might have something to do with the HIV snippets included in this manufactured genome.