Posted by Buygold

@ 9:43 on February 28, 2020

Ipso – Concur. Don’t give a shit if Turkey is in NATO. The guy decided to start this war knowing full well that Russia would help defend their Syrian allies. Erdogan has made his bed, now he can take responsibility and sleep in it. We should kick his dumb ass out of NATO.

Hope Trump doesn’t allow the Deep State and Lindsay Graham who wants us to enforce a “No Fly Zone” to draw us into a ridiculous conflict.

Posted by ipso facto

@ 9:34 on February 28, 2020

Posted by Buygold

@ 9:30 on February 28, 2020

Sure. China will announce something and it will be presented in a positive light. Unfortunately, since they haven’t been honest since the start, or allowed the U.S. CDC into the country to help or confirm what they are saying, the markets will see right through it or won’t care and will continue to selloff.

Looks like the SM and of course PM’s are headed to a nasty open.

Was hoping to pick up some NEM right around these levels but no reason to step in now.

Funny, the world is ending and pm’s end with it. Same as it always was.

Posted by Mr.Copper

@ 9:27 on February 28, 2020

Hi thanks for clarifying that. I don’t remember spotting any of your posts here before. This situation is smelling like 2008 again.

Which reminds me of Mark Haines on CNBC back in the same type of days. Somebody said the market was dropping in an orderly fashion.

Then Mark Haines said. “Gee, I’m glad I’m losing money in an orderly fashion “.  And somebody on CNBC said the same thing this morning, it’s dropping in an orderly fashion.

And somebody on CNBC said the same thing this morning, it’s dropping in an orderly fashion.

I remember those days everybody was surprised gold dropped hard too, and it was a perfect time or opportunity to buy some physical if anybody wanted to.

Normally when bubbles are forming the Fed would tap the brakes with a bump up in rates. Is it a coincidence that we have a “virus” tapping the brakes? On extreme highs?

If there is never any brake tapping, there is no limit infinity, to how high and distorted prices could get. The prices or values are mental, opinions, no reality with this dopey/dollar paper computer money system.

Posted by Richard640

@ 9:01 on February 28, 2020

speaking of news events I saw on Bloomberg TV that China is to release a major summary on the status of the virus on Saturday—if this is true, there is no doubt they will cast the situation in a positive and improving light which could cause Sunday nite futures to precipitate a huge short squeeze. I don’t think they will allow a gloomy number as suggested in this article…

Economics

China Set to Release Biggest Insight Into Virus-Hit Economy

Bloomberg News

February 27, 2020, 7:57 PM EST

Posted by Buygold

@ 8:43 on February 28, 2020

Interesting point about Wolanchuk, Bernie and all.

I’d think that the Fed is coming in is a given. Another 1K down day today and I’d expect there’ll be some sort of announcement Monday am before the SM opens.

Course that being said, as Maddog mentions, how do they re-program the algo’s to react to the constant stream of bad news regarding the Coronavirus and then the negative economic news that’s sure to follow for months thereafter?

What happened to the problem in the Repo markets? Has that been fixed? Is it worse?

So many questions…

Posted by Richard640

@ 8:37 on February 28, 2020

https://futures.tradingcharts.com/marketquotes/YM.html

THIS FROM A POSTER AT WOLLIES SITE=

| From: GROUND ZERO™ |

1 Recommendation Read Replies (1) of 132725 |

| |

| I think there’s a reasonable chance for a good market rally very soon if not sooner, but with gold, I suspect there might be more downside pressure with gold if stocks resume higher, I have no clue, I’ll just follow my signals, they’re much smarter than I am…

Here’s what I see for these markets:

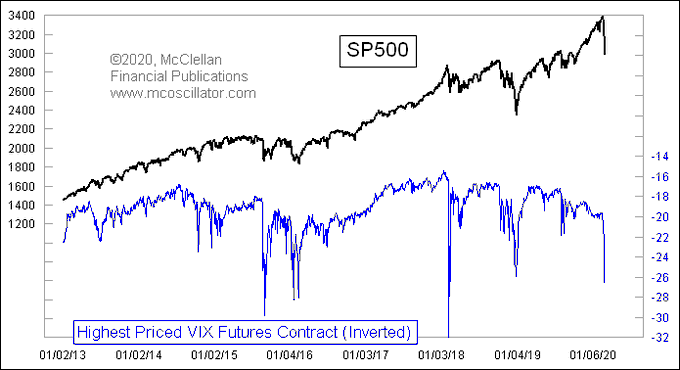

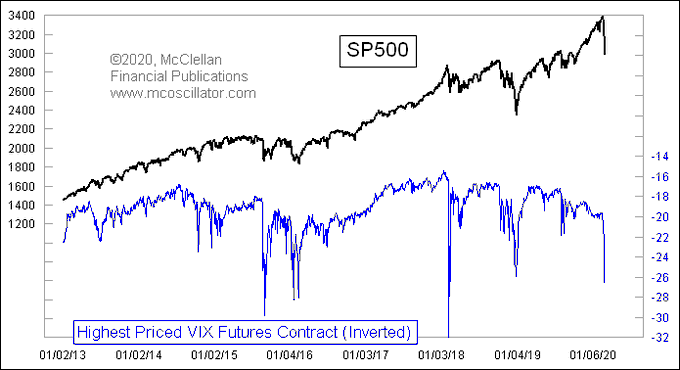

The overnight high for the VIX was 47.15…

The two previous highs for the VIX were the week of 2/9/18 with the VIX at 50.34 and 8/28/15 with the VIX at 53.29, both times were the weeks of major lows before a big rally resumed…

If you draw a line and connect those two previous VIX highs and extend that line to today, the line is at 48.17, just one point above this morning’s high, almost like an overhead resistance line…

This suggests that we actually may have a bottom of some proportion right now overnight…

We’ll see how it goes today and next week, but right now it seems the odds have increased for the possibility of a significant low having been made overnight…

A close today above 2950.00 in the SP futures and this would lend more credence to the likelihood of a significant low having just been made overnight…

So, we’ll see how it goes…

GZ |

Posted by Richard640

@ 8:27 on February 28, 2020

Posted by Richard640

@ 8:20 on February 28, 2020

That said, my good buddy Mike Ballinger posted this on Twitter yesterday=

Re-entering the GLD calls: Initiating 50% position in the GLD May USD $160 calls @ $2.85 Target: USD $7.50 by May 20th.

GLD right back to USD $155 now – pretty easy call yesterday with a 93% DSI…now the hard work begins to find the re-entry level.

GLD right back to USD $155 now – pretty easy call yesterday with a 93% DSI…now the hard work begins to find the re-entry level. https://twitter.com/MiningJunkie/status/1231927928679813120

Correction: GLD to open $158 bid with the March $150 calls at $8.00 for a 370% advance in 20 days. RSI for April gold futures is at 83 and rising with silver still lagging. https://twitter.com/MiningJunkie/status/1231599279715864576

Feb 26=Advice given to all subscribers last Saturday: “Physical Gold: “…I am going to await the first multi-dollar pullback to acquire this position. BUY @ $1,615” (only $22 below now versus $77 three days ago. Thank you bullion banks!)

Posted by Richard640

@ 8:12 on February 28, 2020

your count allows for….

that said, I have to be honest with myself…for the past 12 yrs I have been wrong & the Boyz over at Wolanchuks site have been right concerning the “end of the world”…every time there is a 10 or 20% correction my pals and I get all beared up for a week or so…only to sheepishly admits that Wollie was right again as we see the S&P rocket 300-400 handles off the bottom and not look back…chances are by April or May the Virus will be a distant memory and a lot of people will be wondering what they’re gonna do with all the dry food they hoarded…

Right now the boys at the FED are devising a strategy to turn the U.S. and world markets…whether they like or dislike Trump they are not going allow a Bernie Sanders or the totally daft democrats seize control of the U.S. economy and wreck it…actually this is the perfect time to conduct the much needed correction of the mkts so that they can recover and be at new highs before the election…

So far there has been a 10% correction…maybe it goes to 20%…there should be a very tradable bounce for 2 or 3 weeks then a quick retest of the lows then on to bigger and better things with Boris and Donald firmly ensconced in power for the next 4 yrs.

Posted by Buygold

@ 7:44 on February 28, 2020

You can’t go broke holding physical, but $10K – LOL

Anyhoo, once again pm’s have shown (or the paper pushers have shown us) that they are not insurance in times of crisis.

Now, there is talk of a Fed cut in March, so maybe pm’s do what they did after the crash of 2009, but that would imply some more pain ahead in the short term.

Ten Yr. @ 1.21%

Fun times…

Posted by goldielocks

@ 7:02 on February 28, 2020

Well the only time I’ve seen anyways you have a bullish outlook “sometime” in the future perhaps to unrealistic heights Armstrong is reEvaluating. The PM can is being kicked down the road again.

He says since the slingshot move in gold is dead since it didn’t do a fake out move below 1000 last year it will effect any future highs.

He talks about the future of kids who don’t see gold as money and you can’t travel with it. The part of traveling to me is a question what does that have to do with the pog. Private people aren’t going to risk or have shipping containers of gold around even without checks due to theft but just their personal collection for the most part. The kids also don’t own stocks but didn’t stop the market. What the industrials don’t do is add gold stocks in 401k’s.

Gold & the Slingshot

Posted by Maddog

@ 4:19 on February 28, 2020

Far too early to look for a bottom, the virus has caused this sell off and how can one say it has burnt out and sri the kind of action we saw before, was not a running B wave, it was climactic in a classic ending of an Impulse….Tesla jumping 14 or 18 % /day.

That climactic action doesn’t fit the waves, so I can see where they are coming from…anyway the C wave is not that large yet, much more likely is we see sub 2600 S&P, before we may have a temporary bottom….if u want a scary SM chart, check out the DJT monthly….in a C wave dn, but barely started !!!!!

Plus if the recent all time Hi was only a running B wave, then we will see 100 K on the Dow, as it was only the B of a 2nd wave we still have all of the 3rd and 5th up waves to come!!!!!

The nightmare scenario is this is the start of the 2nd down, correcting all of 2009 to 2021, that could in theory see sub 700 in S&P…..I saw some CNBC last night, the last few mins after the close and the blonde bimbo was still asking….. what they would buy here !!!!!!

Posted by Maya

@ 1:40 on February 28, 2020

The freights can wait. The Canadian needs fuel.

https://railpictures.net/photo/722760/

Posted by Richard640

@ 22:50 on February 27, 2020

Posted by Richard640

@ 22:38 on February 27, 2020

| HI Breeze,

In short are you saying the recent SPX high (3393.52 on 2/19) was the end of a B wave of a an irregular expanding flat. The B wave top extended higher than the start of the A wave down on 3337.77 on 1/22

To fulfill the irregular expanding flat definition (in a bullish market), The low of the C wave must go below the end of the A wave. Which means the C wave low must now reach below the end the A wave (3214.68 on 1/31) .

Mission accomplished

screencast.com

Clx says we’re well into a climatic decline and closing on the end of it, eerily similar to that of December 2018.

If it gets worse than that, tomorrow will tell.

5 day trin in the 2018 decline was a high of 7.25.

Yesterday’s 5 day trin was 6.71. The last hour today was a doozy. I bet it gotto the 7’s again.

If like December, the bottom goes in tomorrow with a weak sides ways to down day. No one will trust it as a bottom, for the next 5 to 6 trade days.

Before I do any dip buying, I’ll wait for clx to turn slightly positive and almost drift sideways till the supermoon on the 9th.

Let’s hope the deep slide of this flat disappears like a pimple on the azz of an elephant. <smile>

Hail to da cheif!

**************************************************

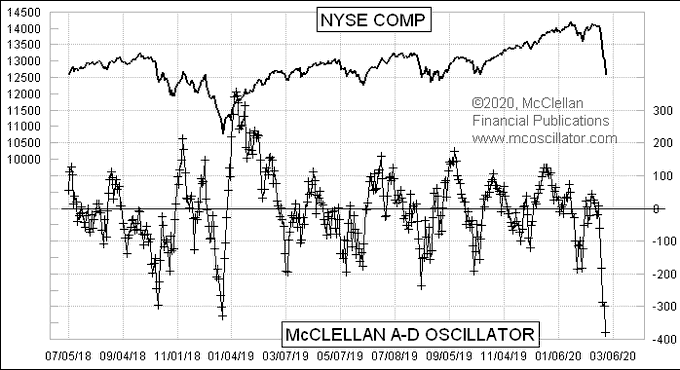

FROM TOM McCLELLAN Twitter

|

Posted by commish

@ 19:16 on February 27, 2020

Posted by ipso facto

@ 18:09 on February 27, 2020

Posted by Richard640

@ 17:54 on February 27, 2020

|

Extended Hours | 4:12:22 PM EST

|

Volume |

|

|

173.85

+ 1.70 (+0.99%)

|

1,631

|

|

|

| Close | 4:00:00 PM EST |

Volume |

52 week range |

| 172.15

-0.99 (-0.57%)

|

357,340

|

88.43 – 188.79

|

Posted by Richard640

@ 17:26 on February 27, 2020

[gold]

Ok…Ok…I don’t give a crap! I am reissuing my RL640 buy call on gold! I just got home and saw the incredible…the outrageous HUI=

HUI down 17.25 or 7%…gold futures as I write up $3….the dollar index DOWN .477–these are extreme divergences…maybe a historic day…

[$ index]

as for stocks, the tic, trin and ad line didn’t confirm the decline…

Posted by Maddog

@ 16:18 on February 27, 2020

and if it does, it could just keep going……today may yet be a pyrrhic victory.

Posted by ipso facto

@ 16:04 on February 27, 2020

Posted by Maddog

@ 16:03 on February 27, 2020

If the SM is gonna die, then so is everything else…..

Posted by Mr.Copper

@ 15:08 on February 27, 2020

A grown adult with a small truck, (wasting gas) just drove up in front of my place, and put a Bobs Store circular in my mailbox. The much lower paid burger flipper works a LOT harder all day than a “delivery boy” mailman.

Every body MOANS when they hear about a burger flipper getting a raise. “Oh geez the burger is going to cost $12.” No it won’t. The owner will make less profit. They can’t raise prices.

Well, what about your various taxes? Village county, state, federal? Nobody complains, probably because 50% of the population works for and gets well paid by the taxpayers. They actually pay taxes to themselves.

This whole financial system regarding values of many things is all distorted. The system has been “worked on” so many times and the condition is getting worse and needs to be replaced with a new one. This system is like a car with 300,000 miles on it but it half ass runs.

Also, picture the whole global economy as a CAR, and picture the USA as the “Battery”, and the battery after 50 years of abuse needs to be replaced instead of keep recharging it so many times. This is why they are hell bent in stimulating the US economy.

The global economy simply needs a new battery. Even for China to continue doing good.

Posted by Maddog

@ 14:57 on February 27, 2020

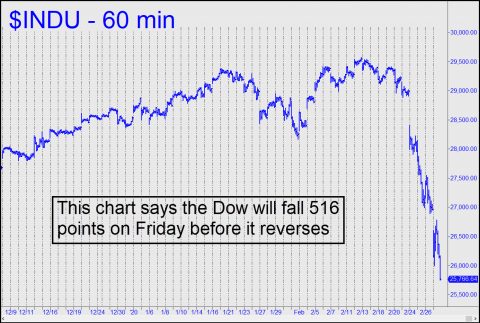

The stock market at its most violent this week has been an easy read, just as it was when the tech sector imploded 20 years ago and during the financial collapse of 2007-08. On the eve of today’s memorable carnage the short-term charts glowered with warnings of the Dow’s imminent, record-breaking plunge. I’d predicted as much in commentary sent out the night before, along with targets for the E-Mini S&Ps that caught the exact bottom of one of the best rallies of the year. Subscribers reported getting the profitable ride of their lives in both directions. In the Rick’s Picks Trading Room, where actionable ideas are shared freely 24/7, a few of them said they’d had their best day ever. In some cases this involved getting aboard for the rally at the exact low of the first selling climax in the morning, riding it to within an inch of the mid-day peak, and then surfing the subsequent avalanche into the close. This chart shows how a Coney Island kind of day looked to traders and technicians.

The stock market at its most violent this week has been an easy read, just as it was when the tech sector imploded 20 years ago and during the financial collapse of 2007-08. On the eve of today’s memorable carnage the short-term charts glowered with warnings of the Dow’s imminent, record-breaking plunge. I’d predicted as much in commentary sent out the night before, along with targets for the E-Mini S&Ps that caught the exact bottom of one of the best rallies of the year. Subscribers reported getting the profitable ride of their lives in both directions. In the Rick’s Picks Trading Room, where actionable ideas are shared freely 24/7, a few of them said they’d had their best day ever. In some cases this involved getting aboard for the rally at the exact low of the first selling climax in the morning, riding it to within an inch of the mid-day peak, and then surfing the subsequent avalanche into the close. This chart shows how a Coney Island kind of day looked to traders and technicians.

And somebody on CNBC said the same thing this morning, it’s dropping in an orderly fashion.

And somebody on CNBC said the same thing this morning, it’s dropping in an orderly fashion.