[in your opinion, what, if any, new implications does this add to an already dire looking situation for world markets?]

It was the fear that this arb would suddenly dislocate in chaotic fashion, culminating in a cross-asset liquidation cascade, that spooked the Fed into activity in September, forcing it to inject over $600 billion in liquidity in the ensuing months via both Repo and QE4.

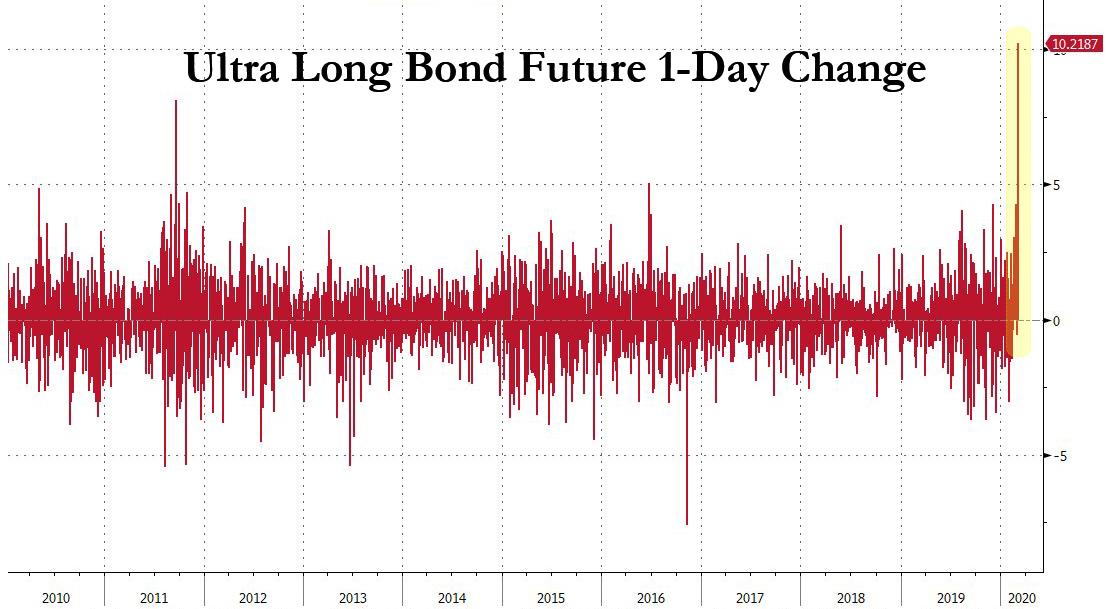

Which brings us to today, and this morning’s unprecedented move in the Ultra long bond future…

… which has already swung higher by over 10points, is the biggest one-day move in history!

Now, as a reminder, most hedge funds are also clients of JPM, which for the past two months had been urging them passionately and over and over and over again to short the long-dated rates complex: