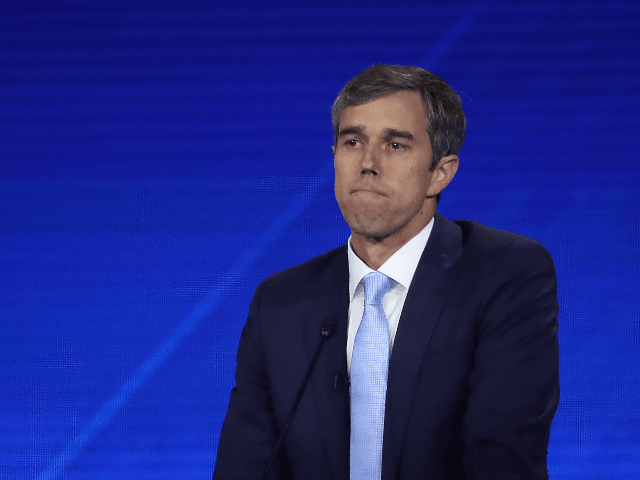

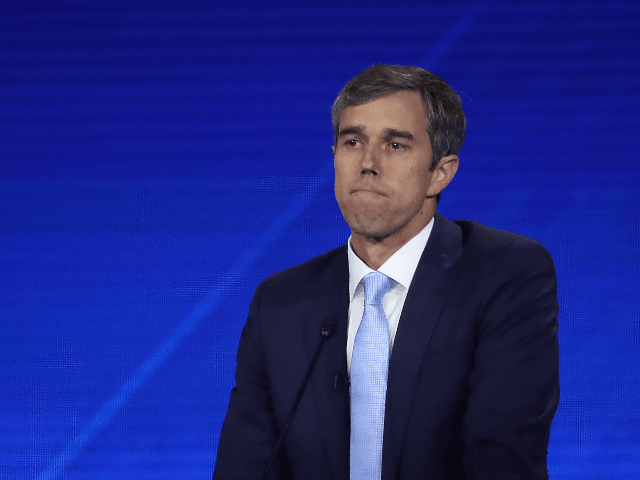

Texas Lt. Governor Dan Patrick (R) responded to Joe Biden’s March 2, 2020, gun control partnership with ‘Beto’ O’Rourke by suggesting O’Rourke try to confiscate Patrick’s AR-15 and “see how that goes.”

I know Wanka would approve.

Why did Bitcoin get wacked too I wonder

“The Fed Has Made People Lazy” – Veteran Trader Filibusters CNBC: “This Doesn’t Get Sorted Out Overnight”

R. King

Nonsense!! Just in the u.s. every yr millions get the flu…there are 50K-80K deaths…now look at the total cases in china and total deaths so far…and cases r declining…I dunno why this covid-19 virus is being so heavily promoted as unique–it isn’t and i don’t give a damm how many harvard people say it’s the worst thing since the Black Death-

-as of march 9th there have been 80,739 cases in china and 3120 deaths and the virus is contained and declining…and they have 3 times our population

https://www.worldometers.info/coronavirus/#countries

Even if you don’t borrow funds to buy a miner, because in a sense you are buying or betting, the climbing value of millions of ounces under the ground. Plus the miner can sell gold at higher prices, more income without hiring and not even increase production.

The values of the Gold miner stocks is FAKE as Trump would say, because the value of Gold in their ground has been climbing since the late 2015 bottom at $1,060, and is $1,675 58% higher today.

I think every body here knows what Margin is, but for others?

“Margin Call In finance, margin is collateral that the holder of a financial instrument has to deposit with a counterparty to cover some or all of the credit risk the holder poses for the counterparty.”

With the long term Bull Market that started on, and since, the March 2009 lows, caused a lot of over confidence. So after the over confident masses start running out of their own money to gamble with, they start borrowing the houses money.

The buyer and the house are then 50%/50% partners on the new buying. The only difference is the buyer or gambler has to pay interest on his half of the positions. The “partner” or house can’t lose, so if the stock goes down instead of up?

The house the wants the money back, and send you margin call for MORE up front money or sell you out on lows to get their money back. So millions are selling both losing and profitable positions to over ride losing positions and margin calls.

the SM is sinking,but so far the Notes won;t follow.

Last trade is $1.10–a month ago it was $18–5 days ago it was $8–last trade just now id $1.10

it had a 10 for one split and was $35 after the split…now $1.10…pretty brutal

So, had there been no split GUSH would have gone from a high of $42 to 11 cents today

at this price it’s a perpetual “call” option on the energy sector with no expiration

The risk?? I guess they could do a 20 for one split then it loses another 50%…who said trading was easy…anybody wanna step up to the plate and buy some fire sale merchandise at a 78% markdown??

what if crude drops another 5 or 10 bucks…??? If the Queen had cajones etc etc what if….??

Some people are so cheap they wouldn’t pay a dime to see Christ ride a bike….[snort!]

just what u want in a mkt with $ Trillions outstanding….no reliable quotes…..and more to the point why is this toxic trash still being traded…

Still scum are making sure u see nothing much to worry about.

https://www.zerohedge.com/markets/cds-pricing-breaks-amid-huge-credit-moves

Re No win

I fear yr right, as long as the scum can do as they wish, then PM’s will not be allowed to react to bad news etc.

Very depressing…..being right and loseing money, is a lousy situation.

Texas Lt. Governor Dan Patrick (R) responded to Joe Biden’s March 2, 2020, gun control partnership with ‘Beto’ O’Rourke by suggesting O’Rourke try to confiscate Patrick’s AR-15 and “see how that goes.”

after the first half hour drubbing, they’ve moved off the lows and sort of stabilized anyway.

GLD no longer going opposite the SM, don’t know what the hell it’s doing now, but probably not going a whole lot lower than it’s been already today.

Maybe I’m overly optimistic.

Whatever happened to circuit breaking gold when it’s getting smashed. No one in sight. bastards

Went from $100 to $150 Billion in the overnights

I’m sure that’s because everything is fine…

In light of the Coronavirus

I have done some extra prepping (55%, 23 Votes)

I have not done anything extra (19%, 8 Votes)

I have not done anything extra but am thinking about it (17%, 7 Votes)

It’s just the flu! (10%, 4 Votes)

Total Voters: 42

Gold is moving in the opposite direction of the SM since the halt. As the SM has recovered a little GLD gets sold. The shares selloff with the SM, so regardless of what GLD is doing, if the SM is selling off they are getting sold.

Jeremy Siegel on CNBS saying the Fed needs to cut .50 bps right now.

The Big diff between today and ’87 is the scum work 24/7……no-one bought the opening, like we are seeing the scum do today.

down $.06

Probably the best news of the day

I haven’t seen mortgage rates fall in a way that’s commensurate with what’s happened in the bond market.

Cramer just said cash is king. Seems right, that and bonds. Hell, even India’s bonds are rallying and they yield 6%.

USD down 1.75% – I guess the world is finding some safer fiat?