Posted by Mr.Copper

@ 13:38 on March 12, 2020

Roger that Capt, agreed. This whole paper casino system is a no brainer. Its a joke. Basically the paper players are voting the prices up and down. Like a super bowl game where the people in the stands vote the winning or losing team.

Its an old worn out tired system. (started in 1913) And started reversing in steps. Y2K, Dotcom, 9/11, and the final coup de gras, 2008. I got so happy and optimist for the USA reversal at that time.

The only problem is pain reversing from a bad 100 year habit to good future. The “withdrawals” have been hurting the Fed and the system as all the stupid decisions are “coming home” hitting them in the face.

Posted by silverngold

@ 13:23 on March 12, 2020

Posted by eeos

@ 13:21 on March 12, 2020

interconnecting all sectors into one convenient funnel for the wizard to control with ease

Posted by Buygold

@ 13:16 on March 12, 2020

all morning a comeback was in the works.

Did they cut again?

NEM now positive.

Posted by silverngold

@ 13:11 on March 12, 2020

Posted by Mr.Copper

@ 13:10 on March 12, 2020

Posted by Captain Hook

@ 13:07 on March 12, 2020

It’s the same reason every time — liquidity — which is what you described.

The idiot Comex players (think hedge funds) must sell gold for over all liquidity reasons.

This is why the open interest bubbles in Comex gold and silver are deflating rapidly as we speak.

Same set up as in 2000 and 2008, where once we hit bottom in Comex open interest we get a slow recovery as the physical markets will play a larger roll in price discovery. This was also the case in 2011 as well, where open interest remained low while thinly supplied physical markets set prices.

With physical markets even tighter today, it’s not a stretch to think prices will recover nicely soon and hopefully keep going in silver’s case.

Cheers

Posted by Mr.Copper

@ 13:04 on March 12, 2020

Posted by Mr.Copper

@ 12:57 on March 12, 2020

Posted by Buygold

@ 12:50 on March 12, 2020

Look like they might be done going down for the day.

NEM is slowly recovering.

Geesh, Germany down 11.5%

Posted by ipso facto

@ 12:36 on March 12, 2020

Posted by Buygold

@ 12:32 on March 12, 2020

including bonds.

Ten yr. was.65% now.81%? Silver down over 7% – shouldn’t it be halted??

For some reason, I’m not worried. Stacked with phyzz watching these idiotic paper markets melt down.

Im just surprised the Fed hasn’t stepped in today.

Posted by Maddog

@ 12:14 on March 12, 2020

LoL

and that doesn’t include Biden…..

Posted by treefrog

@ 11:55 on March 12, 2020

as of tuesday’s numbers, more americans have died by testifying (or looking like they might) against hillary than by the coronavirus.

Posted by Ororeef

@ 11:24 on March 12, 2020

Posted by silverngold

@ 10:43 on March 12, 2020

Posted by Buygold

@ 10:04 on March 12, 2020

Posted by ipso facto

@ 9:54 on March 12, 2020

Posted by Buygold

@ 9:36 on March 12, 2020

Posted by Buygold

@ 9:33 on March 12, 2020

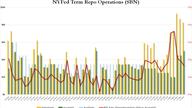

Fed Injects $198 Billion Via Repos To Unfreeze Paralyzed Funding Markets

The Fed is now dangerously behind the curve, with the funding market threatening to lock up at any moment.

Posted by Buygold

@ 9:29 on March 12, 2020

There’s some serious bargains in the shares already. Crazy stuff.

I’m a bit surprised gold hasn’t been slammed below $1600 already, silver’s action as usual sucks though.

Have to think they’ll be shutting down the SM too at some point when Goldman has stolen enough of the plebe’s money.

Germany down 8%, France down almost 9%

The DOW will be halted a couple minutes after the open.

Posted by ipso facto

@ 9:28 on March 12, 2020

“This is all fake.”

Is what happened in Wuhan fake? Is what is happening in Italy fake?

Wait a few weeks and then say that. It’s still early in the USA.

Posted by Captain Hook

@ 9:20 on March 12, 2020

Goes good with the fake PMs market being unraveled now.

Cheers

Posted by Buygold

@ 9:14 on March 12, 2020

Just went down to get some coffee. They’ve closed down serving breakfast and coffee altogether because of the virus although I’m not even aware of any cases in Phoenix where I am.

This is all fake.

Posted by Maddog

@ 8:59 on March 12, 2020

without massive blow ups in related derivative mkts , that price off treasury rates……some people somewhere are destroyed and it will be in the Multi billions, maybe in the Trillions of dollars….it’s all been far too calm so far.

maybe not for much longer

tps://www.zerohedge.com/markets/funding-markets-are-freezing-global-dollar-shortage-hits-alarming-levels