Nope it’s the speculators.

They are not that complicated. That BS works when everything is fine, which is not now.

Cheers

Nope it’s the speculators.

They are not that complicated. That BS works when everything is fine, which is not now.

Cheers

https://futures.tradingcharts.com/chart/GD/M?anticache=1584116990

5 YR CHART OF GOLD PRICES-2016 low$1063—2018 low–$1189 on sept 1st

This analyst sees gold going to 2018 low–if that doesn’t hold then 2016 low

Has the selloff ended? When will it end? What will the bottom look like and am I at risk of taking further losses? What should I do?

Over the past 16+ months, we’ve suggested that the price rotation in 2018 was a Wave 4 downside price rotation of a Wave C upside price structure. If our analysis is correct, the last rally we just experienced (ending near February 1, 2020) was the end of a Wave 5 upside price move that completed the Wave C upside price structure. This would indicate a very real possibility that the current downside price trend is a Wave 4 downside price move.

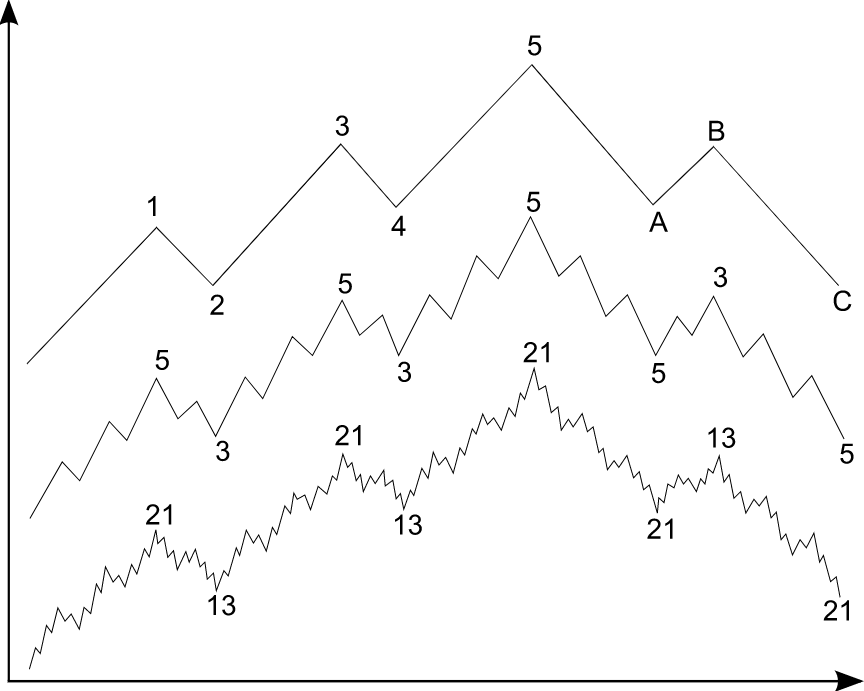

For readers that are not familiar with the Elliot Wave process/structure, each major wave (1 through 5 or A through C) can consist of various types of minor wave structures (as you can see from the middle chart in the example above. The major wave 1 could consist of a 5 wave minor wave structure (as shown). The major wave 2 could consist of a 3 wave minor wave structure (as shown) or even a downside 5 wave structure.

For readers that are not familiar with the Elliot Wave process/structure, each major wave (1 through 5 or A through C) can consist of various types of minor wave structures (as you can see from the middle chart in the example above. The major wave 1 could consist of a 5 wave minor wave structure (as shown). The major wave 2 could consist of a 3 wave minor wave structure (as shown) or even a downside 5 wave structure.

Going even further, each of these minor wave structure could consist of even smaller price wave structures. These types of price rotations often populate in 1, 3, 5, 7, 9, 13 and 21 wave structures. Unlocking the major wave count and minor wave count can help us unlock swing trading and day trading opportunities.

So, to put into context what we are attempting to convey to you is that we believe the peak in early February 2020 was the end of a major wave 3 and the start of a major wave 4 (to the downside). Because the upside price wave 3 originated after the 2009-10 price bottom, we believe true support in the markets is likely the midpoint of the 2018 price rotation range or near the low price levels of 2018. These price levels represent a very clear support level and low price target level that continues to follow the price structure rules of Fibonacci and Elliot Wave. If the 2018 lows are breached and the markets continue to push lower, then we fall back to the 2016 price lows and midpoint level.

https://www.gold-eagle.com/article/wheres-bottom-–-cycles-paint-clear-picture

Do you think it’s possible its the gov’t or its lackeys’ Goldman, and JP Morgan selling out to finance gov’t spending? Pluss, what about the GLD hoard (financed by little people) that can be raided by big share holders, like Goldman or the Treasury Dept itself?

Who is buying or taking delivery of the physical out of GLD warehouse??? And moving it to where?? Fort Knox? Sooner or later TPTB idiots have to rebuild or REVERSE, the low valued US Dollar, back into a HIGH valued US Dollar.

I’ve seen pennies and dimes on floors being swept up and throw in garbage. Even detailing filthy cars, I’ve vacuumed up coins. A Penny or two is supposed to be equal to a postage stamp. In a sense, they have to restore the value of the Penny. A dime should be equal to a cup of coffee.

Since so many things made overseas wouldn’t surprise me.

I went to the store yesterday and thought I’d pick up a extra bottle of hand sanitizer since I use them anyways but now everyone is buying them up. There was two left. Was talking to a woman there about it so she decided to get one too. I told her she could use rubbing alcohol and something like Aloe Vera and a sent or something for moisture cuz you don’t want your hands to chafe or get small abrasions where things can get in I should of talked to her more about. She worked for a radio station next thing you know I hear it on the radio. Out of curiosity at the time we both checked and it was sold out too.

What I didn’t probably should of told her though you need a certain percentage of alcohol in the hand sanitizer to work right. For anyone thinking of it. The optimum is 97 % but no higher because it needs water too to break down the germ

Or virus. You can mix the higher amounts though. So higher amount of straight alcohol is not effective and also should be no less than 70 % or won’t be very effective either.

Hope they make a stipulation those laid off temporarily shouldn’t have to look for another job.

They are having some of the Google workers work at home I heard. Many of them can go anywhere. My oldest daughters brother in law works for Google and although still pretty young but smart with computers, he has his own Chef and masseuse at work. I’m guessing these people like chefs, maintenance what have you to all these buildings are going to be laid off for now. Hope they do extend unemployment but won’t totally help those who get tips to supplement their income they depend on.

My youngest daughter is talking some classes at a college and they closed it. Most she does on line except one she has to go in to test. She’s in sports too so mad about that. I asked her what they’re gonna do about that and she said they’re going to make them watch sports shows evaluate them and keep score. Sheesh I can see why their not happy. Even my other daughter jumped in one sports class with her so I’m guessing she’s not happy either.

I’m waiting for them to call off nurses but no luck so far.

Actually we should stop all person to person contact with our leaders and they can go online for now due to false negatives or not showing up yet but still can be carrying it.

Will only help if they’re exempt during that time so that next year they don’t get hit at tax time. It won’t help those closer to drawing SS as they base what you’ll get on how much you earn and could mess them up. Stoping SS tax could mess those of us who’ve been waiting more years than those who drew really early, looking down the road, if there is a road. It won’t go lower than what they’d get now but won’t go much higher if not paying into it. Now they want to kill them off before they get any of there money back lol

For those already drawing they should raise it a few hundred to compensate for rising cost anyways and for cuts if they stop the ones paying into it.

It’s just not the older and the boomers they’re targeting it’s the conservative voters and patriots.

I saw a post already that said “ If I die make sure I don’t register as a Democrat.

PM’s are going down because idiot speculators are puking up their positions, not the rig. Da boys won’t try to flex their muscles until silver gets back to $18 and they try to topple them over again. This is just idiots who should not be in these markets liquidating their positions and it will keep happening until they go away or start buying physical.

I hope people don’t forget this again with their goldfish memories.

Chuckle

This is it folks, the Fed is bailing out anyone that needs it…..and the scum are trying to make sure it all looks normal, by killing the Gold mkt….which should be flying if it was allowed to….

For sure!

we all know why the PM’s are going nowhere, it’s the Rig….but how much longer can they keep it up….

They better also pray that the Donald doesn’t go down with the virus, as that would kill the SM.

Even other leaders and their staff should be tested before meeting other leaders right now.

Oh ya that’s been great for PM’s over the past 8 years. No it’s going to take an attitude change away from rank speculation, which is what you are doing in making such a statement, before the PM bull will return. If you look at the monthly silver chart it looks like its going to $13 ish again.

Ripley’s believe it or not.

Look at today. Stocks are going up so PM’s are going down. Biggest / fastest crash in history and nothing has changed for da boyz.

Chuckle

President Bolsonaro Tests Positive After Dining With Trump Saturday: Brazilian Press

It’s official: Brazilian President Jair Bolsonaro has tested positive for coronavirus, making him the highest ranking political leader in the world to get Covid-19 thus far.

It was first reported Thursday that Bolsonaro was being monitored and tested, after his press secretary Fabio Wajngarten had tested positive for the virus.

Crucially Bolsonaro along with his aide met with Donald Trump when the Brazilian delegation traveled to Mar-a-Lago on 7 March, with Bolsonaro reportedly having more contact with Trump than this aide, including a Saturday evening dinner at the resort.

saying that Fed expected to cut rates 1.25 bps to zero next week plus announce QE. This supposedly coming from the NY Fed recommendations.

If that doesn’t kickstart pm’s, nothing will.

NY Fed said to be buying $30 billion in treasuries today which is why the 10 yr. is now falling to .87%

edit: now .83% coming fast and furious

You’re right also about the bond market, seems it’s all over the map. 10 yr. is coming back in, now at .89%

Wild swings.

Too bad gold and silver have never acted as a safe haven in times like these and the shares in every case have performed even worse than the broad SM.

this kind of divergence, these gains seldom hold and at the end of the day shares are down quite a bit

Also today=

| coming up out of a diagonal triangle on the short term charts just like mar 09 |

it is swinging by massive amounts all over the place……it is no longer a pricing mechanism….and that is the US governments paper…..the worlds only super power.

VATICAN CITY (Reuters) – A cardinal on Friday modified his order to close Rome’s churches to help contain the spread of coronavirus after Pope Francis cautioned against “drastic measures” and Catholics took to social media to complain.

Cardinal Angelo De Donatis issued a new decree less than a day after his initial order. Many churches in the Italian capital will now remain open.

Some Catholics accused the cardinal of caving in to the government after his initial decree on Thursday night. Andrea Fauro said on social media the move had put “Christ in quarantine”.

When lending money time and to who are the big factors, that set the rate.

The Repo mkt is a clearing mkt where the Bluest of blue chip institutions, lend their excess cash and borrow if short, usually only on an overnight basis,

Therfore the risk should be near zero and the rate at a near discount to bank rate, as time is negligible……that someone/some people are consistently short every day, should be in a normal world, the biggest claxon u can get of a problem….which we are not privvy to…someone/some peoples risk is so bad they are not able to borrow all their o/n needs.

Hence Armstrong saying the Fed had to inject $ 1.5 trillion