Jeff Gundlach predicted during his DoubleLine call yesterday that “the U.S. national debt likely to grow to $30 trillion in two or three years as spending explodes in response to the crisis”, which means about $3-4 trillion in net issuance per year, and that upcoming supply tsunami is certainly sending bond prices lower, potentially dealing a deathly blow to the risk-parity/balanced “60/40” portfolio model.

Said simply: the USD is the world’s reserve currency, which while a huge benefit to the US when times are good, is an unbearable burden during crashes such as this one. While there is no simple solution, the legendary inventor of the MOVE index did propose a brilliant solution back in 2016: the Fed can always crush the dollar by buying gold in the open market, effecting another FDR-like devaluation of the dollar. Because as J.P.Morgan famously said in 1912, “Money is gold, nothing else.” One year later the Fed was born.

But for now, gold is being puked (to raise dollars) along with every other asset…[THAT’S A LIE]

Source: Bloomberg

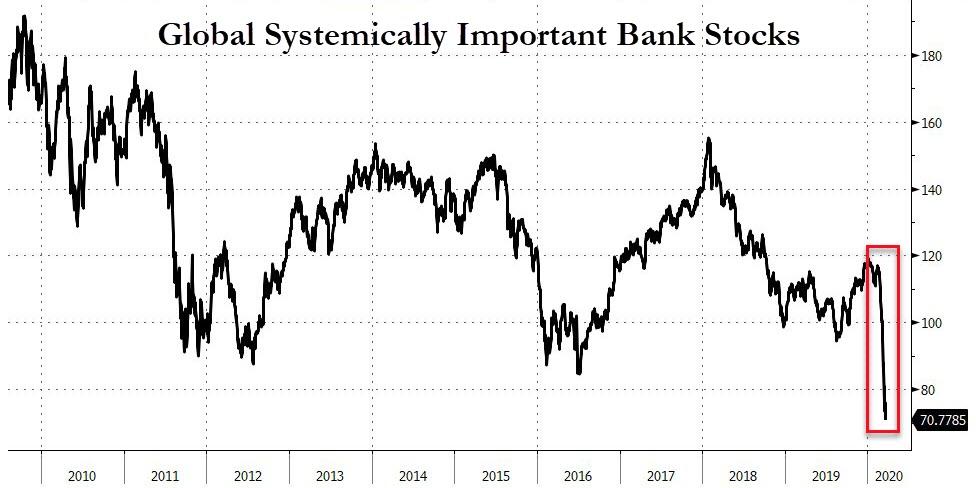

In other ominously concerning news, global systemically important banks have collapsed…

Source: Bloomberg

As Deutsche Bank counterparty risk is exploding to record highs.