Posted by Aguila

@ 23:10 on March 26, 2020

Maddog and buygold and Capt.

Check out this article on aluminum frm 2013. One of many. I think they are doing the same thing with Ag but if y’all haven’t heard about it I’ll do some more googling. For now – time to rest my eyes and toes for another day tomorrow.

https://www.nytimes.com/2013/07/21/business/a-shuffle-of-aluminum-but-to-banks-pure-gold.html

Posted by silverboom

@ 22:38 on March 26, 2020

Posted by Maya

@ 22:22 on March 26, 2020

As a participant in a class action suit, you will be awarded one square… and one square only.

Posted by Maya

@ 22:11 on March 26, 2020

HAWAII TOTAL CASES NOW 106 (up 11) No new cases on my Big Island, (5 in isolation). Urban Honolulu has 77 cases, up 8.

Hawaii now on full incoming quarantine for 14 days. Returning residents quarantined at home for 14 days. Incoming visitors must provide own transport and quarantine quarters for 14 days and all must prove this at airport incoming screening. Airlines are flying a lot of empty jets here because they must position the planes for return trips. Most are empty incoming, or 1 or 2 returning residents. Tourist business non-existent now. Most Waikiki hotels are closed with staff laid off. One or two hotels may be providing incoming quarantine services for 14 days or longer.

Posted by ipso facto

@ 21:09 on March 26, 2020

Posted by commish

@ 20:48 on March 26, 2020

Posted by Buygold

@ 20:09 on March 26, 2020

“I’ve Never, Ever, Ever Seen Anything Like This Before”

“You have enormous buyers of debt meeting massive coordinated fiscal stimulus by governments across the globe. For bond investors, you’re caught between a rock and a hard place.”

Posted by eeos

@ 19:47 on March 26, 2020

Posted by Buygold

@ 19:46 on March 26, 2020

Who the hell is roysebag?

Do you know who he is? or is he just another poster who claims insight?

How would Trump re-open refineries in another country? These markets are what they are and don’t seem to need Trump’s help, not like gold or silver are exploding.

Snooze.

Posted by Richard640

@ 19:41 on March 26, 2020

But right now, “those stockpiles can’t reach other global trading centers so easily,” said Ash. “Monday’s UK lockdown announcement sparked Tuesday’s $100 premium for New York settlement and it’s what’s spooking traders in Comex derivatives.”

That contributed to a rally for futures prices on Comex Tuesday. “The confusion in the London spot market prompted the big European metals traders to rush to buy Comex gold futures as a hedge, as they felt they couldn’t get what they felt were accurate or fair London spot gold prices,” said Jim Wyckoff, senior analyst atKitco.com, in a Wednesday note.-

Posted by Buygold

@ 19:30 on March 26, 2020

Looking forward to it. Hard to see anything like that though now that the Coronavirus has taken over the news cycle.

We are living in Orwell’s 1984

Posted by Richard640

@ 19:14 on March 26, 2020

*Gin Lane Securities

@GinSecurities

THREE-MONTH USD LIBOR RISES BY 10.763BP TO 1.3746% we were 0.74 just 2 weeks ago this suggests banks are scrambling still for USD despite decline in DXY

Sebag

@roysebag

Here is what think the bullion banks are aiming for. Trump will announce an early suspension of lockdowns, refineries, mints, miners rescue bullion banks within a week. If that doesn’t happen, there will be an epic squeeze in paper market.

https://twitter.com/roysebag/status/1243212865231884294

Posted by Richard640

@ 19:06 on March 26, 2020

James Mc checked back in with some goodies…

Too damn orderly to be believable

Bill,

Looking at all the various pieces of information in and around the gold/silver markets it all comes down to this: gold and silver are acting WAY too orderly to be believable. We’ve just had the single largest dislocation event EVER. The Dow goes down 2,000, then up 2,000. Other markets are gyrating WILDLY. Price discovery, speculation, and the daisy chain of derivatives guarantee the markets are in extreme turbulence for an extended period of time. It’s outrageous that the 2 single financial products – gold and silver- the ones that SHOULD be gyrating wildly in an attempt to find price discovery, are essentially comatose. Yes, I know gold popped $200 in 2 days, and silver gained a couple bucks, but SO WHAT? They were demolished in the futures market prior to those gains, and still aren’t back to their (phony-baloney spot) highs back on Feb. 24. They’ve deployed about a gazillion trillion dollars of QE/stimulus since Feb. 24. Looking at most of the daily gold and silver pricing/data you would never know it.

The open interest for both gold and silver are indeed falling, but in an oh-so-orderly way. With yesterday’s 4,872 decline in gold OI it has only declined by 10,716 since last Friday. ORDERLY. Silver OI declined by 4,464, for a total of 13,646 since last Friday. That’s a little more concerted effort to close out shorts than gold but still, historically nothing out of the ordinary. The stunning announcements regarding Crimex physical deliveries – which WAS a defacto force majeure- has been met with eerie dead calm in at least the derivative pricing. Gold was comatose yesterday, up 1% today. Silver off 12 cents today. ORDERLY.

The HUI is only up 3 or 4 points today. If physical gold is already $1800 with little offer why isn’t it up 50 points? ORDERLY. The EFP’s keep getting done in methodical fashion. There were another 9,972 yesterday, consistent with the past umpteen trading days. Who in the hell can just saunter in to the Crimex daily and order up 8-10,000 of EFP’s as if they’re at the drive-up window at McDonalds? ORDERLY.

On the surface it is all WAY too orderly. Behind the scenes however the gold market (and likely soon to be silver market) is chaos, pandemonium, and DISORDER. Don’t believe this “orderly” MOPE for a minute.

James Mc

Posted by Richard640

@ 18:46 on March 26, 2020

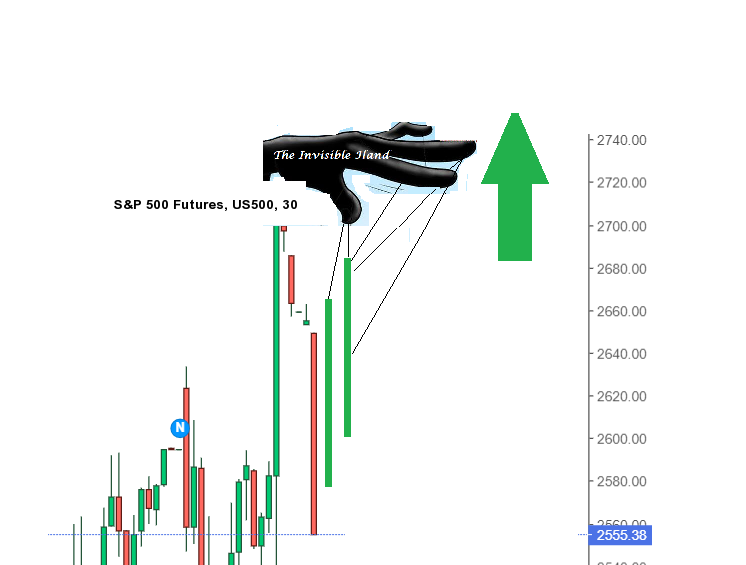

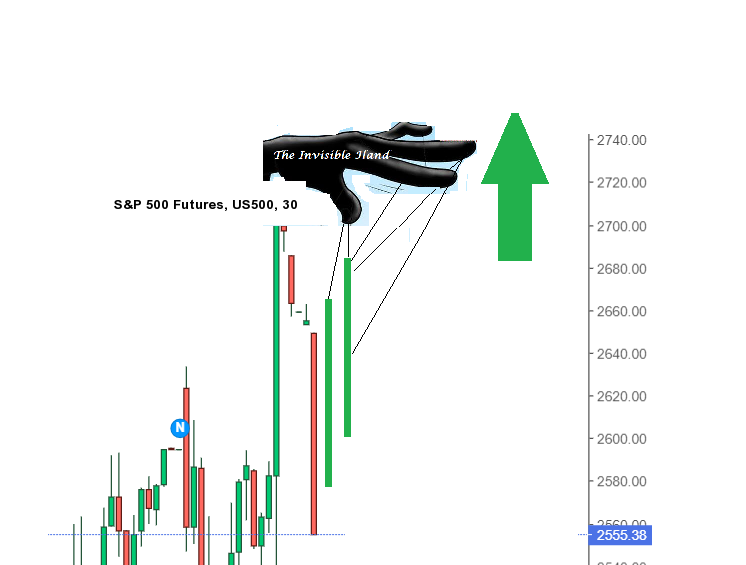

S&P500 futures caught a decent bid after the jobs number – anyone REALLY surprised? #PPT

Posted by Buygold

@ 18:43 on March 26, 2020

Thanks, agree. It never made sense that JPM would somehow be storing millions of ounces of phyzz. They are paper kings. Their mission is to destroy and steal everything real using paper. Thanks for confirming.

Seems like they’ve been able to contain the recent rise in silver and to a larger extent gold using paper. They must have offered unbelievable fiat premiums to convince buyers from taking delivery. I really thought we’d start seeing $50-$100 up days but they seem to have it under control.

Was hoping to see a quick move to $2K

I’ve looked at the shares and at least the ones I own still have RSI’s around 40 so we should have lots of room to run.

Posted by Mr.Copper

@ 18:22 on March 26, 2020

Posted by silverngold

@ 17:42 on March 26, 2020

Posted by ipso facto

@ 17:10 on March 26, 2020

Posted by amals

@ 16:56 on March 26, 2020

Posted by goldielocks

@ 16:18 on March 26, 2020

Take care Warren. I’m focusing around here the highest risk to lock down since I heard about China. I on the other hand can’t but want those who can to do it yesterday. One with lupus on steroids for instance. I figure Im in the middle of a house fire getting people out and I’m probably dead so might as well light up enjoy my last days lol In home visiting nursing getting scared too as less protection as well as the patients if they don’t know them especially. Thing is not to panic or take any unnecessary risks no matter how bored you get. Best to be stir crazy then pushing Daisy’s. Just made that up.

Posted by Maddog

@ 16:04 on March 26, 2020

Posted by Warren

@ 15:58 on March 26, 2020

Posted by Maddog

@ 15:52 on March 26, 2020

Posted by Mr.Copper

@ 15:50 on March 26, 2020

Posted by Maddog

@ 15:47 on March 26, 2020

The idea that JPM shorted paper Ag to oblivion, while buying tonnes of Phys..makes no sense….as the price would not have dropped that much and we can see from the constant smashing that the shorts are so vast…it has been going on for a 1/4 century plus…they can never really cover, without sending the price bonkers.

They will default, not that that would worry them one iota…in fact they think they will laugh all the way home…..but an impoverished crazed mob, hell bent on truly vile retribution, is their far more likely fate.