You have but to view the link I provided–it was on Fox Biz news too-I never

look at Kitco or the spot price–I was looking at June comex gold–as I write June is still up 7 bucks–if u look at the high u will see it was up $17 or so earlier

https://futures.tradingcharts.com/marketquotes/GC_.html

Also the June $ is down .148

Looks like no rally by morning

@ Goldilocks…

I saw that you mentioned the Gates sponsored 201 event.

I found this today, interesting background on the wicked mr. gates:

Gold had a $10 gap open at 6pm in evening trade-it was up $16…now up 14.00

and seems well bid….but there’s a LONNNNNNNNNNNNNNNNNG nite ahead until tomorrow morning…but this is better than a poke in the eye with a stick

April is going to be a disaster. We are not in a recession, we are in a depression, and it is global in nature.”

The Real Crash – Inflationary Implosion of Bond Market – Michael Pento

By Greg HunterOn April 1, 2020

Money manager Michael Pento has long warned the global financial system was “not sustainable or viable” because of record debt creation. Pento has also long said, “This was the biggest debt bubble in history, and it is going to pop someday.” That day has arrived. Now, Pento says, “This is a global depression just like we had in the 1930’s combined with a 2008 style credit crisis. That’s what it is. I was on your program about three months ago, and I predicted a global recession. That was wrong. It is a global depression. . . . We have learned that the S&P 500 earnings will decrease by 10% in the second quarter. We also know that GDP (Gross Domestic Product) for the second quarter is projected to decline by 35%. . . . We also know, according to the St. Louis Federal Reserve President James Bullard, that the unemployment rate in the United States could surge to 4

Pento also cautions, “So, what do you have left for the month of April? The lockdown is going to continue, and then you are facing a plethora of earnings warnings and economic data that is going to be absolutely horrific. . . . I think the stock market has to go lower for the month of April, and then I think we start to find our legs probably in the summer. . . .We have to get through this lock down, and the news is going to be the likes of which none of us have ever seen before–bad, horrific, rancid . . . It will be the worst economic data ever reported. . . . You are going to see GDP plunge at a 35% annualized rate. That has never happened before.”

As bad as this sounds, Pento says it’s going to get worse, “We are not headed into it–it’s here. This is it, a global depression the likes of which we have never seen before, but this is not the real crash. We are going to come out of this, but we are going to come out of this the wrong way, by borrowing and printing money. . . . But that is not the real crash. The real crash is when you have an inflationary implosion of the bond market, and there is not a darn thing central banks can do about it because you can’t bail out inflation by increasing the rate of inflation. . . . After the inflationary implosion of the bond market . . . . and they realize they are destroying the economy because of inflation, they will throw in the towel, and then there will be bail-ins and resets. We are going to default on the debt two ways. First, through inflation, and that’s going to fail. Then, we are going to deflate and rest.”

Pento also predicts, that in the end, the bond market will collapse, “Yields will rise, bond prices will crash.”

Pento thinks physical gold and silver are some of the “must have” assets. He has also recently doubled his investment in precious metals.

Join Greg Hunter of USAWatchdog.comas he goes One-on-One with money manager Michael Pento of Pento Portfolio Strategies.

American Isolationism in the 1930s? Learn, Un-Learn, and Re-Learn, Cycle

We Should all be happy for the future, everything is being re-learned.

parts:

“During the 1930s, the combination of the Great Depression and the memory of tragic losses in World War I contributed to pushing American public opinion and policy toward isolationism. Isolationists advocated non-involvement in European and Asian conflicts and non-entanglement in international politics. ”

“The leaders of the isolationist movement drew upon history to bolster their position. In his Farewell Address, President George Washington had advocated non-involvement in European wars and politics. For much of the nineteenth century, the expanse of the Atlantic and Pacific Oceans had made it possible for the United States to enjoy a kind of “free security” and remain largely detached from Old World conflicts.”

Nevertheless, the American experience in WW I served to bolster the arguments of isolationists; they argued that marginal U.S. interests in that conflict did not justify the number of U.S. casualties.

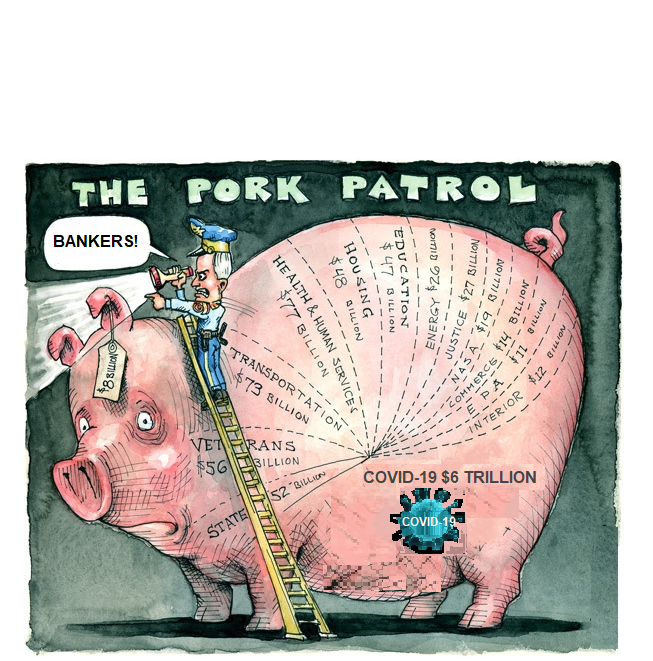

In the wake of the World War I, a report by Senator Gerald P. Nye, a Republican from North Dakota, fed this belief by claiming that American bankers and arms manufacturers had pushed for U.S. involvement for their own profit. The 1934 publication of the book…

The isolationists were a diverse group, including progressives and conservatives, business owners and peace activists, but because they faced no consistent, organized opposition from internationalists, their ideology triumphed time and again. Roosevelt appeared to accept the strength of the isolationist elements in Congress until 1937.

https://history.state.gov/milestones/1937-1945/american-isolationism

Florida lockdown

Well, the gonernor has issued an unnecessary, unconstitutiomal lockdown starting tomorrow night.

BS

It’s A Shame With Society, The Learn, Un-Learn, and Re-Learn, Cycle

Did Boeing forget how to make planes? That dumb 737 Max that took them down? ? What were they thinking?? Less energy use? Just raise ticket prices. We want more miles per gallon? Less smoke out the exhaust? Trying to save money? And you lose.

Look at the 747 was a perfected plane that came for the late 1960s? No computers? And what about the SR 71 Black bird, same era, and they can’t duplicate these days even with computers.

And what about that Shuttle that blew up on re-entry because they used new environmentally friendly insulation that broke off on lift off and knocked tiles off the wing. And the cars? They were perfected by 1970. Keep it simple stupid. The cars today are too complicated. If you get stuck on a country road forget about it. No nearby farmer and his shade trade mechanic son can help you.

Buygold @ 15:08

Good post. That’s the crux of our problem.

Buygold

Who….how about someone who scares the crap out of the banksters……Vlad.

He just sent over a AN 124 full of medical supplies…it can carry 150 tonnes….maybe he told Crimex to fill it up….. or else ?????

I’m getting the same feeling about gold that I had about VXX

I was stalking VXX for about 6 weeks–I knew there was a big trade with VXX…and I was in an out of it 5 or 6 times until I finally caught it

Right now…today…I got the feeling that gold is READY to surprise the majority including the chartists…and their beautiful charts that indicate gold is about to go to SHEOL TACHTIT**…and all these cheap prices and option premiums will look like the greatest missed opportunity…could be tomorrow…or a few days…but no longer..

**And we learned that whoever descends to Avadon, that is called bottom, never rises. That is referring to a man who was cut off and lost to all worlds. [Therefore, ‘tachtit/bottom’ is also called ‘Avadon‘ for one is lost there forever.] And we learned that those men who despised saying ‘Amen’ are lowered to that place. [Not one who neglected answering once but such a man] that many ‘Amen‘s were lost to him, that he did not ascribe importance to them, [therefore] he is punished in Purgatory and lowered to that lowest compartment which has no opening, and he is lost and never rises from there. Hence it is written, “As the cloud is consumed and vanishes away, so he who goes down to ‘Sheol’ [Hell] shall rise up no more”.]

Maddog re: Comex Expiry

To me the question really becomes: who is strong enough to stand up to the banks and demand physical delivery at the risk of being destroyed either financially or being killed?

We’re not talking small stakes here, we’re talking about a chink in the armor of the financial system that will be defended at all costs by men without honor, hell-bound to keep the fiat currency system.

Bloomberg News, “Plenty Of Liquidity” What’s That All About? Did They Have Pan Cakes At The Nautilus Diner? Or Maybe It Was The Fish?

A couple of car dealers I know told me if you want a good physic go to that diner and have the pan cakes.

Cruise ships

Can’t believe how cold the world is being to these Cruise Ships with sick people and won’t let them dock. Evacuate them transport the critical to hospitals isolate the rest. Sheesh If it was sinking or on fire they’d get them off, if their sick they’re on their own. What’s wrong with people. They’re treating them like leper’s of back when. It’s not like they are touring the place they need to get out and some need medical attention now.

Alex

Maybe with the initial stampede no eggs milk or bread amongst other things.

Things get replaced. Towns with small food chain stores had to wait longer probably because more demand than volume when they’re no longer stopping by Starbucks or fast food on the way to work. Can’t speak for all town though.

Goldielocks

Our government did a similar exercise in 2016 …called Project Cygnus, in which the projected results were a horror story, so bad they were hidden and of course no plans were altered or provisions made….funny that.

Jeesh!! All the volatility has been wrung out of gold–those 2 100 buck updays

never haapened,,,It was a miracle we got 2 days…it’s usually one and done

I am hearing there is a run on chicks at farm stores

as supermarket shelves run out of eggs .

Event 201

Nothing surprises me but hate saying that because then something then will.

Was it simulated using hypothetically other countries instead of the real one.

After watching the Alexis video I looked this up.

Some asking how Bill Gates knew or Fauci can refer to this.

Event 201 John Hopkins

Experts Simulated a Coronavirus Pandemic Last Year and It Killed 65 Million

Last October, two months before the coronavirus that causes COVID-19 emerged in central China, a group of public-health experts gathered in New York City for a simulation. Their objective was to determine how industry, national governments, and international institutions could work together to respond to a hypothetical “pandemic with potentially catastrophic consequences.”

Such a pandemic is no longer just a hypothetical. This week, the Centers for Disease Control and Prevention said it’s preparing for a coronavirus pandemic and the organization’s former director flatly declared that COVID-19 “will become a

pandemic.”

The characteristics of the virus currently causing global havoc are remarkably similar to the one proposed in the simulation, dubbed “Event 201.” The simulated virus, called CAPS for Coronavirus Associated Pulmonary Syndrome, began in Brazilian pigs who passed it to farmers. It resulted in symptoms ranging from mild flu-like symptoms to pneumonia. Three months in, the hypothetical illness had caused 30,000 illnesses and 2,000 deaths.

The fake news report that played at the beginning of the simulation looks like a nightly news report from today.

How did humankind fare in the simulation? Not well. The scenario ended after 18 months with 65 million people dead. The Event 201 website sums it up that state of the pandemic a year and a half in:

The pandemic is beginning to slow due to the decreasing number of susceptible people. The pandemic will continue at some rate until there is an effective vaccine or until 80–90% of the global population has been exposed. From that point on, it is likely to be an endemic childhood disease.

In the weeks after the emergence of the coronavirus in Wuhan, event organizers were forced to answer questions about whether they predicted the current pandemic, and contend with a few conspiracy theories.

The exercise was not a prediction, organizers insist. “We are not now predicting that the nCoV-2019 outbreak will kill 65 million people,” the Johns Hopkins Center for Health Security said in a statement. “Although our tabletop exercise included a mock novel coronavirus, the inputs we used for modeling the potential impact of that fictional virus are not similar to nCoV-2019.”

Rather than serving as a predictive tool, organizers say the simulation was more about identifying opportunities to improve the response to a potential pandemic. To that end, they produced seven recommendations “to diminish the potential impact and consequences of pandemics.”

https://www.google.com/amp/s/nymag.com/intelligencer/amp/2020/02/a-simulated-coronavirus-pandemic-in-2019-killed-65-million.html

Alexia, who can run deep into the computer telling someone the government planned this and lost control of it.

https://youtu.be/Vv6mkmxwaZQ

Captain..all you say is true…but I am like the praying Mantis–I patiently await for a fly to land nearby…

with all the monkey shines and shenanigans of the comex there still are rallies and shortable declines…CDE went from 1.56 to $15 in Dec 2015 to mid 2016…I have a “feel” for the gold market so I stick to my knitting…but i definitely hear what u r saying…

R640

Re Dollar tks

That just won’t die..

Am watching the Apr crimex expiry….I know we have been there mny times on deliveries, but something spooked crimex last week big time and my guess is it was Apr delivery intentions….a big long said gimmie.

Maya

If you can get hepa filters even for vaccums if their cloth you can make masks out of them. I’m running out of masks have some on the way I ordered 12 reusable over a month ago still haven’t got so ordered cloth hepa filters will get next week I can make masks out of. Since it’s hard to get the N95 next best choice. Depending how fast I get them.

In about 2 months next comes hurricane season. All NY or now Texas and Louisiana needs if one heads that way. But according to the experts they expect at least 4 major hurricane to hit or brush by the US this year.

Richard640 @ 9:29

You are right, many PM speculators think they have some kind of special knowledge and the moral high ground.

How anybody who has been pumped in the butt the way PM speculators have been this past decade can think this way is amazing to me.

Yes, the fundamentals look good for PM’s, and the crazy bankers know this, and will be working 24/7 like they have been with increasingly clever schemes to maintain the status quo.

All I’m saying is why help them and make some money at it at the same time by buying the shares and most importantly the bullion. Silver bullion is good for a big move by any standards if a move can ever get going. By buying bullion you deprive the crazies running the banks the ultimate control mechanism to suppress PM prices, which just so happens to be occurring today.

We will see very shortly if they continue to win or the physical laws of nature still have a role in our lives.

This is when the two trains shall meet…the value of derivatives and the real world.

Everything’s crossed.

Cheers

Maddog–watch the dollar! It’s come off its high…I think that might be PART of golds’ resilience

But right from the start of trading at 9:30 here in NY, I noticed gold shares would not go down despite the shower of sell orders courtesy of the NY FED trade desk…let’s see how this tug of war plays out…as you say the “civilians” aren’t selling, it’s just the bad guys…

Mickey Mouse V.S. Oil Can Harry