Gold spiked on the terrible jobless data (more helicopter money?)…

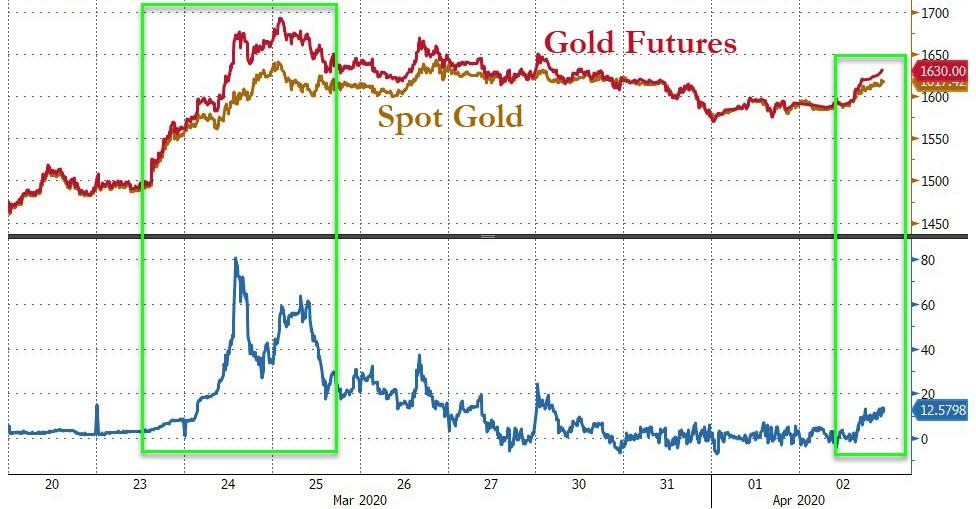

Notably, gold futures and spot have started to decouple once again (as physical shortages rear their ugly head again)…

Source: Bloomberg

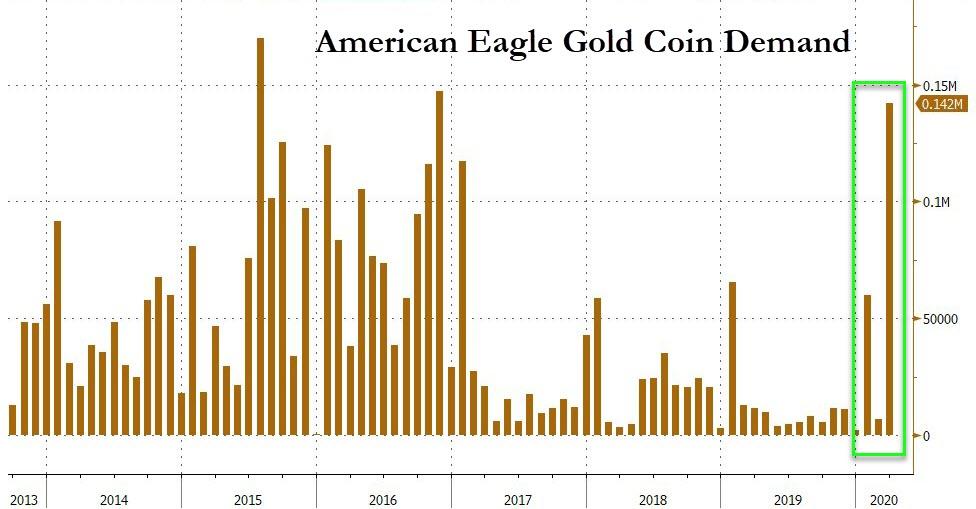

Finally, Gold coins sold by the U.S. Mint were snapped up in March at the fastest pace in over three years as investors flocked to the haven metal amid the coronavirus pandemic.

Source: Bloomberg

As Bloomberg reports, by the end of the month, investors had purchased142,000 ounces of American Eagle coins, the most since late 2016. With so much retail demand, dealers are charging premiums for bullion — and even offering to pay more than spot prices to clients willing to part with their gold bars and coins.