I Told All You Guys A Long Time Ago, “Eventually the gov’t will just have to give people money”

And that they should just put $100 bills in with the junk mail and circulars. Anybody remember? Its one step above Quantitative Easing but they didn’t give it a name yet. Quantitative Giving??

QG instead of QE? Bailing out GM and Banks or Airlines etc etc? All the big industries need people with money to spend, so bail out the poorer entry level people makes sense. They’re learning but very very slowly unfortunately. Even many employed for 40 years don’t make that much.

Back in 1937 they figured that out. They passed the Minimum Wage and maximum hours act of 1937. The later powers that be after 1971 simply weren’t as smart, or greedy, and actually wanted lower wages. They even started union busting.

They said thru their lap dog Media that high wages caused inflation, and they wanted lower inflation numbers, during the 1970s plus brought in cheaper imports to get stupid numbers lower. So if the bone heads want inflation? Why not raise all the non union tax payer job wages with a $35/hr Minimum wage. The Gov’t Should be the Union for their non union population. Unfortunately the Gov’t seems to represent foreign countries, and multinational corporations.

If the weak businesses have to close up, so be it. The owners (or stock holders) can shut down and get a decent jobs at $35/hr. It would be survival of the most fittest and most profitable businesses. The whole system is man a made artificial system anyway. This is not capitalism anymore that is failing. Its the Bankers “experiment” that evolved after 1913 that is failing. They weaned away Gold Silver Copper and Bronze for use as money between 1913 and 1971.

What’s with all these guys like Rick Ackerman? Looks like all they do look at numbers. Like Gov’t bean counters. There are very bad things that already HAPPENED to the USA, worse than all those big scary things they say about quadrillions.

The worst thing that could ever happen, happened. We imported more than we exported, and we allowed the back bone tax PAYERS to get HOSED. The country has a $22 trillion debt, the US Dollar and the Penny lost 95% of their value. Most tax absorber jobs are good jobs to get. But what happenes when 100% of the population gets from the Gov’t? Whos going to pay the taxes? People from another planet. They abused their bread and butter.

@ Richard 640 RE: your Rick Ackerman post

Hi Richard,

If the Fed through its proxies, is willing to buy equities in any quantity, at any price, I can’t understand how it is possible for the market to fall any further than they want it to fall.

Could you (or Rick) explain ?

————-

Regarding the Money from Heaven Loans:

A friend who is retired, but still holds stock in his company told me Friday that his partner just raced down to the bank to sign papers to suck at this money fountain.

He said there were well over a hundred applications in front of him when he got there. Everyone expects that the loan will be forgiven.

@ Capt. Hook RE: your 14:22 post on GLD

Do you have an opinion on the Sprott Physical Products (PHYS; PSLV: CEF; SPPP)?

British Prime Minister of Great Britain Boris Johnson will undergo artificial lung ventilation, a source close to the leadership of the national health system in England told RIA. “Johnson is urgently hospitalized, they will undergo artificial ventilation of the lungs,” the source said.

Haven’t seen this anywhere else …

Rick Ackerman=even the dumbest lawmaker on Capitol Hill can probably see that only a hyperinflation could result. This would not be your grandmother’s QE

Published Sunday, April 5, at 5:30 p.m. EDTFollowed by Hyperinflation

Granted, two trillion dollars worth of consumer stimulus is bound to produce short-term benefits and a fleeting bounce on Wall Street. Were you aware that much of that money is in the form of loans that will allow employers to avoid laying off even a single worker? The loans are structured as gifts, and if you borrow a few million dollars now and don’t furlough any employees, there’s reportedly a good chance the debt will be forgiven. This effectively creates a months-long paid vacation for the idle at the expense of those who are working. Or perhaps not; for if those still on the job are not taxed at some point to pay for this epic giveaway, the money will have come, so to speak, from trees. To use another metaphor, it would be the torrent of helicopter money that Ben Bernanke famously asserted could prevent the U.S. economy from getting crushed by deflation.

An Ethereal $88 Trillion

Could halting the reversal of American’s long run of prosperity be as simple as printing tons of money? I somehow doubt it. But I am still not quite ready to cede the endgame to the inflationists. For even if a series of bailouts injects as much as $2o trillion into the system, that would still be far less than the sum remaining to be deflated from the asset side of America’s ethereal balance sheet. At early February’s peak, we owned in the aggregate about $32 trillion dollars worth of residential real estate, $16 trillion of commercial property and $40 trillion in stocks, for a total of $88 trillion. This sum was effectively reduced by $15 trillion when the stock market bottomed on March 23. Does anyone actually believe the low is in? In any event, real estate has not yet begun to collapse because transactions have temporarily dried up. But when price discovery returns to this crucial store of the nation’s wealth, it stands to be an even more powerful deflator than falling share prices. Indeed, were property values to fall as hard as they did during the 2007-08 crash, it would reduce the private sector’s balance sheet by a further $16 trillion.

So where does that leave us? Better sit down for this, because those assets, all $88 trillion worth, are just a drop in the bucket compared to the financial derivatives edifice for which they, along with the world’s supply of oil and natural gas, are the chief source of collateral. Financial derivatives constitute a $1.5 quadrillion-dollar market — that’s $1,500,000,000,000,000 — and even a thousand helicopters filled with Benjamins could not keep this black hole from imploding. Nor is it certain whether Nancy Pelosi and her ilk, presented with an unparalleled opportunity to give away vastly more OPM than all of their predecessors combined, will be able to muster the crazed gumption to undertake fiscal countermeasures commensurate with the problem.All Eyes on Illinois

But here’s the wild card: the great state of Illinois, birthplace of Abraham Lincoln and Ronald Reagan. Its pension plan is headed toward certain bankruptcy, undoubtedly sooner rather than later, and it remains to be seen whether Uncle Sam will go “all-in” attempting to save it. If so, you can be sure that two dozen other tottering states, including California, New York, New Jersey, Connecticut and Massachusetts, will scream “Help!!” I rate the political outcome a toss-up, because even the dumbest lawmaker on Capitol Hill — AOC, to name names — can probably see that only a hyperinflation could result. This would not be your grandmother’s QE, where the mountebanks who run the central bank are tasked merely with pumping up stocks and real estate via easy credit. No sirree, this is the kind of monetization that would require sending out checks every month to more than a million recipients. Provide the same free lunch, in perpetuity, to every public-job retiree in every tottering state, and Fed helicopter money would soon lurch toward infinity. The predictable result after just a few months is that the $1687 check the Illinois DOT retiree receives every four weeks would buy a small bagful of groceries. This outcome is so obvious that even Pelosi and AOL would see it coming.

That doesn’t mean we can rule out an open-ended bailout, since it is politicians and their lackeys on the Open Market Committee who would decide. Assuming they agree, as is their wont, that “Voters will LOVE this!” we are no longer talking about a mere $20 trillion bailout, but one with no practical limit. This would come on top of national debt that is already at $23 trillion and growing by an unprecedented $500 billion a month. The Guvmint will eventually have to cap interest rates, since allowing them to rise to market levels would raise the burden of debt for all of us to a fatal threshold. Under such circumstances, the Fed would become the only buyer of Treasury paper — not because the banksters are economic dunces, which they manifestly are, but because their role as lender of last resort remains legally unconstrained and politically unimagined.Boxcars of Digital Money

Before hyperinflation erupts with the force of ten H-bombs, I expect deflation to play out ruinously in the private sector, impelled by a crash in real estate, commodities, household and business income. When the Guvmint comes riding to the rescue in a way that dwarfs the paltry trillions advanced us so far, that’s when hyperinflation will take off. It will probably play out more quickly than the Weimar hyperinflation of 1921-24, since the means to effect it are digital rather than via train and truckloads of U.S. currency. This scenario will be extremely tricky for those who would secure their financial fate with gold and silver. That’s because bullion will be trying urgently to separate out the mere suspicion that fiat currency’s days are numbered from the actual moment of its inevitable demise. Although I have long doubted gold could soar to the sensational heights predicted by some seers, I am now open to the possibility. I have remained firmly in the deflationist camp for more 30 years because I believed cumulative debt would eventually act like a black hole, sucking us into its maw so slowly at first that we would not feel the pull until it became irresistible. The pandemic has altered this dynamic by giving politicians and banksters a popular excuse for making mind-blowingly reckless decisions that are happening too quickly to challenge or resist. If the courage and sanity to oppose them exists, it will surface in token op-ed essays by the few who understand why money needs to be backed by something scarce that has real and enduring value.

even the dumbest lawmaker on Capitol Hill can probably see that only a hyperinflation could result. This would not be your grandmother’s QE

|

||

|

||

|

@Captain I just pulled up a chair. Video GLD Warehouse Bob Pisani

I believe its a scam, but not that there is no real gold. I think the scam is that millions of little people that buy GLD to have and to hold, unwittingly put up all the money to have gold on hand for banks and gov’ts and maybe even to help make deliveries for COMEX in emergency situations.

Kind of like the old days and bank deposits. The banker knew not everybody would withdraw their funds, so they could lend out some of the inventory. Before those days there were gold smiths where people would deposit their gold and get a warehouse receipt.

The “goldsmith” or what ever they were called, knew for certain the same thing, there would ALWAYS be inventory, so they loaned out Gold “receipts” to people that did not have any gold stored there, to be paid back with interest. Which was the start of I guess gold backed paper money.

In the next emergency, TPTB may NOT have to confiscate Gold from people. (but they already did get gold from SOME people with GLD) to re-start the game. Its a strange coincidence, that the entire global economy was slowing after the 2008 crisis even though TPTB kept dropping rates globally, and blowing bubbles.

We had the everything bubble, Stocks bonds and real estate. The USA prosperity in my opinion was artificial. A lot of lower taxes and less regulations and more gov’t spending and tax incentives, and tons of hype and jaw boning. There is no prosperity in the USA until a 19 year old can buy a new car with a three years loan. We had none of that so hence, no real recovery. Simple. imo of course.

I have been telling relatives around me for two years now that the US economy was not really in recovery, and system was going to crash, its all “too good to be true”. Back in the middle of the ’08 crash, I was telling them, we hit bottom, we can’t lose anymore, and TPTB have to give the USA economic priority to lead the rest of the worlds economies, like 1945 all over again and everything was going to get better, and it did. “It was too bad to be true”.

Things did get artificially better during Obama, but too little late and too slow until Trump got elected. They went into speed up panic mode. They actually reversed the first reversal. No more time now. But the virus, versus a big bankruptcy to spark the crash, is a very strange coincidence, and some people say…”Nothing is a coincidence”.

I remember seeing this on TV around when Gold was around $1800, March 18 2012, it was all over the news. CNBC had a video, Bob Pisani being driven the secret location of GLD storage warehouse near London.

Mr.Copper @ 16:47

GLD does not have the gold they claim. They have a bunch of paper like Comex and would make it very difficult for anybody to withdraw physical because they are also drawing off the same hypothetical supplies in London and New York Comex claims to be representing.

They do have some physical inventory, but again, i can assure trying to get any of it would be next to impossible no matter who you are. It’s likely spoken for many times over as well. It’s a scam, like SLV, Comex, certificates, etc.

This will all be exposed one day at the fraud trials (chuckle – that will never happen).

Cheers

Follow Plunger on Twitter

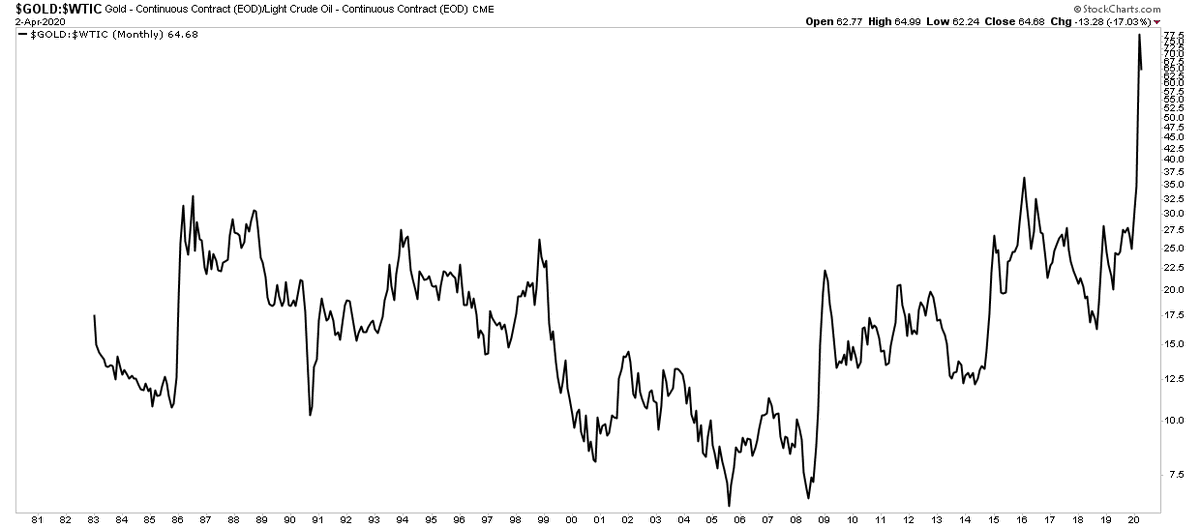

Gold to Oil ratio divides golds price (financial stress measure) by oil (industrial activity measure). uncharted waters… except for 1933 with gold at $36 & Oil $0.50.. Same ratio as today. Markets saying Depression looms.

Morris Hubbart video chats–GDX potential bull flag breakout into the $32 area or slightly higher

Here are today’s videos and charts. The videos are viewable on mobile phones as well as computers. Double-click to enlarge the charts.

https://www.gold-eagle.com/article/gold-and-stock-market-key-candlestick-action

P.S.—re: Jack Chan]

[I’ve followed this guy for years and he is very unemotional—he just follows his indicators—for him to use the word sky rocketing is unusual and, IMO= shows strong conviction]

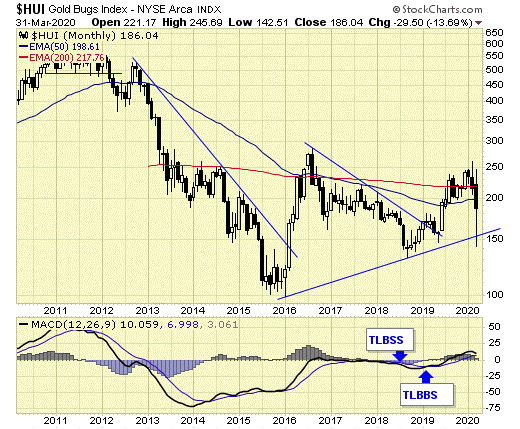

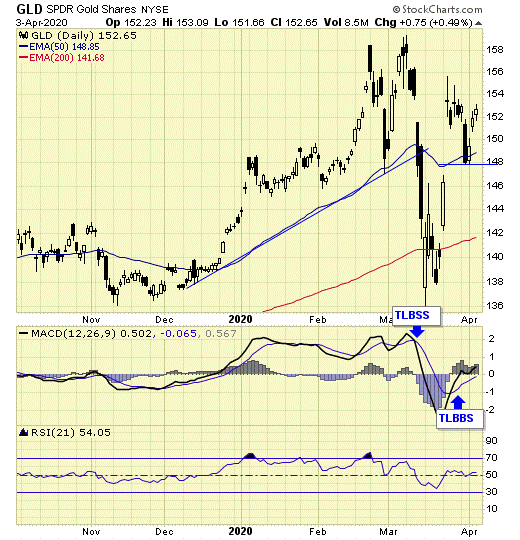

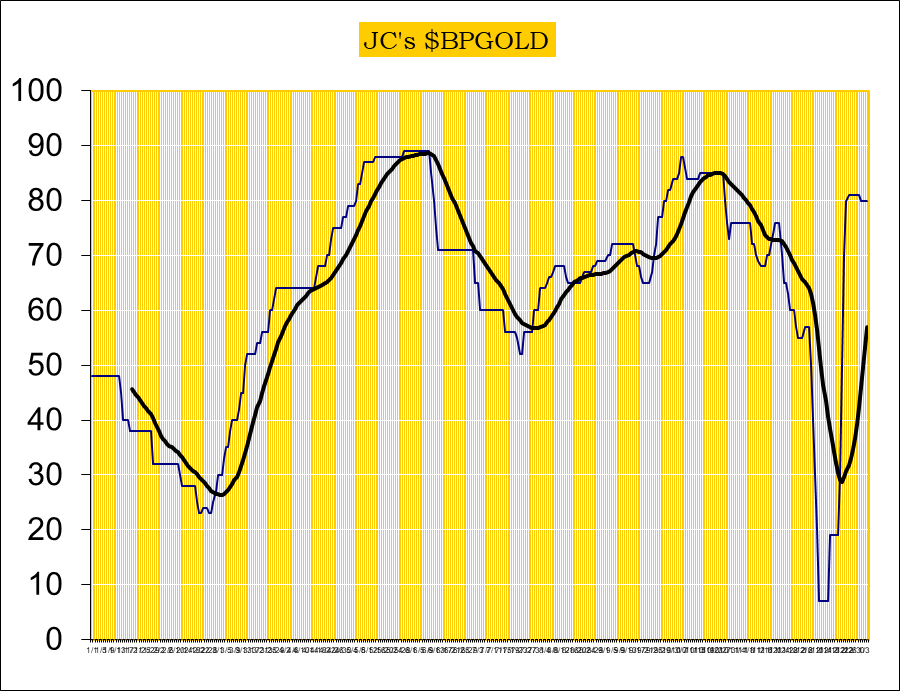

JACK CHAN IS NOT A GOLD PERMA BULL-ONE OF THE BEST TIMERS=Long-term – on major buy signal. Short-term – on buy signals. Gold sector cycle is up.

To public readers of our updates, our cycle indicator is one of the most effective timing tool for traders and investors. It is not perfect, because periodically the market can be more volatile and can result in short term whipsaws. But overall, the cycle indicator provides us with a clear direction how we should be speculating.

Investors

During a major buy signal, investors can accumulate positions by cost averaging at cycle bottoms, ideally when prices are at or near the daily 200ema.

During a major sell signal, investors should be hedged or in cash.

Traders

Simply cost average in at cycle bottoms when prices are at or near the daily 200ema; and cost average out at cycle tops when prices are above the daily 50ema

Gold sector remains on long-term buy at the end of March

GLD is on short-term buy signalGDX is on short-term buy signal.

XGD.to is on short-term buy signal.

GDXJ is on short-term buy signal.

Major support and resistance, with a median price are now established for trading the GDX.

Summary

Long-term – on major buy signal.

Short-term – on buy signals.

Gold sector cycle is up.

We are holding a core position, and also trading the short-term with GDX.

https://www.gold-eagle.com/article/gold-price-exclusive-update-shows-sector-cycle-sky-rocketing

From the Hawaii Petri Dish

32 NEW CASES, ONE NEW DEATH. Stats from HDOH:

Total cases: 351 (32 new)

Hawai’i County: 22 (2)

Honolulu County: 266 (29)

Kaua’i County: 15 (2)

Maui County: 38 (2)

Pending: 8 (-3)

Residents diagnosed outside of Hawai‘i: 2 (0)

Required Hospitalization: 19 (1)

Hawaii deaths: 3 (0)‡

Released from Isolation: 82 (4)

Cumulative totals as of 12:00pm, April 4, 2020

‡A fourth death was reported on 4/4/2020 in a hospitalized individual on Oahu and will be included in tomorrow’s counts.

“Stay at Home” orders. Mandatory 14 day quarantine for air travelers, including interisland travel. Travelers arriving without a place to stay are immediately turned away at airport and sent back. Most business closed.

Our proprietary cycle indicator is up, rising vertically from the lowest level in years.

Our proprietary cycle indicator is up, rising vertically from the lowest level in years.