If you hope to survive the chaos that’s accelerating, you MUST be able to discern the difference between what’s REAL vs. FAKE … see this list

Buygold–june gold is still up a buck-july silver down 2…but the problem is how far off their highs

I thought gold might be down 15-20 and silver down 30-50 cents along with stocks…we’ll have the verdict by morning..

Oro

If this is the case in WPM show it to me in a chart, otherwise just noise

Hmmmm….silver already 30 cents off its high tonight-down 2 cents…gold $10 off the high…the $ up .210

The old “dollar shortage” B.S. as an excuse to sell PMs

Global US Dollar Shortage Rises As Emerging Markets Lose Reserves

Posted by eeos @ 13:45 on May 3, 2020

I have done a little observation on MOMENTUM idicaters like MACD ,RSI and STOCHASTICS and I soon realized they can stay in that 80% range for months ,some Ive had were there 3-4 months …there’s no limit at how long it can stay at 80% ,as long at momentum is up ! It shows momentum ,not the top of the market ! short term it may be the TOP ,it may NOT… It can stay there for months while price continues to climb…

Sorry yes overbought not oversold Richard

RSI was above 80

Any time I see an RSI 80+ in WPM, a smackdown magically shows up. Hold down Control Button and press + to zoom in, and hold Control Button and the negative key to zoom back out

It seems like the tent compresses all my large format file sizes so it’s difficult to post clear charts

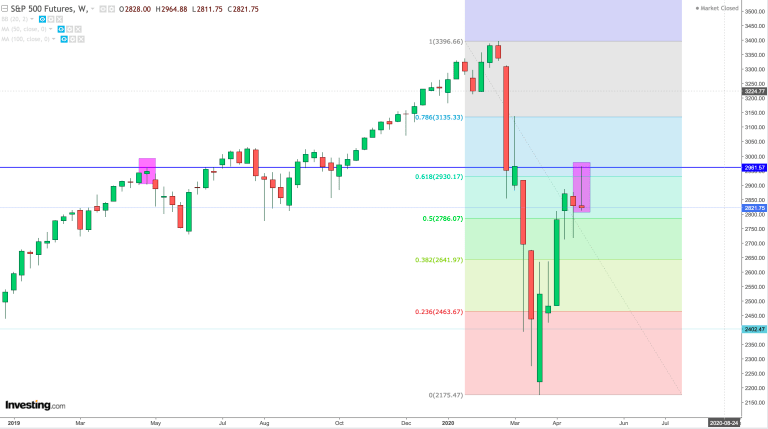

No, last week’s month end rally disappeared as quickly as it appeared leaving a massive weekly rejection candle:

While the interventions are still historically gigantic a drastic reduction in incremental liquidity amounts to a relative tightening. Markets that have been entirely dependent on artificial liquidity have yet to prove they can do without. In fact all evidence points to the contrary, for the liquidity reduction in 2018 resulted in a massive market correction and the 2019 rally didn’t really take off until the Fed expanded its balance sheet by nearly half a trillion dollars into Q4 and Q1.

No, last week’s month end rally disappeared as quickly as it appeared leaving a massive weekly rejection candle:

A rejection that occurred ironically from the very same price and date as the the rejection in 2019 when unemployment was 3.5%. Now we have 30M newly unemployed and Q2 GDP looking to drop between 20%-30% following a 4.8% drop inQ1 GDP.

https://www.zerohedge.com/markets/smackdown-following-bear-market-bounce-script

Mark Lundeen=to illustrate how the 1957 to 1980 BGMI, and 1971 to 1980 bull markets for gold and silver happened in a rising interest rate environment.

[Gotta be good for PMs, ain’t it?]

Barron’s Confidence Index is Collapsing

Mark J. Lundeen

Mlundeen2@Comcast.net

01 May 2020

I haven’t written anything on the Barron’s Confidence Index (CI) for years. As since Barron’s March 30th issue the CI has been in a state of collapse, maybe it’s time to review this historic market series.

Barron’s has never properly covered or promoted their own market series, so most investors have never heard of their Confidence Index. The now discontinued Barron’s Stock Averages (BSA) were published weekly from 1938 to 1988, and except for a few articles during the early 1940s, the BSA were left to Barron’s readers to scrutinize on their own.

For the past nine decades Barron’s Confidence Index’s story is much the same, which is a pity as the story it tells about the financial markets is extremely informative.

The Confidence Index is the ratio of two investment-grade corporate bond yields:

- Barron’s Best-Grade Bonds (Blue Plot Below)

- Barron’s Intermediate-Grade Bonds (Red Plot Below)

Barron’s has published this data since 1938, but I pushed it back to 1934 by using the bond tables which at the time were also published. I noted the yield for their best-grade bonds on its first week of publishing, which I then took ten bonds with similar yields, taking an average of those yields, I reconstructed Barron’s Best-Grade Bond Yields going back to Barron’s 01 January 1934 issue.

The Intermediate-Grade Bonds Yields were easy, as Barron’s used the Dow Jones 40-Bond Average Yields which they published weekly since their 09 August 1926 issue. So, below is a record of these corporate bond yields going back to the first week of January 1934.

I inserted a table for the Barron’s Gold Mining Index (BGMI: the sole remnant of the BSA) as well as price data for gold and silver to illustrate how the 1957 to 1980 BGMI, and 1971 to 1980 bull markets for gold and silver happened in a rising interest rate environment.

As most “market experts” warn investors that rising interest rates are bad for gold and silver, it’s important to know this certainly wasn’t true in the last precious metals bull market. When these two historic bond yields once again trend higher; I expect our current precious metals bull market will have entered into a new and much more intense phase.

Why would this be so? Because since 1945 the Federal Reserve had been issuing more than $35 paper dollars for every ounce of gold held in the US gold reserves, and these inflationary paper dollars were flowing into consumer and producer prices. This was in disregard to the Bretton Woods $35 gold peg, but then “policy making” has always placed itself above the law of the land.

https://talkmarkets.com/content/us-markets/barrons-confidence-index-is-collapsing?post=260680&page=2

How Bill Gates Monopolized Golbal Health, by Master Researcher James Corbett.

Unbelievable job of research done by James Corbett.

‘Bill Gates seeks to microchip humanity!’ Russian Oscar-winning director pushes vaccine conspiracy… loosely-based on REAL patent

One Microsoft patent that recently received international recognition has been found by many ‘truth-seekers’ to be particularly alarming. The patent WO/2020/060606 describes a “Cryptocurrency system using body activity data” – basically, a device which can be used to ‘mine’ some digital coins using one’s body. Or, rather, “award cryptocurrency to the user whose body activity data is verified,” as the patent abstractly puts it.

https://www.rt.com/news/487634-mikhalkov-bill-gates-microchip-implants/

Eeos–good move–u mean’t over bought not oversold on WPM, right?

-but…but… will gold ans silver follow stocks down?…they didn’t Friday nor did the $ rally…

Brace For A Monday Massacre: Buffett Liquidates All Airline Holdings As Berkshire Sees Another Leg Lower

I sold a nice sized potion in WPM on Friday at close in my IRA

I couldn’t resist. Silver looks like shit, WPM had a huge breakout, the RSI was way overbought and the shorts needed shares so I sold them to the boys. I’m going to become more active in trading again for a while. I didn’t get my option puts in GDX as I had hoped for but no reason to get punked by the boys. If it keeps going I can try my hand at something else. WPM is my largest holding and I can’t have so much skin exposed

ororeef, 0:01

vaccines, yes, we’re still waiting for a vaccine for the common cold.

…but we do have vaccines for the flu. every year we are urged to get our “flu shots.”

with coronavirus, which seems to mutate as readily as the flu, is there any reason to believe that a coronavirus vaccine would be any more effective than flu shots which do a half-assed job of protecting us from last year’s version of the flu?

I’m not going to post this on social media because it could create a panic amongst other things.

Besides economic shut downs and food disruptions from COVID it’s also affecting power plants. For those invested in these areas not to mention possible accidents.

Not just electric power but nuclear power.

The attack of the coronavirus has even altered the business of nuclear plants. U.S. nuclear plants “will be allowed to keep workers on longer shifts to deal with staffing problems in the coronavirus pandemic.”

Naturally, this is raising worries among watchdogs and people living near nuclear plants about employee exhaustion possibly causing accidents.

The nuclear industry is “scrambling to keep up mandatory staffing levels through what will be weeks or months more of the outbreak.” Extending shifts would allow workers to work up to 86 hours per week.

Nuclear plant workers are currently having their temperatures taken as they arrive for each shift, and employers are considering having workers live at plants full-time for a while, during this outbreak.

Federal inspectors on and off site would monitor employees to make sure the plants do not work any employees to the point of exhaustion, and if necessary, they could revoke the expanded shifts.

Expanded hours, say supporters of the idea, could reduce crew rotations and minimize exposure to the coronavirus.

However, fatigue has “often been deemed a factor in accidents at nuclear plants,” so this is definitely a concern.

In recent days, U.S. nuclear plants “are reporting some of the first coronavirus cases among their workers.”

The Nuclear Regulatory Commission said it would “consider on a plant-by-plant basis 60-day exemptions that would let plants keep workers on the job for up to 86 hours in a seven-day period.”

The Union of Concerned Scientists, a watchdog group, however, says this solution to preventing COVID-19 in nuclear workers, by making them work 14 12-hour days in a row, is “untenable.”

Nuclear plants are also considering bringing back former plant operators, and perhaps “sequestering crews on site.”

If things get worse, sequestering crews “remained one of the options.”

That would probably not be much different from what some of the refineries do when strikes occur, the senior management starts working long shifts to keep the plants going.

We will wait and see what happens with the coronavirus, and we hope nuclear workers don’t get so tired, accidents occur.(Associated Press, Sunday, April 5, 2020.)

Putting the puzzle together

Someone I know posted this and filled in a gap on the drug. Still be interested in knowing who owns shares of J& J who expects to have a vaccine by Sept.Now hows has that possible? They’re finally coming out on the bio lab.

Vaccines have not worked for the common cold

what makes them think ..this time,its different ? Prove it to me ,You take it first !

Do a 500 case study with 500 Democrats …and dont fudge the results…