While the interventions are still historically gigantic a drastic reduction in incremental liquidity amounts to a relative tightening. Markets that have been entirely dependent on artificial liquidity have yet to prove they can do without. In fact all evidence points to the contrary, for the liquidity reduction in 2018 resulted in a massive market correction and the 2019 rally didn’t really take off until the Fed expanded its balance sheet by nearly half a trillion dollars into Q4 and Q1.

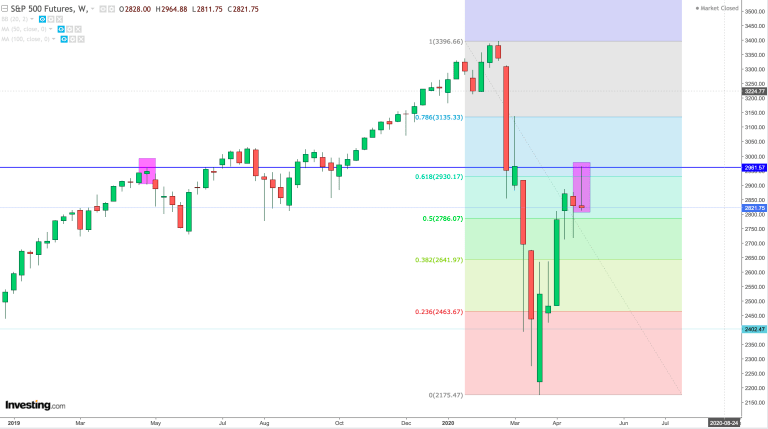

No, last week’s month end rally disappeared as quickly as it appeared leaving a massive weekly rejection candle:

A rejection that occurred ironically from the very same price and date as the the rejection in 2019 when unemployment was 3.5%. Now we have 30M newly unemployed and Q2 GDP looking to drop between 20%-30% following a 4.8% drop inQ1 GDP.

https://www.zerohedge.com/markets/smackdown-following-bear-market-bounce-script