These Trillions Treasury is borrowing is heavily in T-Bills. Chair Powell has stated in plain English he is opposed to negative interest rates. Yet the pressure to go negative on Fed Funds will build as short term borrowing explodes and dominates. Please, no. Rates < 0 = Fatal.

It Begins: For The First Time Ever, US Fed Funds Price “Fatal” Negative Interest Rate Starting Jan 2021

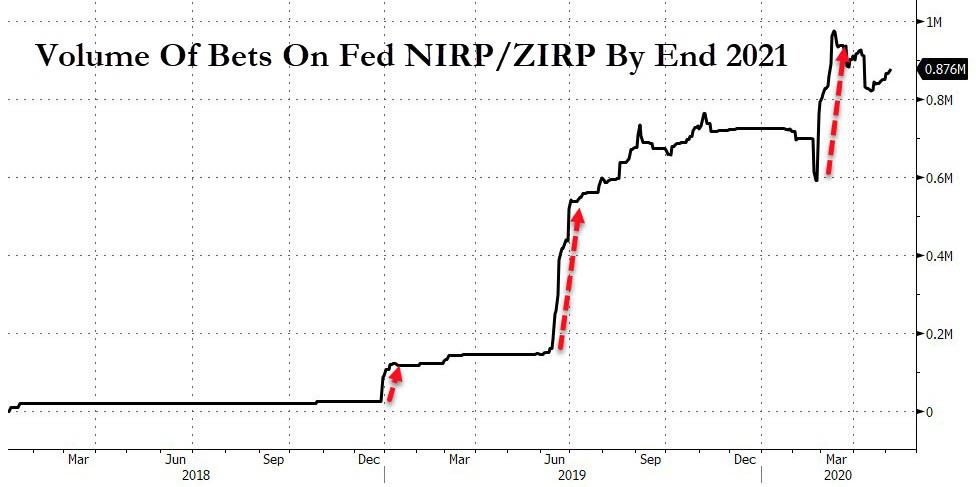

Understandably, the volume of bets on NIRP by end of 2021 has been surging, and sure enough the market finally cracked in what is the most serious test of the Fed’s conviction to not impose negative rates.

What does a negative interest rate mean, aside from the obvious death sentence for banks? We have written thousands of articles (literally) why sliding into this monetary twilight zone – where both Japan and Europe already are to be found, frozen in monetary carbonite – means game over, but instead of recapping them all, we will give the final word to the bond king Jeff Gundlach himself, who conveniently summarized it best last night when he tweeted that a rate < 0 is “fatal”.