Retail isn’t always wrong, I mean, being long for the past 10 years has been pretty crowded but still paid off.

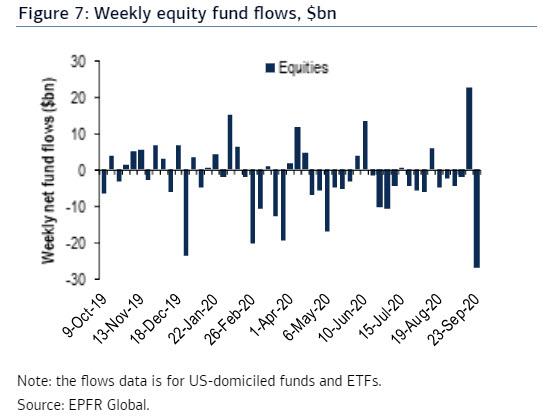

On Friday we pointed out that one week after one of the biggest inflows into stock funds on record – when retail traders furiously BTFD in hopes the market’s upward momentum would accelerate – speculators hit a brick wall and reversed furiously as stocks slumped, with US equity funds and ETFs reporting $26.87BN of outflows, the largest weekly outflow since December 2018 and the third largest outflow ever! In other this was the fastest and biggest sentiment reversal on record.

[After the spike down in 2007, there was a rally, but the shorts were correct in 2008 all the way down.]

****************************************************************************************